The past year’s been anything but dull for THG (LSE: THG), having re-entered the FTSE 250 in September, just months after a dramatic exit.

After the British nutrition and beauty digital retailer’s rollercoaster year, many are asking: is this comeback for real, or just a sugar rush for investors thinking about bargain hunting?

A hard-earned turnaround

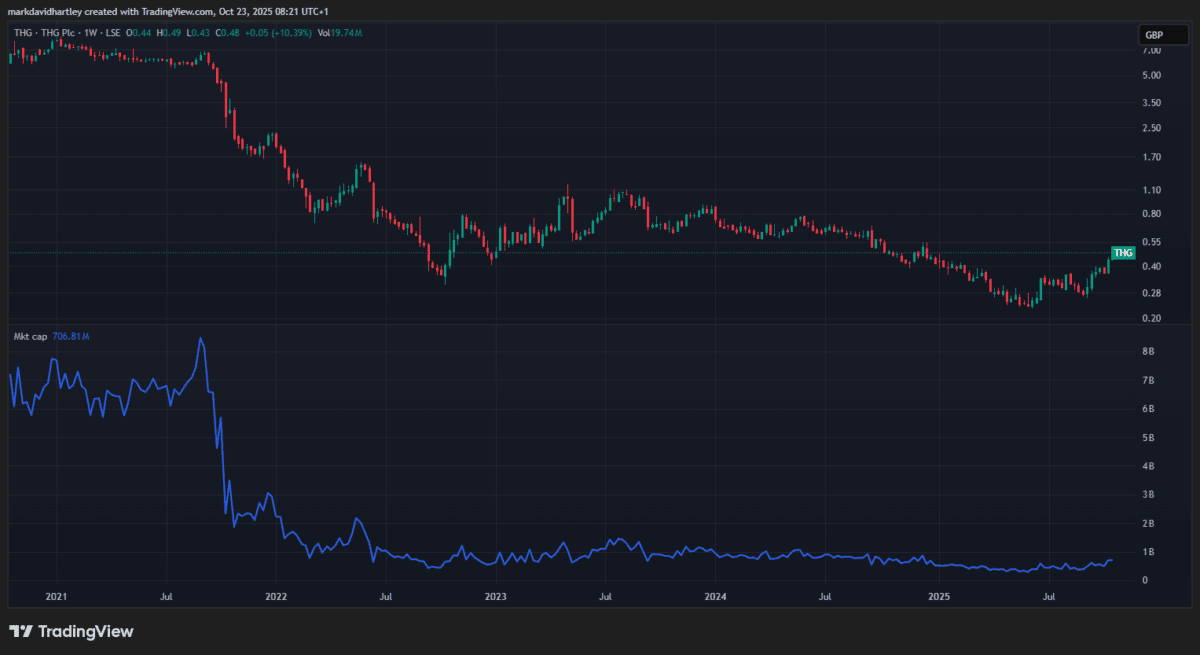

With a £664m market-cap, THG sits at the lower end of the index, on par with the likes of Aston Martin Lagonda and Close Brothers. That’s a far cry from its peak, when it was worth close to £8.5bn.

Most recently, revenue growth in Q3 has shifted sentiment – it’s the strongest quarter of organic sales since 2021, with revenue up 6.3% to £405.2m. JP Morgan’s recent rating upgrade didn’t hurt either, and CEO Matthew Moulding has called this turnaround a hard-earned victory after years of chaos and restructuring.

The company, which owns brands including Myprotein and Cult Beauty, suffered devastating losses in late 2021, with the price crashing by over 70%.

Now, after years of struggles, it seems determined to rise up through the ranks again. So does that make the current price an opportunity — or a value trap?

Let’s take a closer look.

Assessing value

THG’s still loss-making, so there’s no price-to-earnings (P/E) ratio for investors to weigh up. Instead, its price-to-sales (P/S) ratio comes in at just 0.4, which could suggest undervaluation, but the price-to-book (P/B) ratio of 1.59 is a tad rich. It’s this blend of numbers that often draws value investors to the story.

The share price performance has certainly been impressive. It’s up 68% over the past six months – but don’t forget, THG’s still down more than 90% from its all-time high. That leaves plenty of room for growth if the firm can deliver consistent results.

But what’s the city saying?

Most brokers reviewing THG rate it Neutral or Hold, with an average 12-month price target predicting little-to-no growth in the next year. Some are optimistic about the operational improvements and brand portfolio, while others remain cautious amid profitability issues and competitive threats.

Risks to consider

THG’s debt stands at £601m. It’s not massive for a business of this size, but it outweighs equity, which isn’t ideal. Add in its quick ratio below 1, and it’s clear THG doesn’t have enough liquid assets to cover its short-term liabilities.

That’s worth thinking about, especially as online retail’s a crowded territory and rivals are quick to pounce on any weakness.

Analysts note the company’s ongoing restructure – including selling non-core assets and automating operations – should help in the long term. But any slip in consumer demand or further volatility could cut short the rally.

My verdict

After years in the wilderness, THG appears to be getting its act together. Sales are up, and forecasts predict profitability by the end of fiscal 2025. Value investors looking for turnarounds might want to consider THG, since the low share price and improving numbers could merit a closer look.

Personally though, it’s still a bit too risky for my portfolio just yet. The mix of weak liquidity, debt, and fierce competition gives a lot to weigh up. Still, I’ll be watching to see if it grows stronger as the year ends.