The FTSE 100 is the prime target for investors seeking dividends from UK shares. What gets less attention is the enormous passive income opportunities also on offer from FTSE 250 stocks.

The Footsie‘s appeal is obvious. It’s home to financially robust companies with diverse revenue streams and market-leading positions. With limited growth opportunities compared to mid- and small-cap shares — companies that make up a large portion of the FTSE 250 — they also have added scope to return money to shareholders through dividends and share buybacks.

But those neglecting the UK’s second-tier share index may be missing some excellent dividend opportunities. Indeed, at 3.4%, the FTSE 250 actually carries a higher forward dividend yield than the FTSE 100 right now.

Let me show you how investors could target a £1,000 passive income every month with a portfolio of mid-cap dividend shares.

Five top stocks

Some of the FTSE 250’s highest-yielding stocks are real estate investment trusts (REITs). This reflects sector rules that demand at least 90% of annual rental profits be returned to shareholders via dividends.

Supermarket Income REIT and Primary Health Properties (LSE:PHP) are a couple of such companies I’ve chosen for our example mini portfolio. Like any property stock, they are vulnerable to spikes in interest rates that depress asset values. But on balance, I think their focus on defensive sectors make them top dividend stocks to consider.

Primary Health rents out medical centres and GP surgeries, while Supermarket Income — you guessed it — operates a portfolio of food retail outlets. Dividends on both these shares sit at 7.8%.

Water supplier Pennon Group faces regulatory uncertainty, but again is a non-cyclical share famed for robust dividends. Its forward yield is 6.6%.

Pets at Home, which yields 5.8%, is more vulnerable to consumer spending patterns. But it’s well placed to capture long-term growth in UK pet ownership levels. And TBC Bank, while operating in a politically-volatile part of the world, has a strong record of earnings and dividend increases thanks to its focus on fast-growing Georgia. The yield here is 5.4%.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

A dividend hero

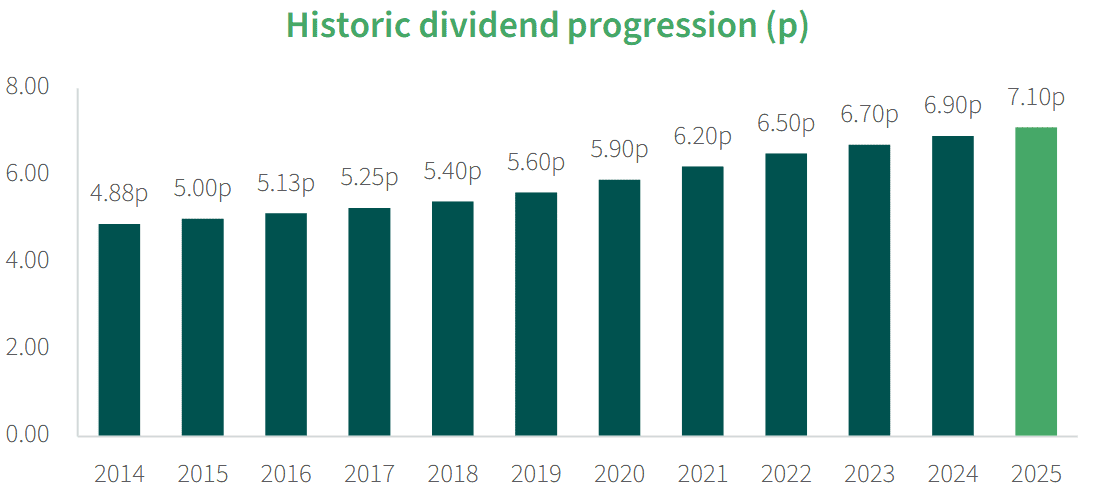

Primary Health Properties’ excellent defensive qualities have made it one of the FTSE 250’s standout dividend growers. Cash rewards have risen every year since the mid-1990s.

This REIT doesn’t only benefit from stable demand for healthcare services. A whopping 89% of its rents are also backed by government bodies, while contracts are linked to the rate of inflation, too.

Future profits could be vulnerable to changes in UK healthcare policy. But, in my opinion, the long-term opportunities outweigh this risk, as a booming elderly population boosts demand for medical centres.

Targeting a £1k income

Dividends are never, ever guaranteed. But a diversified mini portfolio like this can reduce the risk of dividend shocks and deliver a reliable passive income over time.

With an average 6.7% dividend yield, a £180,000 investment fund spread equally across these shares would yield a £1,000 monthly second income. That’s a lot of money on paper. But it could be achieved with a £500 monthly investment in under 16 years, based on an average yearly return of 8%.