The BT (LSE:BT.A) share price has been a steady performer since the pandemic. In October 2020, its shares were changing hands for just over 100p. Today (9 October), they sell for around 185p. This five-year performance just about puts it in the top third of those currently on the FTSE 100.

Then and now

The sale of BT shares to the public in 1984 was the first major privatisation of the Thatcher government. The idea was to free the telecoms group from state control and let it compete internationally without being held back by bureaucracy and union power.

But a look at the 1984 sales prospectus suggests that the group’s made little progress since. At the time, it was valued at £7.8bn — or £25.6bn in today’s terms. Now, its market cap is ‘only’ £18.2bn.

During the year ended 31 March 1984 (FY84), it made a profit after tax of £990m (£3.25bn in current money). Forty years later, in FY25, it reported adjusted post-tax earnings of £1.83bn.

So in real terms, it’s now worth less and isn’t as profitable as it was over four decades ago. Also, its dividend is less generous. In 1984, the stock was yielding 7.1%. Based on amounts paid over the past 12 months, it’s now offering a return of 4.4%. This is a reminder that payouts are never guaranteed.

Sectoral challenges

This disappointing performance is symptomatic of the telecoms industry, where the infrastructure is expensive and the returns are poor.

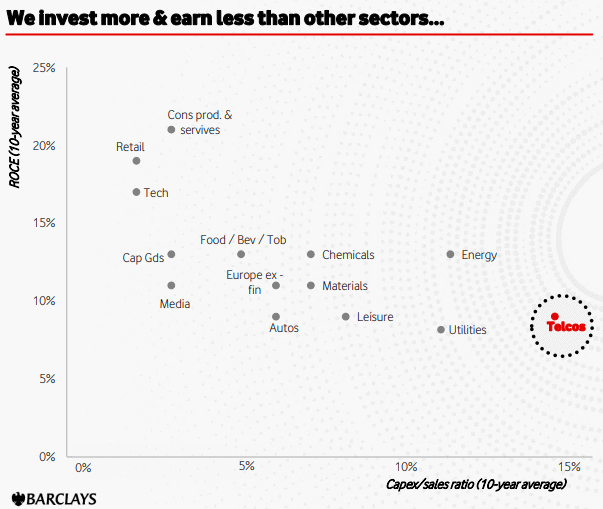

In 2023, Vodafone published research from Barclays that showed the ratio of capital expenditure to sales was the highest of any industry. The sector also had one of the lowest returns on capital employed (ROCE).

This is also evident from BT’s accounts. At the end of FY84, it had fixed assets of £8.8bn and debt (including leases) of £3.9bn. By the end of FY25, these had increased to £42.6bn and £23.3bn, respectively. Over the same period, its ROCE has fallen. And it’s remained largely unchanged over the past five financial years (FY21-FY25) fluctuating between 8.3% and 8.7%.

Pros and cons

One bright spot has been its adjusted EBITDA (earnings before interest, tax, depreciation and amortisation). It’s increased from £7.42bn in FY21 to £8.21bn in FY25. Although this is the group’s preferred measure of profitability, it can be controversial. Warren Buffett has described it as a “very misleading statistic” that “can be used in pernicious ways”. Pithily, he once asked: “Does management think the tooth fairy pays for capital expenditures?” This seems to be a highly relevant question in an industry where, as we’ve seen, the infrastructure isn’t cheap.

Adjusted earnings per share is probably a more reliable indicator. But in FY21, this was 18.9p. In FY25, it was slightly lower at 18.8p. The business appears stuck to me.

But brokers are optimistic. They have a 12-month share price target that’s 15% higher than its current value. And BT has some impressive names on its share register. The largest chunk of stock (24.5%) is held by Bharti Overseas. In my opinion, the group also retains a strong brand.

However, this isn’t sufficient to make me want to invest. BT looks like too much of a plodder in an industry that demands deep pockets. I think there are better opportunities for me elsewhere.