The post-pandemic surge in the Rolls-Royce Holdings (LSE:RR.) share price means the aerospace and defence group now (22 September) has a market-cap of £96.9bn. This makes it the fifth-most valuable company on the FTSE 100. But as impressive as this might be, Nvidia‘s worth over 30 times more.

A lending hand

However, I think the chipmaker’s boss, Jensen Huang, could help close the gap. He’s recently announced that his company will invest £2bn in artificial intelligence (AI) businesses in the UK. And the one thing that AI consumes in huge quantities is electricity.

According to Loughborough University, if the industry is to reach government targets by 2030, it will use an amount equal to around a quarter of the UK’s total electricity consumption in 2021.

To help meet this demand, Huang says “sustainable power like nuclear, wind, and solar” will need to contribute. He also claims that gas turbines will play a part.

But the government wants to move away from fossil fuels. Wind and solar can be inconsistent. And powerful lobby groups argue that most renewable energy infrastructure is a blot on the landscape. Nuclear power could be the answer.

However, the UK has a terrible record in delivering large-scale energy projects on time and on budget. Hinkley Point C is reportedly 12 years behind schedule and four times over budget. It’s a similar story for Sizewell C.

A possible solution

That’s why small modular reactors (SMRs) have their supporters. These are factory-built mini nuclear reactors that are assembled on site. And Rolls-Royce has been using its expertise in building nuclear-powered submarines to develop its own version.

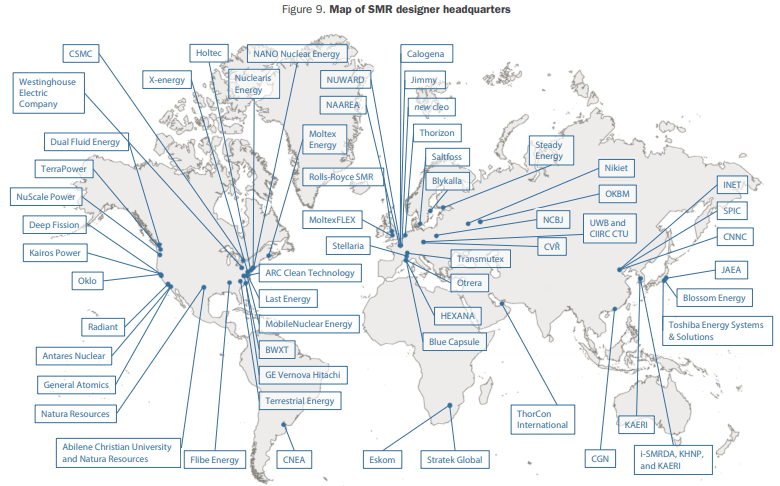

However, the technology’s still unproven from a commercial perspective. And according to the OECD, there are currently 127 different designs. Which ones (if any) are likely to be successful isn’t yet known.

Also, nuclear power has its critics. Due to the highly-toxic waste that’s produced many question its green credentials.

Powerful backers

Nvidia has a vested interest in selling more chips to data centres. And the more it sells, the more power will be required. That’s why the group’s venture capital arm is reported to have participated in a recent fundraising by TerraPower, another developer of SMRs.

But Rolls-Royce isn’t expecting to earn any revenue from the technology until the 2030s. More immediately, there are other reasons why the group’s share price could do well. Its defence division’s likely to benefit from increased global uncertainty. And aircraft flying hours are expected to continue rising year-on-year.

The group’s share price continues to be one of the best performers on the FTSE 100. Since September 2024, it’s risen 116%. The stock’s expensive – it trades on 46 times forecast 2025 earnings – but it’s been like this for a while now and doesn’t seem to put off investors. But should its profit growth stall, there’s likely to be a sharp correction.

On balance, although I don’t think the group will ever be valued as highly as Nvidia, I believe the world’s need for more electricity — driven by AI and semiconductors — is one of the reasons why Rolls-Royce shares are worthy of consideration.