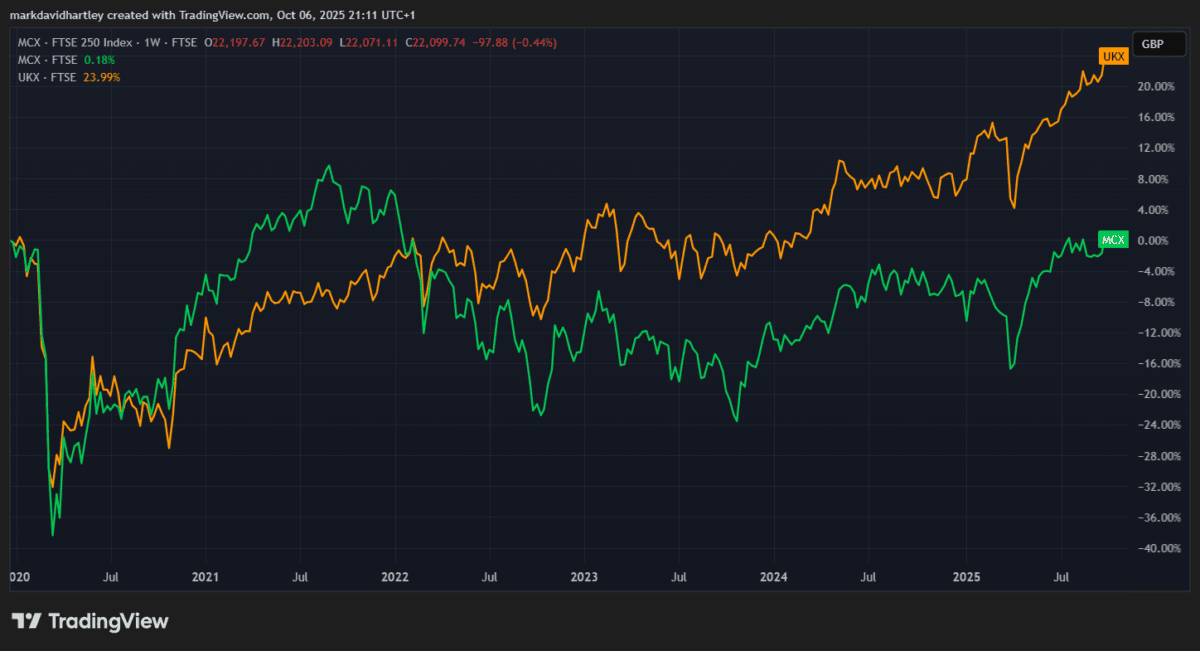

The UK investment world’s buzzing as the FTSE 100 has smashed through new highs again this month. Meanwhile, the mid-cap FTSE 250 seems stuck at its pre-Covid level of about 22,115 points — a mark it briefly breached in July but has since failed to break through.

Meanwhile, the FTSE 100 sits almost 24% above its pre-pandemic levels.

It’s tempting to write off mid-caps entirely. But I remain a staunch believer that smaller dividend shares deserve a place in a portfolio, especially when many big Footsie names look overpriced.

With that in mind, here are two FTSE 250 dividend stocks I won’t be selling any time soon.

Banking on a property boom

I’ve held Primary Health Properties (LSE: PHP) for several years, and it remains a core component of my income portfolio. As the name suggests, this real estate investment trust (REIT) is focused on primary care and health-oriented facilities, many leased to the NHS or private healthcare providers.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Its forward dividend yield stands around 6.78%, well above what many FTSE names offer now. More importantly, dividends are sufficiently covered by earnings and it’s been paying dividends consistently for nearly three decades.

When it comes to long-term investing, that’s the kind of reliability I prefer over the volatile nature of big-name growth stocks.

Of course, no stock’s without risks. Being property-based, it’s sensitive to interest rates and property valuations. If the broader real estate market weakens or borrowing costs climb, rental income and valuation gains could come under pressure.

But given its track record, balance sheet and dividend consistency, I think it’s a share investors should consider holding in a dividend-seeking portfolio.

Putting my money where my mouth is

Another favourite of mine is MONY Group (LSE: MONY). The business delivers services in personal finance, comparison tools and financial advice — exactly the kind of operations that stay relevant in tighter economic times. Its current dividend yield is about 6.25%, with a payout well supported by earnings.

The company also has an 18-year streak of uninterrupted dividend payments, and the average growth rate over the last decade is roughly 4.28% per annum. That mix of durability and income focus appeals strongly to me.

Of course, it also faces risks. The sector’s increasingly competitive, and any misstep in adapting to digital transformations or regulatory shifts could compress margins. Even though its dividend is well-covered for now, a surprise earnings shock or increased costs could strain sustainability.

It’s always important for investors to take these concerns to heart. But compared to many other income shares on the FTSE 250, I believe MONY Group’s in a stronger position than most and is worth further research.

Maintaining a long-term mindset

Yes, the FTSE 250 has struggled to break new ground this year. But that doesn’t mean all’s lost. High-quality dividend shares like Primary Health and MONY Group offer cash returns plus room for capital appreciation.

In my view, income investors would be wise to consider buying and holding such names, even when the mid-cap index feels stuck. After all, sometimes it’s less about hitting new highs and more about collecting reliable income along the way.