My individual shares portfolio mainly consists of high-quality, blue-chip growth stocks with clear competitive advantages. I’m talking about names like Apple, Amazon, and Rightmove.

However, I’m not afraid to take small positions in high-risk, high-return growth companies in an effort to generate explosive gains. I call these my ‘moonshot’ growth stocks.

Recently, I was doing some research into the autonomous driving and humanoid robotics industries and stumbled on a relatively unknown business that I thought looked really interesting. So, I bought a few shares for my portfolio.

This stock is really risky. But I think it could have more potential than any other in my portfolio.

A global leader in niche technology

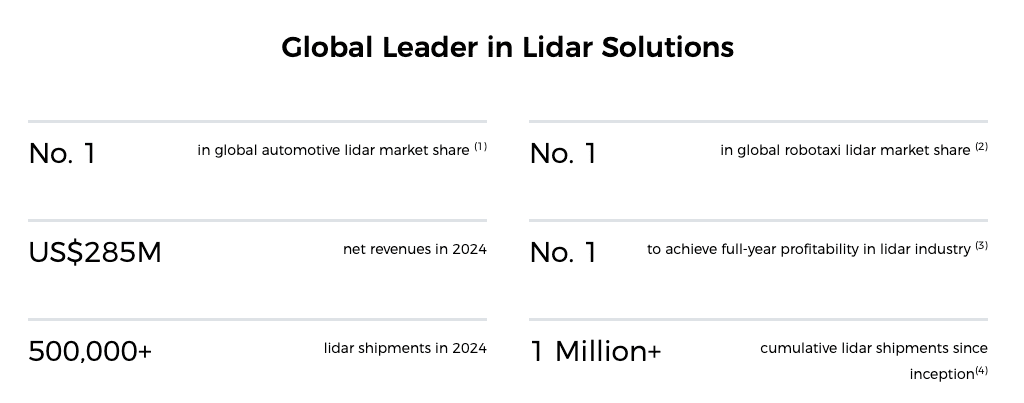

The stock I bought was Hesai Group (NASDAQ: HSAI). A Chinese company that’s listed on both the Nasdaq and the Hong Kong Stock Exchange, it’s a global leader in LiDAR (Light Detection and Ranging) technology.

LiDAR is a remote sensing tech that emits rapid laser pulses to create precise, high-resolution 3D maps of the environment. Today, it’s used by most autonomous driving companies including Waymo, Apollo, and Zoox.

In 2024, Hesai had a 33% market share of the global LiDAR market by revenue (61% market share in autonomous ‘Level 4’ driving). Meanwhile, it also had more global LiDAR published patent applications than any other company.

Out of my comfort zone

Now, this is very different from my normal type of investment. It’s fair to say that it’s out of my comfort zone.

For a start, it’s a Chinese ADR (American Depositary Receipt). I tend to steer clear of these due to geopolitical risks (the possibility of a US delisting, high tariffs, etc) and transparency issues.

Secondly, it’s hard to know if the company has a genuine competitive advantage. While it has substantial market share, it has a few competitors including the likes of Luminar and Ouster.

Enormous potential

As I said above though, I see huge potential. There are two reasons why.

For a start, Hesai looks really well placed to benefit from the shift to self-driving vehicles. Currently, it has partnerships with a range of robotaxi companies including Apollo, Pony.ai, DiDi, and WeRide. It also has partnerships with many regular carmakers offering Advanced Driver-Assistance Systems (ADAS) and exploring self-driving tech. Names here include Mercedes-Benz, Toyota, and Li Auto. As the self-driving industry grows, I expect LiDAR technology to be in high demand.

Secondly, it looks well placed to benefit from the humanoid robot revolution. That’s because most of these robots use LiDAR for perception too (along with cameras). Now, this industry is still nascent today. However, experts see huge growth ahead. According to Morgan Stanley, it could be worth $5trn by 2050. That’s good news for Hesai, which already has partnerships with several humanoid developers.

It’s worth noting that the company is already growing at a rapid clip. In Q2, it made total LiDAR shipments of 352,095 units, an increase of 307% year on year. This resulted in a 54% increase in revenue. It also led to a swing from losses to profit.

I’ll point out that I expect this stock to be a wild ride. It could crash spectacularly. With a market cap of around $4bn and a price-to-sales ratio of 8.5, however, I like the set-up. I’m excited about the potential.