Tesla (NASDAQ:TSLA) stock is back in the headlines. On 12 September, Elon Musk disclosed he had purchased more than 2.5m shares, worth just over $1bn.

The purchase, one of the largest insider buys in US market history, has helped propel Tesla stock higher once again.

But after such a strong rally, has the window closed for UK investors looking to buy into the technology giant?

Valuation remains dubious

Tesla’s market capitalisation has now climbed past $1.4trn, making it one of the world’s most valuable companies. Yet the fundamentals don’t appear to justify the valuation.

On a trailing basis, the shares trade at around 231 times earnings. That’s a far higher multiple than US tech peers. By comparison, Nvidia trades at roughly 47 times net income, while Meta Platforms sits closer to 27.

The concern isn’t simply the high multiple, but the direction of growth. Tesla’s revenue in the last 12 months fell 4.2% year-on-year to $92.7bn, while net income dropped more than 60% to $5.9bn.

That’s in sharp contrast to companies such as Nvidia and Meta, both of which are posting double-digit revenue and profit growth.

Looking forward, the metrics still aren’t attractive. Analysts see the price-to-earnings (P/E) ratio rising to 251 for 2025, before falling to 172 times in 2026.

This eventually moderates to 72 times for 2028, but there’s a caveat. Only the most bullish analysts and those with the strongest conviction are providing their forecasts throughout the medium term.

So on face value, buying Tesla stock wouldn’t seem like a great idea.

Finding value

It’s true that insider buying is normally a bullish signal. However, given Musk’s personal fortune, the $1bn outlay represents a relatively small proportion of his net worth.

More importantly, the purchase doesn’t change Tesla’s financial trajectory. The company is still battling falling margins, rising costs, and uncertain timelines for its most hyped innovations.

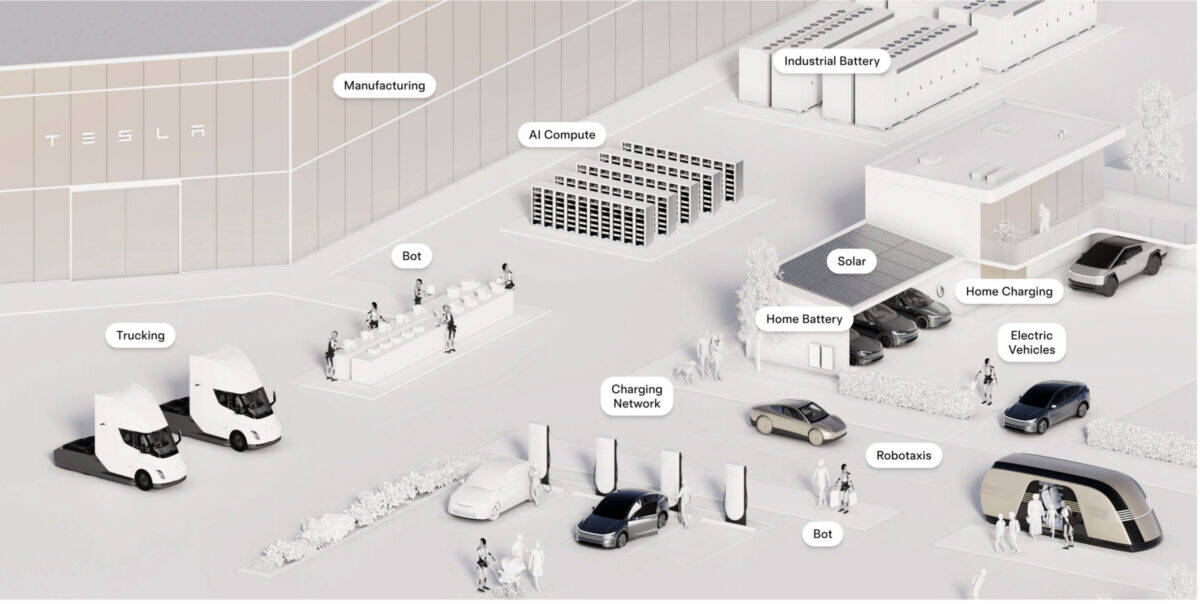

However, Tesla’s proven doubters wrong before, and the value proposition today revolves around the company’s potential leadership in self-driving vehicles and robotics.

Yet those potential growth drivers remain highly uncertain. Tesla’s robotaxi programme has been repeatedly delayed, and the Optimus humanoid robot is still years from meaningful commercial revenue.

That said, these are innovations that could change the world. Some of the most bullish forecasts see widespread robotaxi deployment globally by the end of the decade.

And there are plenty of reasons to believe it will be the winner in the self-driving era. It already produces millions of vehicles, has millions of real-world self-driving hours, and appears to be technologically ahead of its peers.

However, investors are being asked to pay for optimism rather than tangible results in the near term. And in my opinion, for now, the balance of risk and reward looks unfavourable so I don’t think it’s worth considering.

They may well find better entry points ahead if near-term challenges weigh on the stock. Have UK investors missed their chance? Only time will tell, but I wouldn’t be surprised to see some pullback.