Grainger (LSE:GRI) is a UK-listed real estate investment trust (REIT). With its shares priced at £1.94, it offers investors a way to get a foot on the property ladder with less than £2.

It’s no secret that the hardest part of buying a house is often getting the deposit together as prices just keep going up. But I think this could be a smart way to try and build some wealth to help the process.

Building a deposit

Trying to put together a deposit to buy a house can be a soul-destroying experience and we all know why. Despite higher interest rates in the last few years, property prices just keep going up.

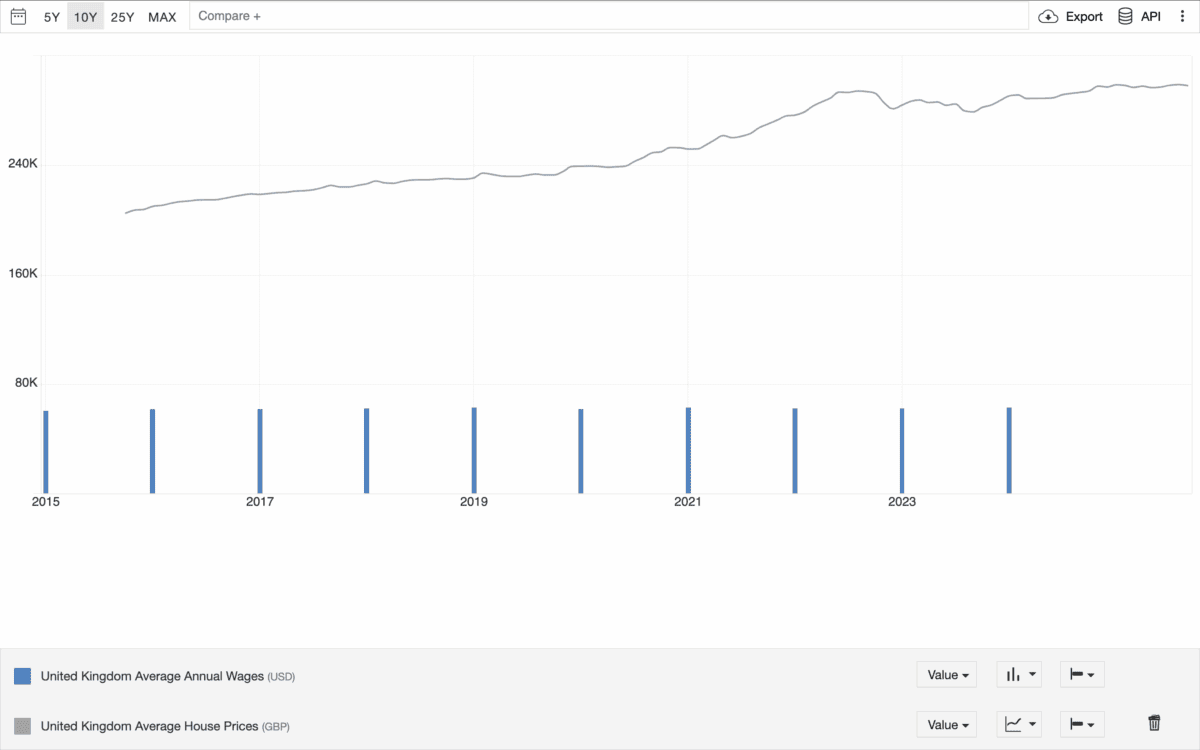

In the last 10 years, the average house price in the UK is up by around 50% and the average wage has increased by about 4%. Forget Netflix, gym subscriptions, and whatever else — that equation just doesn’t work.

Source: Trading Economics

There are lots of theories about why property prices keep going up – I certainly have mine – but that’s a conversation for another day. What matters right now is what to do about it.

To avoid being left behind, future first-time buyers need something that can keep pace with rising house prices. And I think Grainger is well worth checking out as a potential answer.

