FTSE 100 shares have a reputation for being less exciting than their S&P 500 counterparts. But I think a lot of investors have an exaggerated view in both directions.

Outside a handful of explosive tech names, there’s not much growth coming from US stocks right now. And the UK has more in the way of exciting opportunities than you might think.

Growth stocks

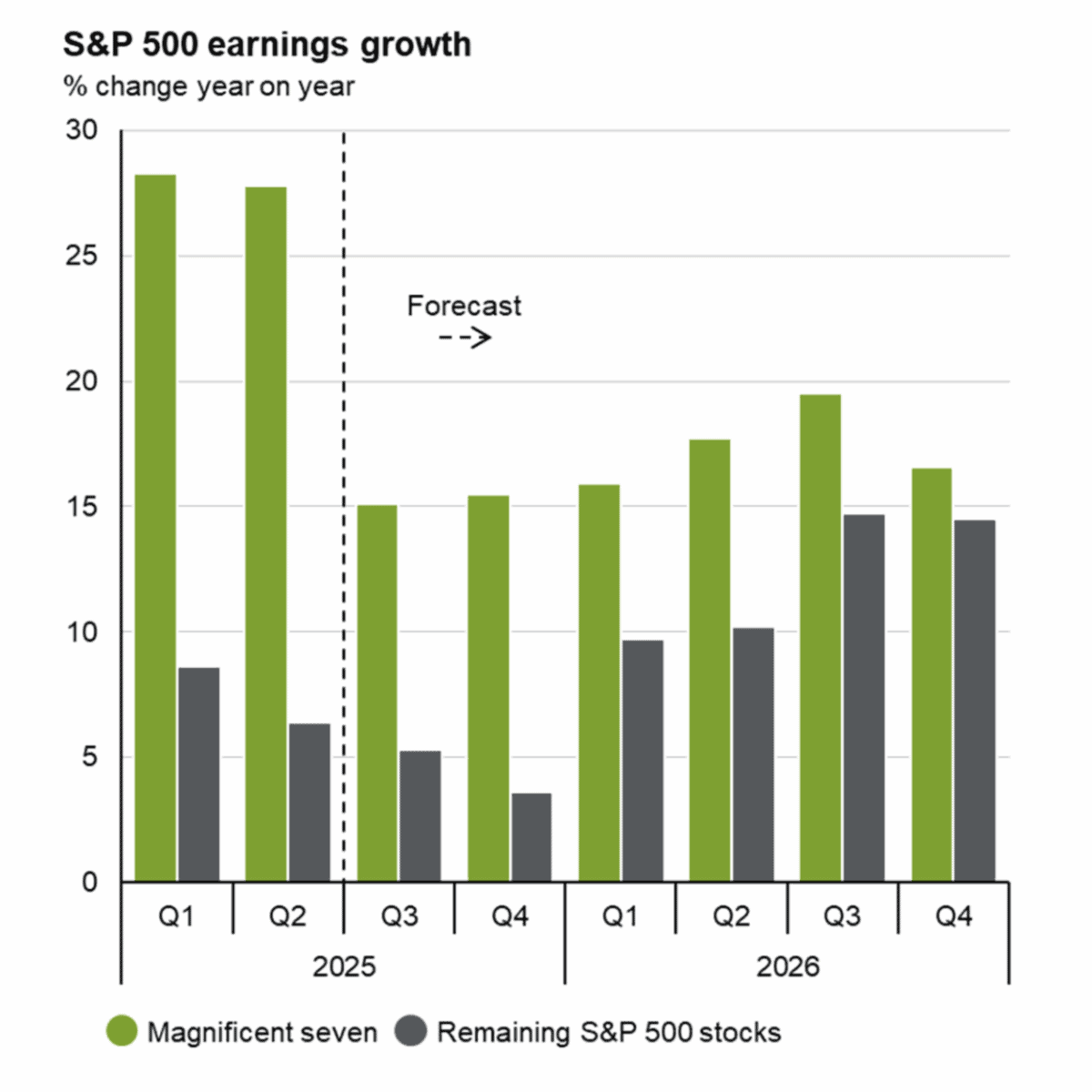

Outside the collection of stocks known as the Magnificent Seven, earnings growth has been pretty weak recently. Analysts at JP Morgan are expecting growth to fall to around 3% in Q4.

Source: JP Morgan Guide to the Markets Q4 2025

That means anyone looking to buy an S&P 500 tracker fund had better hope the 10 largest names can keep growing. They’re holding the entire show together by themselves right now.

