Exchange-traded funds (ETFs) are a rapidly-growing asset class among global investors. With eligibility for tax-efficient products like Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs), they can be a value addition to a long-term portfolio.

These funds offer a low-cost way for investors to diversify their holdings. And they provide exposure to a wide range of markets and themes. This means they can be tailored to each individual’s specific financial goals, risk appetite and investing style.

Yet while gaining in popularity, a report by the Investment Association (IA) shows that ETF investors “tend to be younger, higher-income and male, with a quarter living in London“.

Indeed, roughly 41% of fund investors are aged between 18-34. That compares with just 17% for those aged 55 and above. The IA believes “a lack of awareness and understanding… is the single biggest barrier preventing many retail investors from considering ETFs“.

Targeting high returns

This is striking, in my opinion, given the huge versatility of these products and the potential they have to generate mammoth returns.

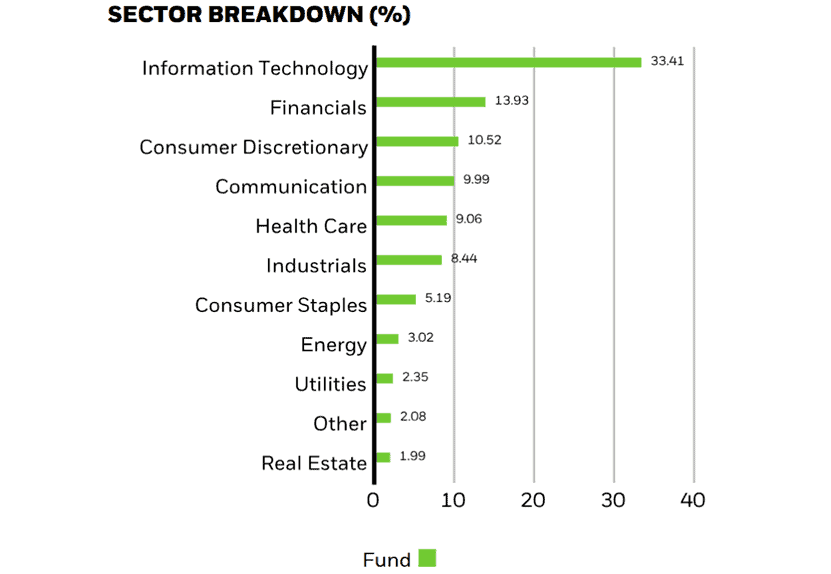

Take a simple tracker fund like the iShares S&P 500 ETF (LSE:CSPX), which mimics the performance of the US index of blue-chip shares. This spreads investors’ capital across hundreds of different companies spanning regions, industries and sub-sectors.

It’s delivered an average annual return of 14.4% over the last five years. And with a total expense ratio of 0.07%, it’s achieved this at extremely low cost to investors.

Past performance isn’t a guarantee of future returns. And in this case, investor profits could disappoint if the recent rotation from US equities into European shares continues.

But on balance I expect S&P funds like this to continue outperforming, thanks in large part to their large weighting of high-performing tech shares like Nvidia, Microsoft and Apple. It’s why I own an S&P 500 fund in my own portfolio.

Achieving a £572k retirement fund

This fund’s performance suggests even someone starting their investing journey late on can make a decent pile of cash for retirement.

Let’s say a 50-year-old invests £500 a month until they reach their State Pension age of 68 (between 2044 and 2046). Based on that S&P 500 fund’s past returns, they’d have a healthy £572,092 nest egg by retirement.

As I said though, there’s a vast range of thematic, sector and index funds that investors can choose from today in anticipation of high returns. The L&G Cyber Security ETF, another fund I hold, has delivered an average annual return of 9% since 2020.

I’ve also bought the Xtrackers MSCI World Momentum ETF for my portfolio, which holds “large and mid-cap companies from global developed markets with high momentum scores“. This fund’s provided an average yearly return of 12.8% during the last half a decade.

Regardless of an investor’s goals and experience, I think funds like this are worth serious consideration for building retirement wealth.