Many investors shy away from investing in the FTSE 250, believing it to be too risky. Certainly, the index does tend to exhibit more volatility than its larger cousin. However, it is also packed with high-quality businesses with proven business models and paying sizeable dividends.

Dividend champion

One of my favourite stocks is asset management giant, Aberdeen (LSE: ABDN). Today, the dividend yield is a headline-grabbing 7.3%.

So how much could an investor who parked £5,000 in the stock today realistically expect to get back in 15 years’ time?

The company has already made it clear that it will not be hiking dividend per share (DPS) until payouts are covered 1.5 times by adjusted earnings. That is unlikely before 2027. So let us add that fact to the model.

After 2027, let us assume that DPS grows at 2% annually. A 2% annual share price growth is also extremely conservative.

Dividend compounding

Of course, no dividends are ever guaranteed. But that said, if I plough my annual dividend payments into buying more shares, then I create a compound generating machine.

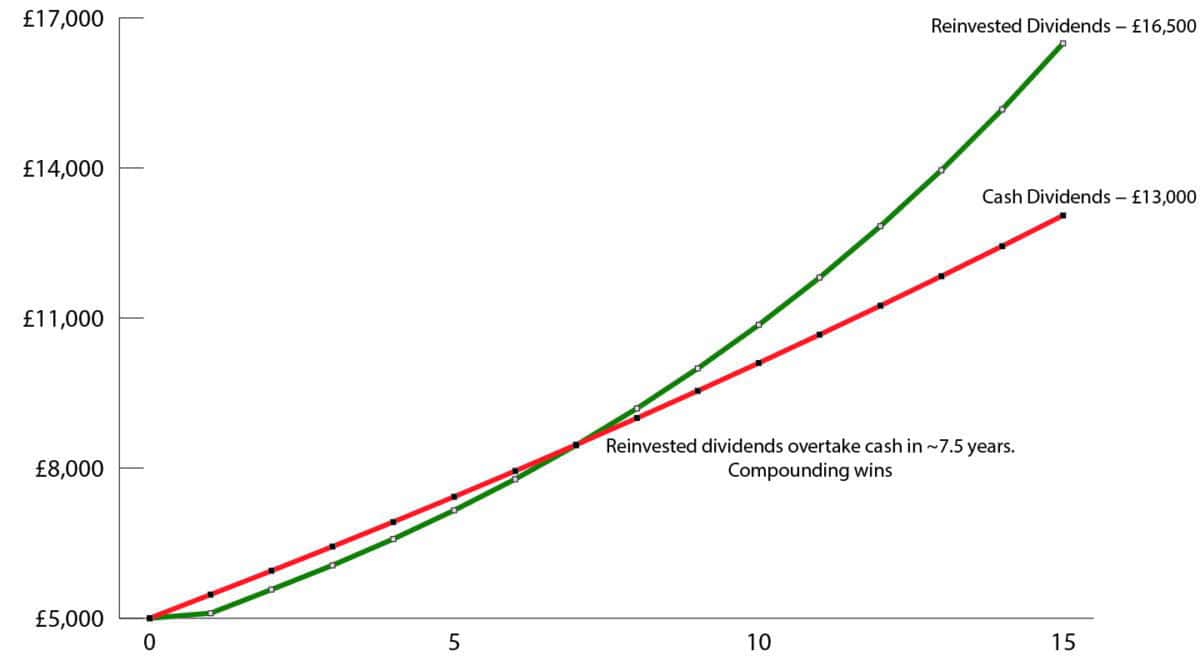

Most investors fail to really appreciate the importance of compounding in building long-term wealth. As the following chart highlights, after 15 years £5,000 compounds to over £16,500.

Chart generated by author

If I take the dividends as cash, then the number of shares I own remains flat. As the graph shows, the orange line, although growing, always remains linear.

Fund outflows

One of the reasons why Aberdeen’s dividend yield is so high is because the share price has been in long-term decline.

Nevertheless, in the last six months the business has begun to show signs that it might finally have turned a corner.

In H1, net outflows from its Adviser business were £900m. Although disappointing, investors need to look at the trend line not the absolute number.

Over the last four quarters, net flows have improved significantly. Indeed, net outflows are now 50% lower than they were in 2024.

Part of the reason for this improving picture is down to lower management fees on its various funds. Although this has led to a short-term hit to revenues, I believe it will likely prove to be the right strategy in a highly competitive industry.

Changing industry

The asset management business is evolving rapidly. Investors today do not have a lot of patience. If they see a fund performing badly, they will ditch it without much thought.

With so many funds and fund managers to choose from, standing out from the pack can be extremely difficult. But just because an industry is highly competitive, does not mean it cannot be lucrative.

In my opinion, Aberdeen’s differentiating factor is that it possesses deep, personalised relationships with independent financial advisors (IFAs).

It understands what IFAs require from a fund manager. For example, it recently ramped up capital investment and now has a sleek modern platform. I believe such investments will help entice more IFAs to sign up.

In my books, the company still has one of the biggest brand names across the industry. If it can replicate the runaway success of interactive investor across its other businesses, then that 2% share price growth, modelled earlier on, will look extremely conservative. That is why I recently bought more shares – for both growth and income.