After the first few minutes of trading today (24 September), the JD Sports Fashion (LSE:JD.) share price was largely unchanged following publication of the group’s results for the 26 weeks to 2 August (H1 26).

This isn’t a surprise to me given that towards the end of July, the leisure retailer told investors that like-for-like sales were 2.5% lower in H1 26 compared to a year earlier. And organic sales were up 2.6%.

Were the results any good?

The actual figures turned out to be a tiny bit better but by not enough to make a significant difference.

However, over the past 12 months, the company has bought two retailers, one in the US (Hibbett) and another in Europe (Courir). This means reported revenue for the period is 18% higher.

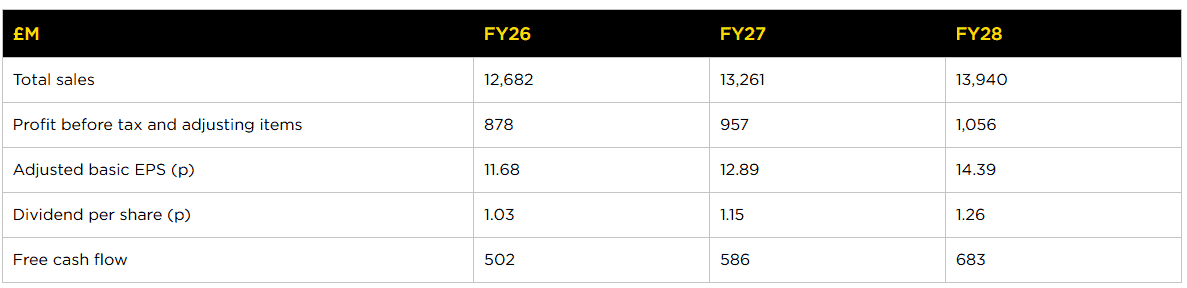

Crucially, the group is predicting a 12-month profit before tax and adjusting items in line with analysts’ forecasts. Since its last announcement, the consensus has fallen by £10m to £878m. But the range of estimates is largely unchanged (£853m-£914m). Thanks, in part, to some stockpiling the group now expects “limited impact” from the US tariffs in this financial year.

JD Sports has decided to keep its interim dividend unchanged although fans of share buybacks will welcome the announcement that it intends to purchase another £100m of its own shares.

One area I’m keeping an eye on is the group’s cash position. At 2 August, it reported net debt (before lease liabilities) of £125m. A year earlier, it disclosed net cash of £41m. However, it expects to return to the black at the end of the financial year.

My verdict

On the face of it, JD Sports appears to be going in the wrong direction. It now owns more stores than ever before but it’s less profitable. But I think this reflects market conditions (the company blames “strained consumer finances”) rather than anything to do with the group.

Some of this downturn has been attributed to mistakes made by Nike. It’s estimated that around half of what JD Sports sells is made by the American sportswear giant. This probably explains why their share prices tend to move in tandem. Nike is due to provide a trading update on the last day of September.

But JD Sports isn’t a one-trick pony. Over the years, it’s demonstrated that it’s able to move with the times and adapt to changing consumer tastes. If its customers continue to turn their backs on Nike, there are plenty of other brands that can be sold.

Don’t get me wrong, the group isn’t going gangbusters at the moment. But I think it’s doing okay in a difficult environment. A bit like the company itself, I’m cautious about its immediate prospects. But history tells us (no guarantees, of course) that economies are cyclical and the current uncertainty, particular in the UK, is unlikely to last forever.

Due to its healthy balance sheet and strong brand, I think JD Sports is well positioned to bounce back should consumer sentiment pick up. And I think the current economic gloom is reflected in a historically low valuation for the group’s shares. The stock’s currently trading on 7.5 times this year’s forecast earnings. For these reasons, I think it’s a stock worthy of consideration.