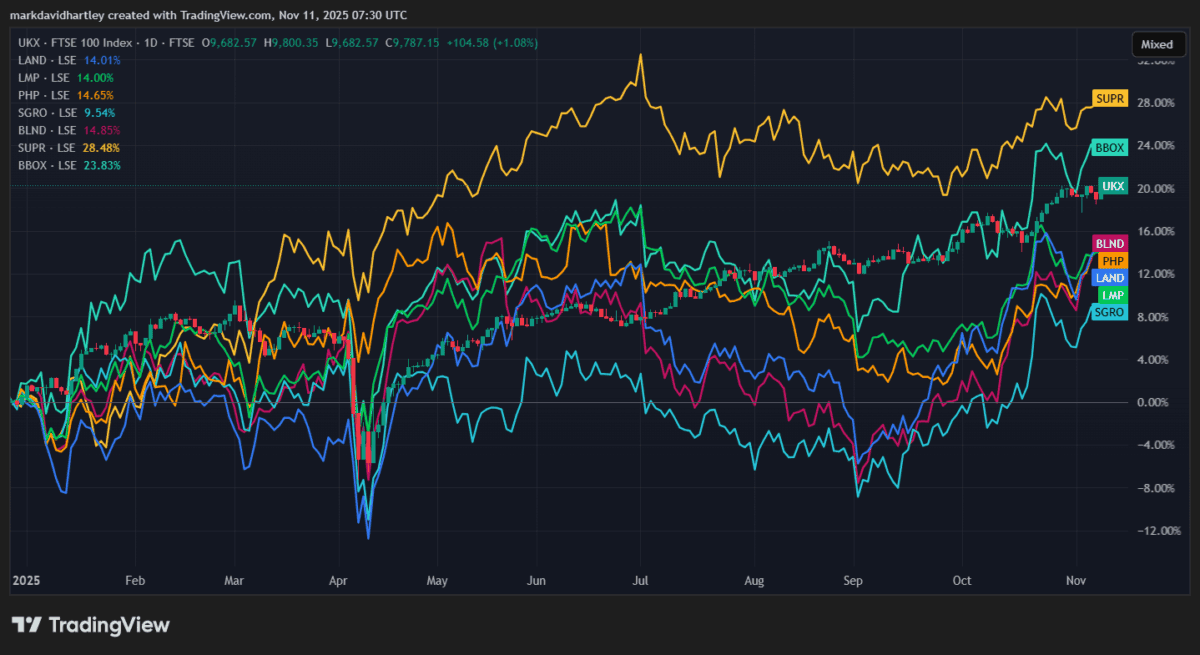

So far, this year hasn’t been the best for real estate investment trusts (REITs). After a decent start to 2025, many REITs took a dive in the third quarter.

This was largely attributed to stubbornly high inflation and compounded by rising bond yields and hedge fund positioning.

But the past three months have seen notable improvement, with many REITs growing between 10%-20%. While most residential REITs still trail the FTSE 100, commercially-focused ones seem to be surging ahead.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

A closer look at the UK housing market

On the residential side, fewer people are buying houses in London while more are purchasing up North. The North East has experienced the strongest annual growth this year, at 6.6%, while London showed a marginal decline of 0.3%.

Official data from the UK House Price Index reveals that average property values increased by 3% annually in August, down slightly from 3.2% in July. More recently, Nationwide reported annual house price inflation reaching 2.4% in October.

And according to Halifax, house prices rose by 0.6% month-on-month in October, marking the largest monthly increase since January.

Mortgages are also up, with a reported 65,900 approvals in September — the highest level since December 2024.

But the real growth seems to be in the industrial and logistics sector. Q3 saw a 23% year-on-year increase in square meterage sold for warehousing, driven largely by e-commerce and supply chain optimisation needs. Artificial intelligence (AI) and analytics have also led to a growing demand for data warehousing.

With no sign of this demand slowing, I expect 2026 to be a bumper year for logistics-wise REITs. One that seems to be taking the lead is Supermarket Income REIT (LSE: SUPR).

A rapidly growing real estate space

As the name suggests, Supermarket Income REIT invests in properties that form a critical part of modern grocery infrastructure. Beyond just standard shopping premises, it owns and lets click-and-collect services and online order fulfilment centres for home delivery.

These are key areas likely to see exponential growth in the coming years.

The business successfully completed the internalisation of its management function in March, transitioning from Atrato Capital management to an in-house operating structure. It’s estimated the move will reduce costs by £4m, becoming profitable after a five-year payback period.

However, whike the 7.6% yield’s undoubtedly attractive, dividend coverage is thin. In fact, it’s currently paying out more than its earning, and cash reserves only cover half the payments.

That means there’s a fairly high risk of a dividend cut if profits don’t improve soon. And there’s the ever-present risk of inflation, interest rates and a market downturn — all of which could hurt the share price.

My verdict

Despite the persistent inflation-linked challenges and budget uncertainty, the UK housing market‘s proving resilient. Prices are up around 2%-3% annually, supported by falling mortgage rates and a stabilising job market.

With logistics driving this recovery — a trend likely to continue — I think Supermarket Income REIT could emerge as an income gem in 2026.

But it’s not the only dividend stock investors should consider as 2025 comes to a close. When it comes to high yields, the FTSE has a wealth of attractive options to choose from.