I just added these UK shares and exchange-traded funds (ETFs) to my Self-Invested Personal Pension (SIPP). Here’s why.

Buying on the dip

Like billionaire investor Warren Buffett, I love purchasing high-quality shares when they’re going cheap. So I’ve used a recent drop in the Legal & General (LSE:LGEN) share price to top up my holdings.

The FTSE 100 financial services company is now the single-largest holding across my entire stocks portfolio.

My motivations for holding Legal & General shares largely reflect my appetite for passive income. The company’s long been one of the UK’s most dependable dividend stocks, growing annual payouts every year (bar 2020) since the start of the last decade,

And following recent price weakness, its forward dividend yield has nipped back above 9%, to 9.2%. To put that into context, the FTSE 100 average sits way back at 3.2%.

Dividends are never guaranteed, of course. But the firm’s impressive Solvency II capital ratio of 217% bodes well for the short-to-medium term, at least.

Over a longer horizon, I think earnings and dividends could rise strongly as Legal & General leverages its immense brand power in growing markets like asset management, pensions and insurance. I’m especially excited by its opportunities in the UK pension risk transfer (PRT) market, though competition here — like in its other product categories — is a major threat investors need to consider.

Security guard

Having robust online security systems isn’t a luxury but a downright necessity. Over the last month, attacks have halted carmaker Jaguar Land Rover’s production and shut down several European airports, underlining the growing danger of malicious actions.

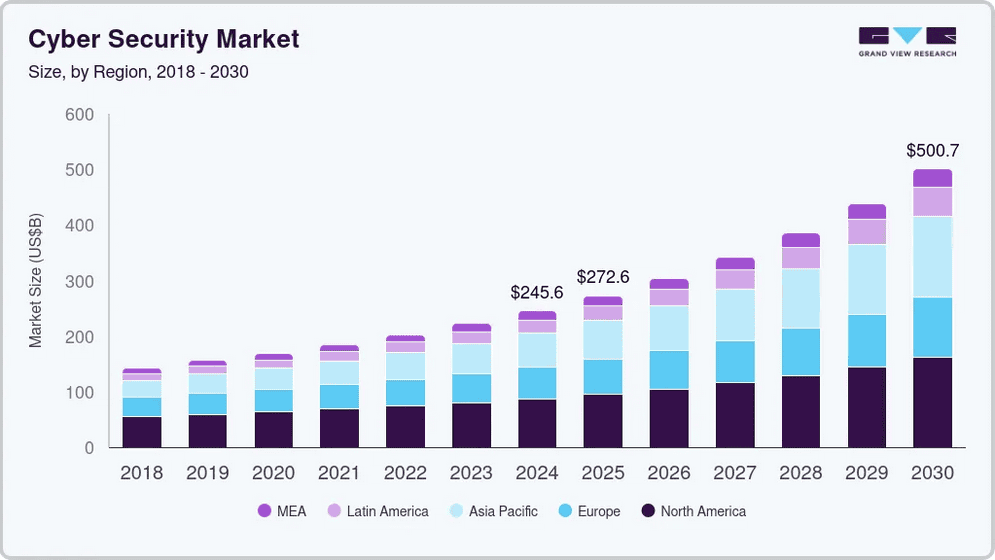

Given this, it’s no surprise that analysts are tipping rapid long-term growth for the cybersecurity sector. Grand View Research analysts predicted annualised market growth of 12.9% over the next five years, for instance.

UK share investors have a multitude of ETFs they can buy to seize this opportunity. I hold the L&G Cyber Security fund in my SIPP, and last week added the iShares Digital Security ETF (LSE:LOCK) alongside it.

The former gives me more focused exposure to market leaders Cloudflare and Palo Alto. In total, it holds 34 shares in its portfolio. By adding the iShares ETF beside it, I enjoy a more diversified approach that helps me to reduce risk. It carries most of the same big hitters but boasts a much larger pool of 111 companies.

One added sweetener is the fund’s lower total expense ratio of 0.4%. On Legal & General’s fund, this sits at 0.69%.

Like any tech-based ETF, both of these funds could underperform during economic downturns when consumers and businesses cut spending. These two are denominated in US dollars, too, which leaves my returns vulnerable to exchange rate changes.

But on balance, I’m extremely optimistic they will still deliver excellent long-term returns. iShares Digital Security’s produced an average annual return of 10.6% since its creation in 2018.