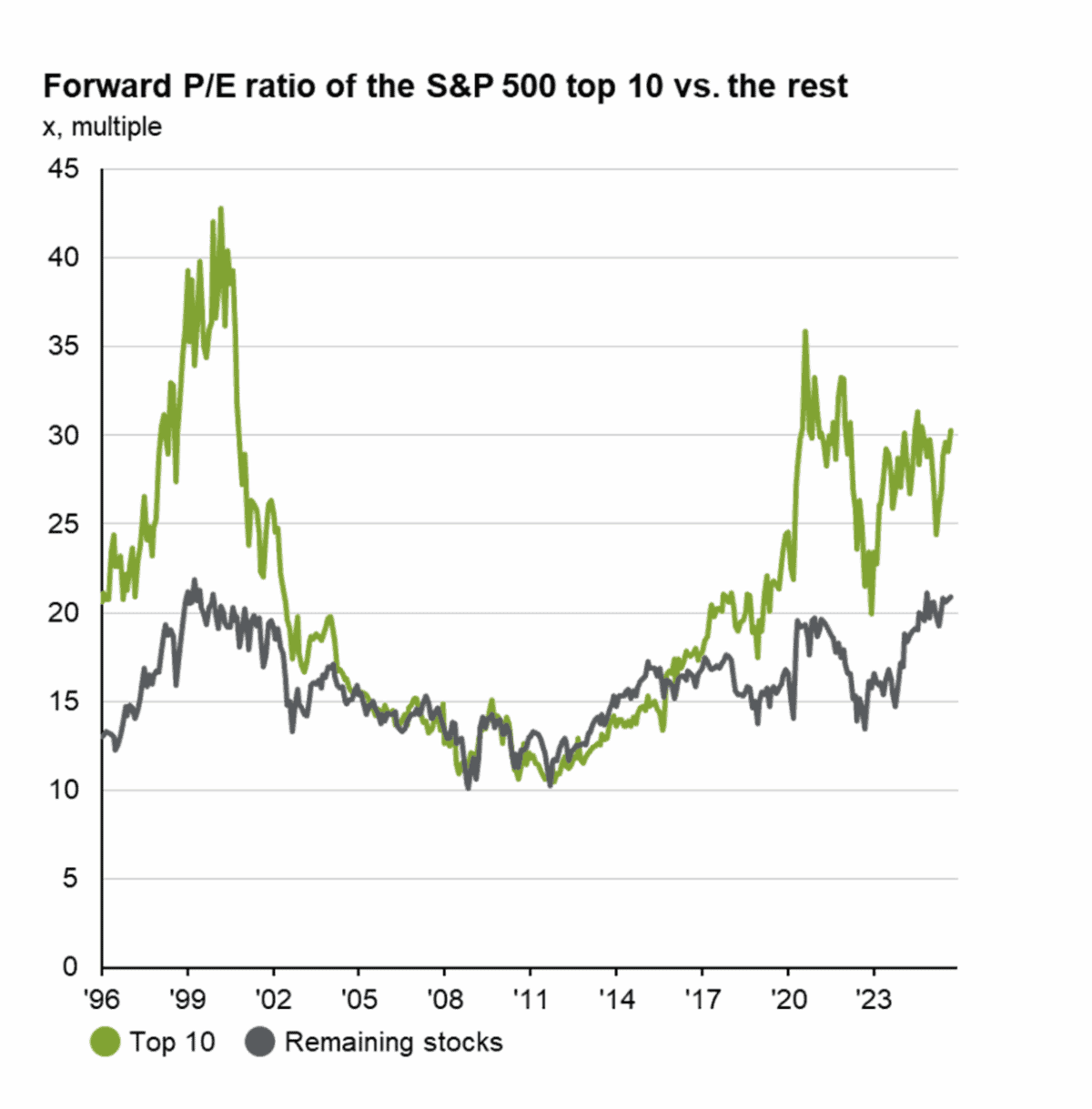

A small number of companies doing all the work in terms of growth means valuations have become stretched in relative terms. And that gives investors looking at US stocks a dilemma.

Source: JP Morgan Guide to the Markets Q4 2025

The choice is between paying very high multiples for a few growth names, or looking at a large sea of businesses that aren’t growing much. Neither option is particularly attractive.

B2B events

Investors looking at UK equities arguably have a much easier time of things. Take Informa (LSE:INF) – the owner of major trade shows globally – as an example.

The company’s revenues have grown at 18.5% a year for the last five years. Now, that does include a Covid-19 recovery, but the average annual growth rate since 2015 is still 12%.

Investors should note that some of this has been driven by acquisitions, which are naturally one-off. And Informa has done some deals at high multiples recently, which creates risk.

The firm’s asset-light model, however, gives it some very attractive economic properties. So at a (forward) price-to-earnings (P/E) ratio of 15, I think it’s well worth considering.

B2C products

Games Workshop (LSE:GAW) is another FTSE 100 firm that generates outstanding returns on invested capital. And it’s grown revenues at an average of 17% a year over the last decade.

The big question is whether or not it can continue. The growth rate over the last 10 years has been very uneven and this illustrates the risk of a recession for the company.

It’s worth noting, though, that its products aren’t exactly big-ticket items compared to things like holidays or home improvements. And I think this makes the firm unusually resilient.

The stock also has a 3.5% dividend yield, which is unusual for something growing at that rate. As a result, I think investors looking to build wealth over time should consider buying it.

Building wealth

Outside a few outstanding names that trade at relatively high multiples, the S&P 500 and the FTSE 100 look fairly similar to me. And I think both have growth stocks worth considering.

In the UK, Informa and Games Workshop are two that investors looking to build wealth should check out. In my view, they’re among the best stocks to consider buying right now.