Shares in Compass Group (LSE:CPG) are down 6% since the start of the year. That’s hardly a crash, but shares in the FTSE 100 company are trading at an unusually low valuation at the moment.

I’m a big admirer of the business, its competitive position, and its growth record. So I’m wondering whether this might be my opportunity to add the stock to my portfolio.

Valuation

Right now, Compass Group shares are trading at a price-to-earnings (P/E) ratio of around 40. That’s higher than the likes of Alphabet, Amazon, and Meta and doesn’t sound low, by any standards.

Sometimes however, P/E multiples can be misleading and I think that’s the situation here. Shares in the UK contract catering firm are actually a lot cheaper than they look.

The company’s official net income reflects a number of one-off costs and non-cash charges. Adjusting for these, the current share price implies a P/E ratio closer to 26. That’s a much more reasonable metric. And it’s well below where the stock has traded in recent years, which suggests investor sentiment’s weaker than it has been in some time.

Growth

After more than doubling since October 2020, the share price has been falling since the start of the year. And one of the main reasons is that organic revenue growth’s been slowing.

Leaving aside acquisitions, sales grew 8.5% in the first half of the year. While a lot of FTSE 100 businesses would view this as not bad at all, it marks something of a decline for Compass Group.

The more the firm uses acquisitions to drive top-line growth, the more risk investors see in the stock. And this might be justified, given the inherent danger of overpaying for other businesses.

I think though, that there are reasons to be optimistic about sales growth. Recent macroeconomic data from the US – where Compass generates more than half of its sales – looks encouraging.

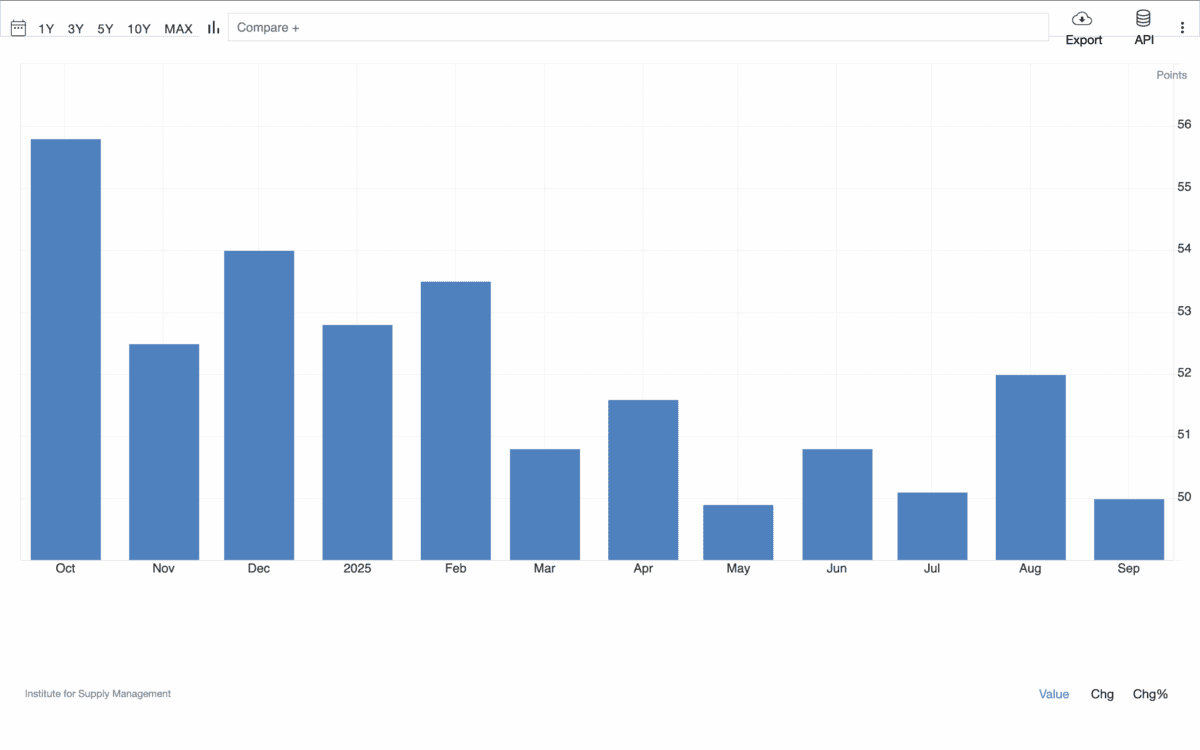

Services PMI

The Purchasing Managers Index (PMI) by the Institute for Supply Management (ISM) is one of the best monthly economic indicators. And the latest report for the services sector looks encouraging.

Source: TradingView

The index as a whole is at 50, which indicates neither contraction nor expansion. But below the surface, Accommodation and Food Services were the strongest sectors overall.

There are signs of the impact of US tariffs on imported ingredients, which is another risk. So I’ll be keeping a close eye on margins when Compass Group reports in November.

Overall though, I think the latest report’s very encouraging for the FTSE 100 company. And that’s why I’m thinking carefully about whether this might be my chance to buy the stock.

Long-term investing

Compass Group has a strong position in an industry that I expect to be durable. Its scale gives it a number of advantages over competitors in terms of lower costs, efficiency, and reliability.

This long-term strength is why I’m interested in the company in the first place. But right now also looks like an unusually good time to consider buying. The stock’s trading at an unusually low valuation and there are signs that growth might be about to pick up.

That’s why I think this could be my chance to add the stock to my portfolio and hope to do so as soon as I have the cash.