Shares in Rio Tinto (LSE:RIO) climbed around 8% in September. But the FTSE 100 stock is still trading below where it was a year ago.

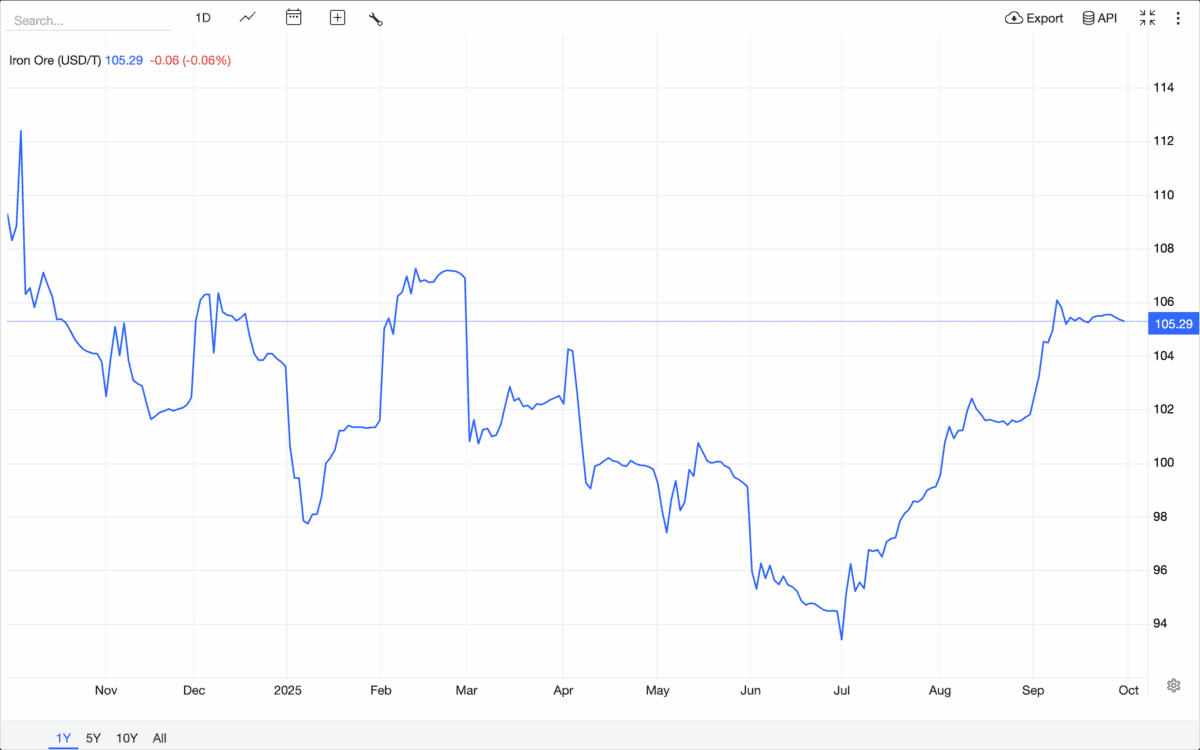

Iron ore prices have been relatively weak over the last 12 months and this is a big part of the issue. But increasing demand from China could give the company a boost going forward.

Iron ore

Rio Tinto’s largest product – by some margin – is iron ore. And that means its sales and profits depend heavily on movements in the price of the commodity.

For most of the last 12 months, iron ore prices have been falling, which is bad for producers. But things have started to turn around since the start of July.

