Since I invested in Admiral Group (LSE: ADM) earlier this year, my shares are down 9%. Yet I still think it’s one of the best shares to buy now. Why?

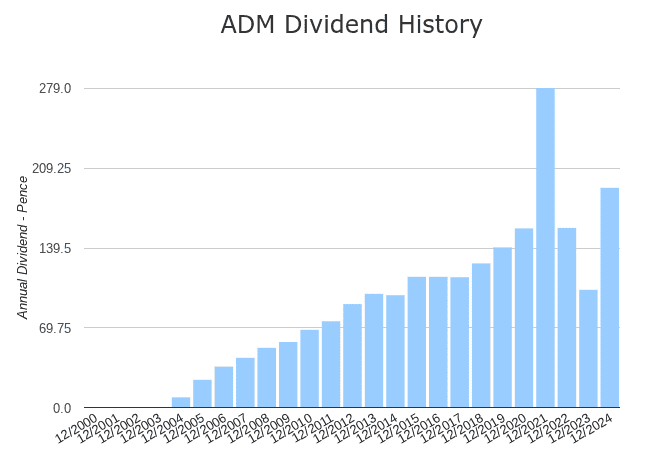

Well, partly because it raised its dividend by 86% this year — a sharp turnaround after a challenging 2022 forced two years of reductions. Now, this year’s increase brings it back in line with a growth trajectory that saw dividends rise from 9.3p per share to 279p over a 16-year period.

If that growth continues, it’ll be on track to reclaim its place as a top FTSE 100 dividend stock.

What’s driving growth?

A once-regional Cardiff-based insurer, Admiral’s grown to become a diversified international financial services player. Over the past decade, its comparison sites, Confused.com and Compare.com, have helped catapult it into the top ranks of UK insurers.

In its 2025 half-year results, it reported 10% customer growth and a 69% year-on-year increase in profits before tax. Its motor insurance arm, the core part of the business, did particularly well, with profits up 56%.

These profits are largely driven by a cost structure that’s 25% lower than industry averages. Being headquartered in low-cost Cardiff certainly helps, but its digital-first approach is another factor.

Confidence

While results are a good way to gauge a company’s performance, they aren’t always reliable. A struggling business can mask underlying issues with clever accounting. But what a struggling business can’t afford to do is boost its dividend by 86%.

That kind of dedication to shareholder returns suggests a company with a high level of confidence in its future profits. Plus, its dividend policy is backed by over 20 years of payments and strong earnings and cash coverage.

But does the business have what it takes to keep that performance going in the long term?

Ahead of the competition

What makes Admiral stand out among other UK insurers is its unique operational style and strategic positioning. It operates more like a technology company that sells insurance than a traditional insurer. For example, it uses advanced data analytics for risk selection, pricing optimisation and fraud detection.

This proprietary technology has helped it achieve claim ratios significantly below the industry average. And it’s not slowing, investing heavily in customer experience and technology capabilities to maintain this competitive advantage.

The recent sale of its US-based Elephant Insurance allows management to concentrate on core European operations where Admiral sees better long-term opportunities.

Challenges

With the UK insurance market softening this year, Admiral expects earnings growth to slow. This potential blow to investor confidence may be one reason for the dividend boost.

But if it can’t bring in the profits to cover payments, a dividend cut would do even more reputational damage. If it pushes ahead with dividends despite losses, it may neglect debt repayments. Both situations pose risks. In order to stay ahead, it must balance these issues carefully.

Final thoughts

The UK insurance market has had a tough year and remains highly sensitive to inflation and interest rates. As noted, this may still impact Admiral’s upcoming FY results.

Still, I think it’s one of the more promising insurance stocks to consider for 2026 and beyond. With its strong technological edge and excellent track record, I expect to see further dividend increases for years to come.