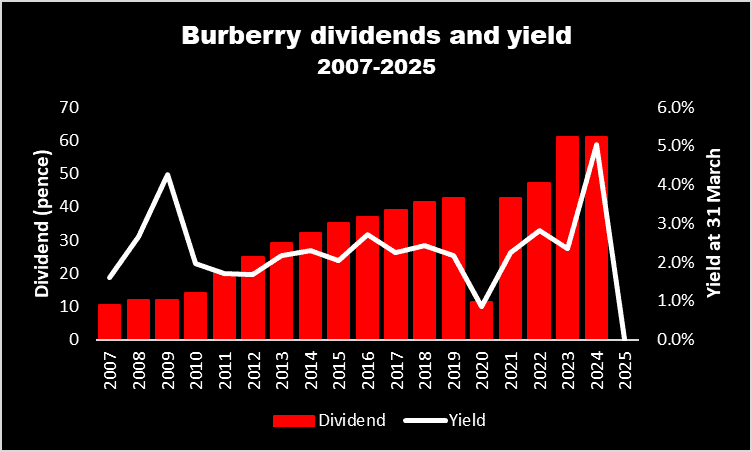

The incomes of those holding shares in Burberry Group (LSE:BRBY) have taken a bit of a hit lately. That’s because the luxury fashion house suspended its dividend in July 2024 to help preserve cash following a period of falling sales. Squeezed incomes and increased global uncertainty have caused a drop in demand for the more expensive things in life.

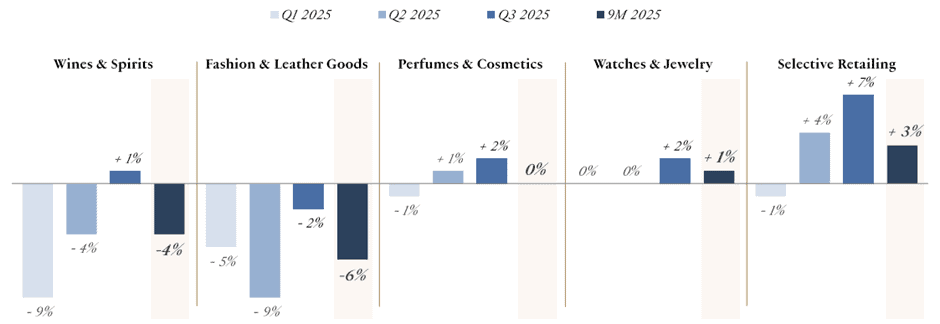

However, the luxury sector received a bit of a boost last week (14 October) when LVMH, owner of many ultra-pricey brands including Louis Vuitton and Moet & Chandon, announced its sales rose by 1% year-on-year in the third quarter of 2025. This beat analysts’ expectations and led to a big jump in the group’s share price. That same day, investors pushed Burberry’s shares higher on the news, perhaps hopeful that the group may also have turned the corner.

We will know whether this is the case on 13 November when the group announces its interim results. Traditionally, this is when its interim dividend is also confirmed. However, I think it’s a little early to expect payouts to resume for a couple of reasons.

Challenging conditions

Firstly, LVMH is about more than just high-end fashion. It sells everything from champagne to watches. And of its five divisions, sales increased in four of them. However, the outlier was its fashion and leather goods business, which experienced a 2% drop.

Secondly, the Chinese economy is continuing to slow. Q3 GDP increased by 4.8% but this is lower than during the previous two quarters. Most countries would love to experience a growth rate like this. However, the economy appears to be weakening. This is a potential problem because, in common with most retailers in the luxe sector, China is a hugely important market for Burberry.

Therefore, I think the best shareholders can hope for next month is evidence that the decline in sales is continuing to slow. I’m not expecting the group to resume paying a dividend just yet.

But to be honest, I don’t think Burberry is an income share. Although the term is often used to describe any stock that pays a dividend, I think it should be reserved for those that offer above-average payouts. And as the chart below shows, for much of the past decade or so, its yield has been pretty unspectacular.

My view

However, despite this, I think the group‘s share price could return to previous highs, although it might take some time.

I believe the power of Burberry’s brand should never be underestimated. The group’s distinctive check design still appeals to celebrities and its current autumn/winter collection was well received by the industry’s press. Its 2026 spring/summer range — with its festival vibe — is also generating positive headlines.

During the second quarter of the year, Burberry re-entered the Lyst Index of ‘Hottest Brands’ at number 17. This is compiled using the “biggest data set in fashion”, which incorporates actual purchases as well as social media activity. I think this gives the list credibility and could be a sign that things are on the turn.

Also, Burberry isn’t the most expensive designer brand around. This could help it recover more quickly than some of its rivals.

That’s why I own the stock. And for the same reasons, others could consider adding it to their own portfolios.