Source: Trading Economics

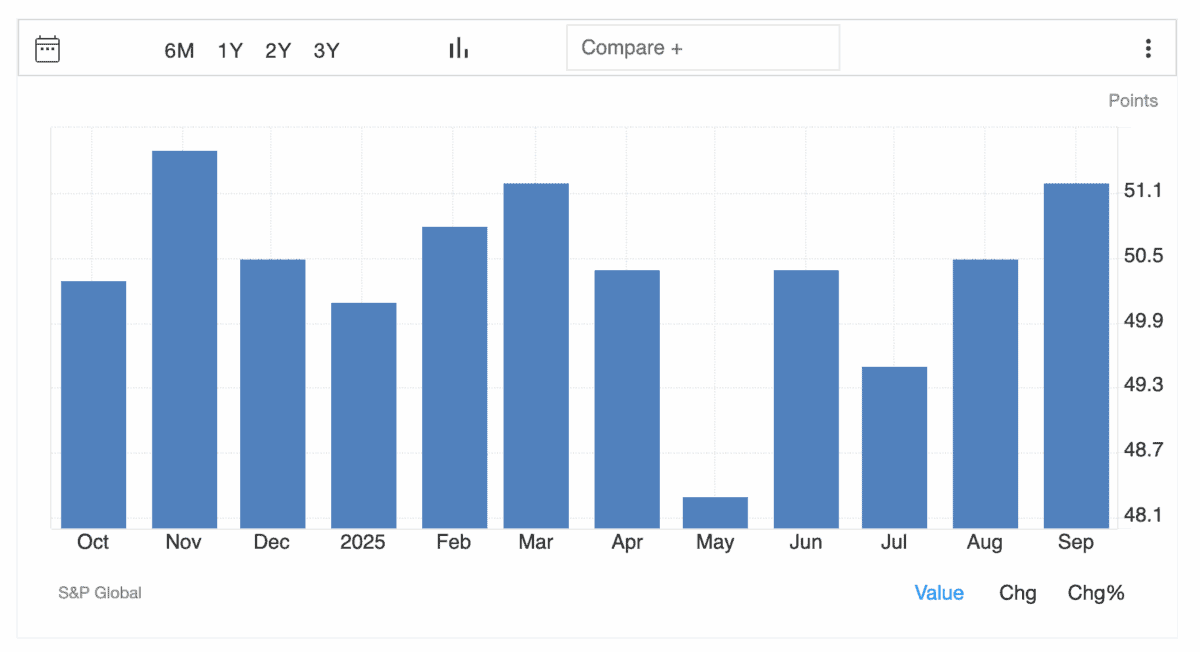

A big reason for this is demand. And China – one of the world’s largest consumers of iron ore and Rio Tinto’s largest market – has been showing signs of strength recently.

Industrial production has been increasing over the last few months, though the rate of growth has slowed. But the forward-looking signs are reasonably encouraging.

Source: Trading Economics

Since July, China’s Private Manufacturing PMI – a key leading indicator of manufacturing activity – has been climbing. Importantly, the metric crossed 50 in September, indicating it has entered ‘expansion’ territory.

In the context of Rio Tinto, I think that’s a very good sign. The prospect of higher demand in one of its major markets should be a big positive for both sales volumes and prices.

Risks

Political uncertainty is often a risk for mining firms, often meaning the threat of operational disruption. But with mines located in Australia and the US, this seems limited in Rio Tinto’s case.

Nonetheless, the company isn’t entirely immune from geopolitical issues. One example is the European Commission’s plan to impose tariffs on imports from China.

Rio Tinto doesn’t directly export goods from China to Europe, but it does sell the raw materials that they’re made from. So tariffs present an indirect threat to iron ore prices.

That means investors need to focus on the internal situation in China. Stronger demand internally is the most likely force that could offset the effect of trade restrictions.

The latest data suggests that consumer confidence is still relatively weak – as it has been since the start of the year. And this is a potential concern.

This, however, is why the Manufacturing PMI data is important. And strength in this area should give investors some cause for optimism at the moment.

Time to buy?

With investing, the time to look for buying opportunities is often when others are pessimistic. And that’s especially true of commodities producers like Rio Tinto.

With China typically accounting for over half the firm’s revenues, investors need a clear sense of where the country’s industrial output is heading in the long term. And that’s not something I have.

For investors who do have such a view, though, I think Rio Tinto could be a great stock to consider. And despite a recent rally, the share price is still well below where it was a year ago.