Nvidia (NASDAQ:NVDA) and the shares known as the ‘Magnificent Seven’ have been leading the stock market higher recently. And there’s a pretty straightforward reason for this.

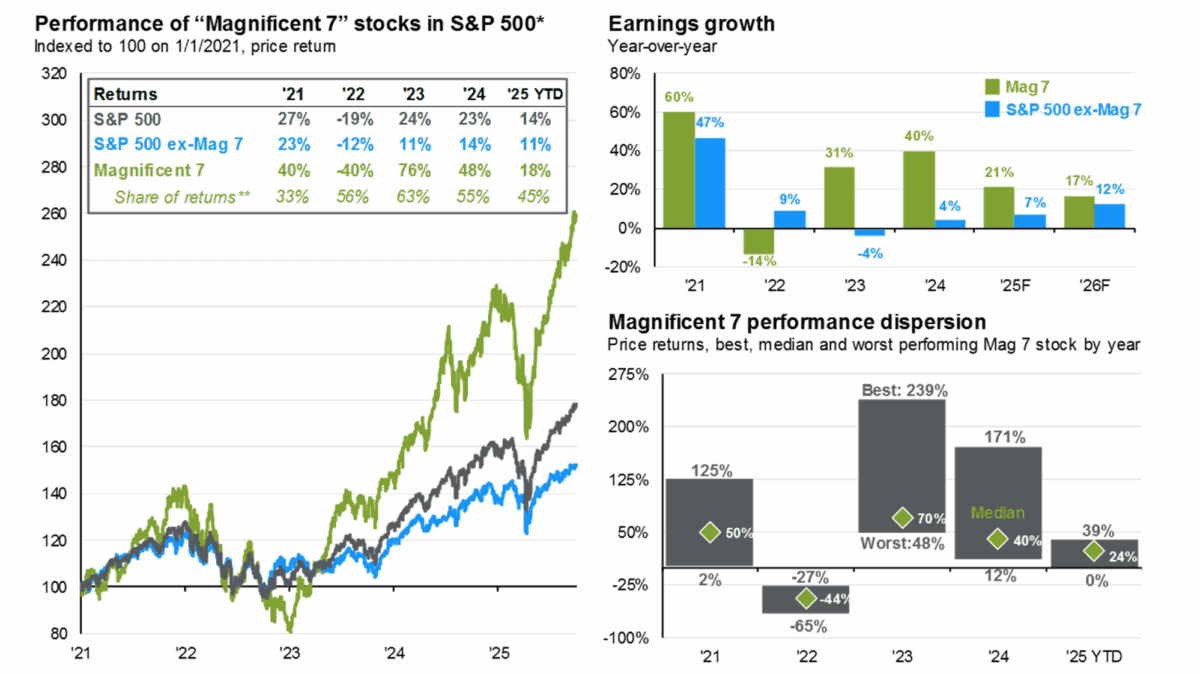

The US big-tech firms have been the source of most of the earnings growth in the last few years. But analysts think this might be starting to change in the next couple of years.

Earnings growth

Together, Apple, Amazon, Alphabet, Meta Platforms, Microsoft, Tesla, and Nvidia have generated earnings growth of around 29% a year since 2020. That’s huge.

By contrast, the rest of the S&P 500 has managed to grow earnings at around 11%. That’s not exactly bad, but it’s less than half of what the big tech firms have achieved.

Source: JP Morgan Guide to the Markets Q4 2025

Looking ahead to 2026 however, the gap is expected to close from both sides. Analysts are forecasting slower growth from big tech companies as the rest of the index picks up.

This might make investors wary of the higher valuation multiples the Magnificent Seven trade at. But I think this idea is one to be careful of – especially when it comes to Nvidia.

Data centres

Nvidia’s growth over the last few years has been driven by strong demand and a lack of any meaningful competition. And there are strong reasons for thinking this is set to continue.

Microsoft, Amazon, and Alphabet are still seeing strong demand for computing power. And they’ve announced big plans to keep investing heavily in building out data centres as a result. The capital expenditures associated with this might well weigh on profit growth for the cloud computing providers in the short term. But this shouldn’t be an issue for Nvidia.

While there isn’t a major competitor in sight, the firm should benefit directly from growing data centre spending. But there are still risks worth paying attention to.

Risks

The growth story to date has been extremely impressive, but it hasn’t all been plain sailing. And there are some potential challenges investors will want to keep an eye on going forward. One of the most obvious is restrictions on the company’s ability to sell its chips in China. The issue isn’t that there are limitations – the firm can deal with this – it’s that they keep changing.

Nvidia’s already anticipating $15bn in lost revenues as a result of shifting regulations. And in a political environment that’s been changing rapidly, this might get worse.

As well as the financial hit, it also increases the chance of a competitor emerging with a different chip. That’s another key risk the investors need to be mindful of.

Too late?

Earnings growth across US big tech companies is expected to slow over the next 12 months. But I think Nvidia might be in a stronger position than some of the other names.

Where Microsoft and Amazon invest in data centre infrastructure and look to realise a return in the future, Nvidia benefits directly from that spending. And that could be an important difference.

At the start of the year, I flagged the firm’s slowing sales growth as a potential concern. That hasn’t manifested itself in the share price yet, so maybe it isn’t too late to consider buying the stock.