WPP (LSE:WPP), the FTSE 100’s only advertising and marketing stock, has had a rough time lately. Since November 2024, the share price has tumbled 66% following profit warnings and the suspension of its dividend.

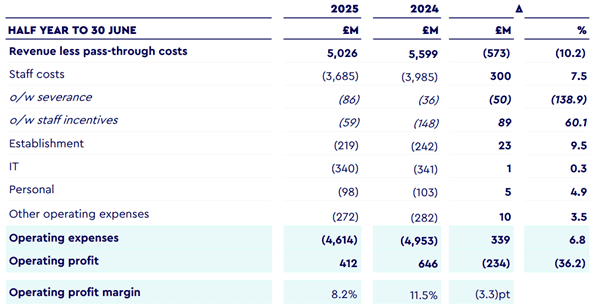

Of further concern, its results for the six months ended 30 September showed a 10.2% reduction in revenue less pass-through costs compared to the same period a year earlier.

One person’s trash is another’s treasure

However, on 11 November, Betaville reported a rumour of a possible takeover. Some investors appeared convinced that there could be some substance behind the speculation. WPP’s shares closed the day 5.6% higher.

And there’s been some other interesting buying activity lately. In November, FIL increased its stake from 5.65% to 8.92% and RWC Asset Management disclosed an interest of more than 5%.

However, on 13 November, both the group’s chair and newly-appointed chief executive bought 50,000 shares in the company. City rules forbid insider trading, so these transactions tell me that the rumour isn’t grounded in reality.

Before these transactions were disclosed, Betaville commented that it “might be total codswallop, nonsense or rubbish — but then again there may be something in it”.

Déjà vu

However, WPP’s been here before. It’s previously been reported that the group has attracted the interest of Warren Buffett’s Berkshire Hathaway (2012), Accenture (2017) and Blackstone (2023). Nothing came of these.

But we live in different times now, with artificial intelligence (AI) likely to affect every industry. However, it’s sometimes difficult to separate hype from reality. When it comes to AI, it could be a case of Amara’s Law applying. This states that there’s a tendency to over-estimate the impact of new technology in the short term and understate its effect in the long run. The Law’s sometimes used to explain the dotcom bubble.

WPP takes a balanced view. It says AI “has disrupted our business forever” but “it will always need curious minds to keep the promise of what it can do – and honest voices to call out what it can’t”.

And having previously worked for Microsoft, WPP’s new boss is a bit of an expert in the field. Cindy Rose has joined the group at a critical time. It’s recently launched its Open Pro platform that gives its client access to its “advanced AI marketing capabilities” enabling brands “to connect to its tools and services independently”.

But others are developing similar products. Amazon, Meta Platforms and Microsoft are just three of the companies offering solutions that enable businesses to do more creative work in-house.

Final thoughts

Buying shares on the basis of a takeover rumour is a bad idea. But taking a stake in anticipation of rising earnings is a better one. However, I’m not sure WPP’s going to be a winner from AI.

I’m convinced it will enable the group to automate some routine tasks and cut costs. But competition is fierce. And even if a small proportion of its clients use other AI platforms – or do more creative work themselves – WPP’s going to suffer.

That’s why — despite its impressive blue-chip client base and international presence — the stock’s not for me. There’s too much uncertainty surrounding the futures of the advertising and marketing industries for my liking.

But there are plenty of other exciting opportunities that I’m looking at.