A ready-made portfolio

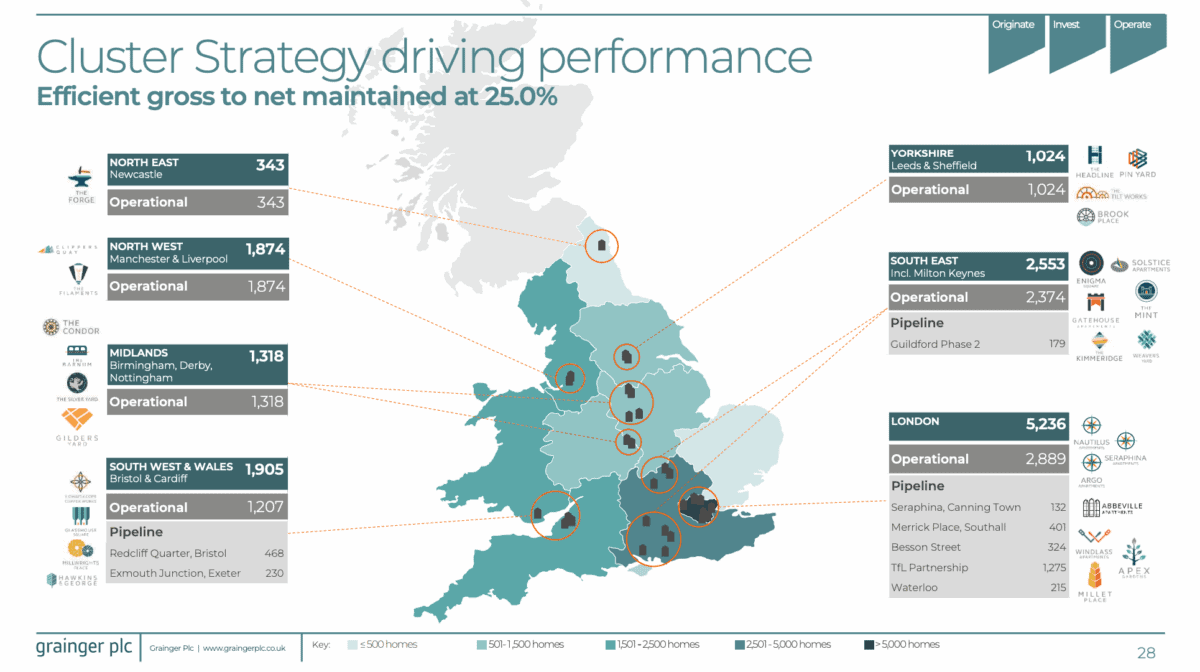

Grainger owns and leases a portfolio of over 11,000 houses across the UK. And around half of these are located in London, where demand always seems to be exceptionally strong.

Source: Grainger Investor Relations

Put simply, this is a way of investing in property. So unless something strange happens, an investment in the company should grow as the value of its portfolio increases with rising house prices.

There are a few reasons why it might not. One is the possibility of changing rental regulations generating a lot of unforeseen costs if Grainger has to keep modifying its buildings.

Other things being equal though, an investment in the firm should be able to keep pace with a rising property market. And we haven’t even got to what I think is the best bit.

Rental income

As a REIT, Grainger is required to return 90% of its taxable income to shareholders. So investors don’t just participate in rising property prices, they also get cash dividends from the business.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Dividends are never guaranteed, but have been growing steadily over the last decade. And the company reports that a lot of its tenants tend to stay in its properties for the long term.

Grainger also has big plans for future expansion. A future pipeline worth around £1.3bn means it’s looking to add another 37% to the value of its existing portfolio.

In a market where prices only seem to go higher, that could be worth a lot. And investors can participate in this growth by buying shares in the company without needing a huge deposit.

If you can’t beat ’em…

It feels like first-time buyers in the UK are at a structural disadvantage – and they have been in recent years. But investing in property via REITs is an idea that’s well worth thinking about.

Owning shares in Grainger could help future buyers avoid being left behind by rising house prices while earning passive income on the side. And it’s not the only opportunity worth considering.