More and more Britons are using artificial intelligence (AI) models to save and invest. So I’ve jumped on board and asked ChatGPT — by far the world’s most popular AI platform — which FTSE 100 stocks I should consider buying.

The answers it gave were interesting. But they were also deeply troubling. Let me explain why.

AI boom

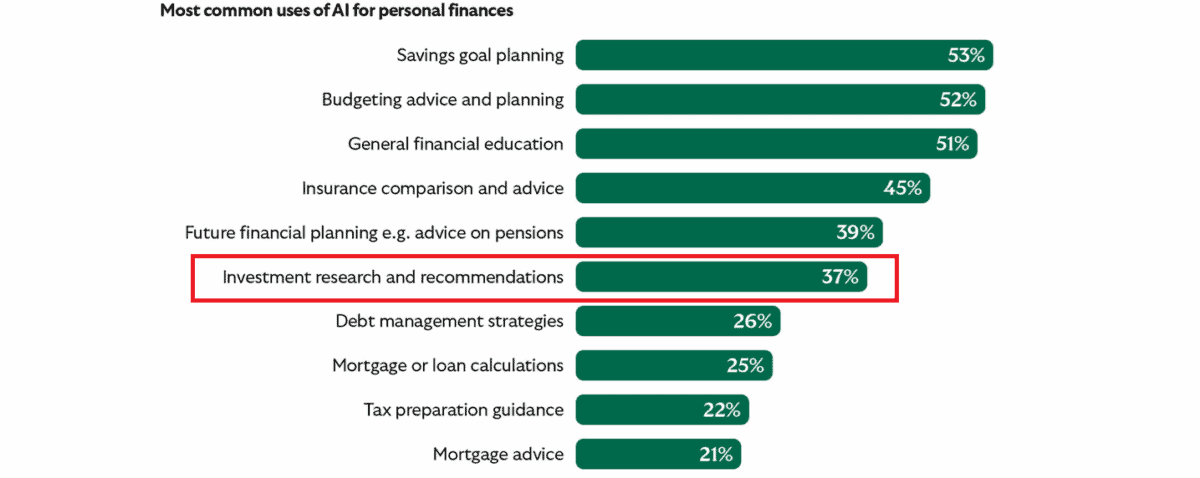

The number of people who are using the likes of ChatGPT to hit their financial goals is staggering. According to Lloyds, “more than 28m UK adults are now turning to artificial intelligence to help manage their money”.

Interestingly, the Footsie bank’s research showed more than a third of Britons use AI for investment research and recommendations:

Yet paradoxically, Lloyds’ research also revealed that trust in AI remains thin. For instance, 80% of respondents say they “are concerned about receiving inaccurate or outdated information”. Another 72% have stressed worries over potential AI bias affecting recommendations.

Starting off hot

As an investor, questions over information quality have always stopped me from embracing AI when choosing stocks. I’ve already noticed troubling results in other areas, from tailoring my weightlifting programme to planning my holidays.

But I’m prepared to try anything once. Besides, I’m curious to see what AI might be capable of. So I punched “what are the best two FTSE 100 shares I should buy?” into ChatGPT and sat back to see what it threw up.

The first suggestion was AstraZeneca (LSE:AZN). A promising start, I thought. ChatGPT flagged up the company’s “global pharma pipeline, and growth in oncology and cardiovascular/renal/metabolic (CVRM) treatments”.

Though it also carries “drug-pipeline risk and regulatory risks (like pricing, approvals)”, ChatGPT says it could be “a growth with defence ballast pick [that’s] good in uncertain macro climates”. It also praised the “diversification benefits” that AstraZeneca’s worldwide operations provide.

AstraZeneca’s delivered an exceptional 13.2% average annual return since 2015. With a packed pipeline, and global healthcare demand rapidly increasing, the company looks in good shape to hit its $80bn annual revenue target by 2030 and continue delivering impressive returns.

Glaring errors

Yet while ChatGPT started well, the good times didn’t last. In fact, my stock picking exercise then took an alarming turn for the worse. The AI’s next buy recommendation was BP (LSE:BP), with the oil producer’s “dividend history” cited as one reason.

Okay, BP’s annual dividends have risen consistently since 2022, and are forecast to keep on growing for the next few years. But BP’s also cut them three times since 2010, including twice this decade. Dividend forecasts are also never set in stone.

But my main worry over ChatGPT’s suggestion related to its description of BP as an “energy transition” play. The truth is that the FTSE company this year generated just a fraction of profits from non-fossil fuels. Also this year, it slashed spending targets on clean energy and sold renewable assets (like its US onshore wind business back in July) as it refocuses on oil.

This strategy may pay off when crude prices are high. However, it also raises serious long-term questions for investors as the clean energy transition gathers pace.

I expect AI recommendations to improve as the technology becomes more sophisticated. But right now, I believe the dangers of using AI to choose shares to buy remain far too great to ignore.