There are between 4,850-5,000 Stocks and Shares ISA millionaires, based on recent data. And I imagine very few of them are under 30. However, this doesn’t mean it’s impossible for someone to achieve millionaire status by this still-young age.

The trick of course is starting early. A Junior Stocks and Shares ISA can be started at any young age before being converted to a normal adult Stocks and Shares ISA when they turn 18. However, by starting an ISA for a loved one at birth, we can truly leverage the power of compound returns.

Doing the maths

So how does it all work? Well, at first, a parent, grandparent or guardian would have to open a Junior ISA in the name of the child. This can be done through any major UK brokerage. Then comes regular contributions. By constantly contributing to a portfolio, we’re providing the fuel with which to grow wealth.

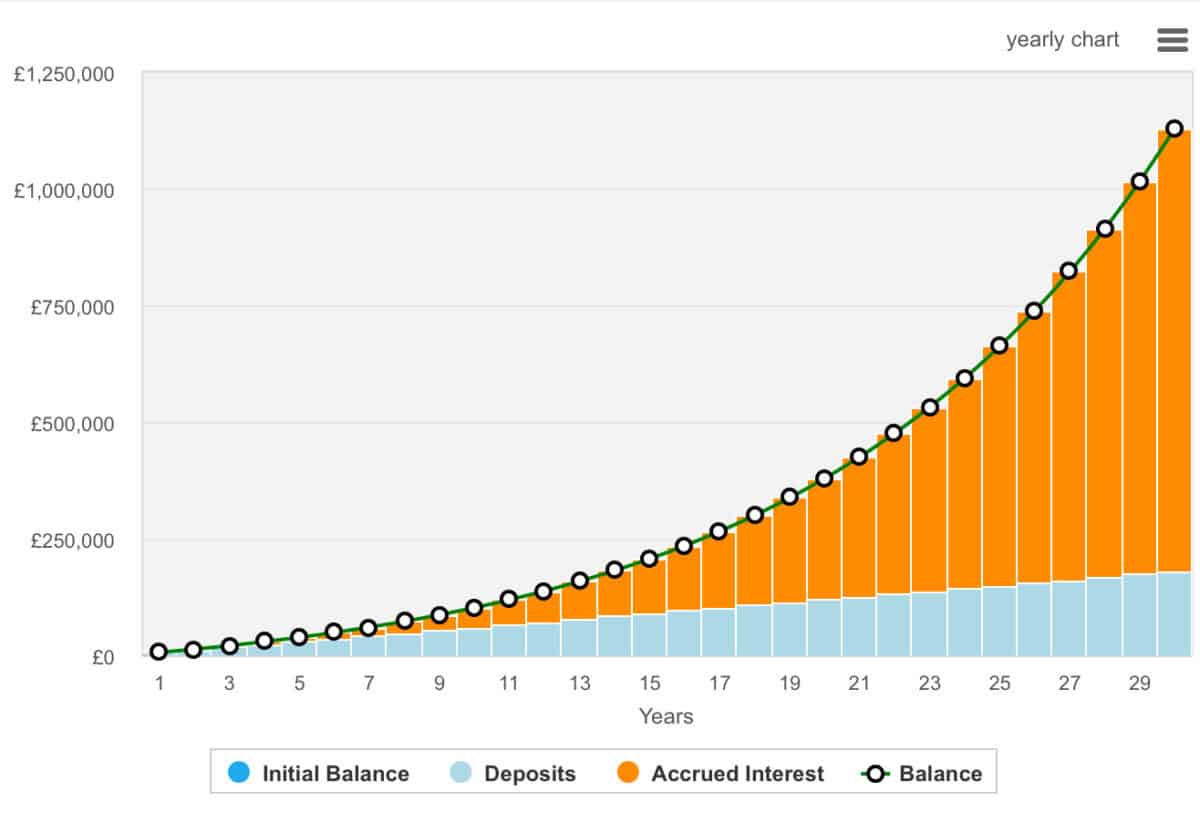

Turning regular contributions into £1m isn’t easy. However, it’s certainly possible. Here’s one calculation: with £500 of monthly contributions and a 10% annualised return, the portfolio would reach £1.13m within 30 years.

Now, this calculation relies on an above-average rate of growth — 10%. However, it’s very feasible when investors focus on building a diverse portfolio of quality stocks. For some, a more realistic long-term average would be 8%.

Of course, anyone running their own portfolio needs to be aware that they can lose money. Share prices can be volatile in the short term, and even well-researched investments may underperform expectations.

Where to invest?

My daughter’s Junior ISA contains mostly stocks, but some investment trusts. The latter adds an additional measure of diversification, especially when the majority of the investments I make are in growth-oriented stocks.

One of the investment trusts she invests in is Scottish Mortgage Investment Trust (LSE:SMT). Plenty of investors had their fingers burned with this trust a few years ago when growth-oriented stocks slumped, and Scottish Mortgage tanked.

This happens because Scottish Mortgage shares reflect the value of the trust’s holdings. The top holdings currently include privately-held SpaceX, as well as major public names such as MercadoLibre, Meta, Amazon, and Nvidia.

These companies are the driving forces behind the technological changes, but their valuations are also rather volatile. For Scottish Mortgage, this volatility’s enhanced by gearing — borrowing to invest — which can magnify losses.

However, on a positive note, I’d point to management’s track record of picking the next big winners before most of us have even heard of them. The trust’s shares are up an impressive 2,800% over the past 32 years, representing a very strong rate of return.

While there are plenty of investment trusts out there, I do believe Scottish Mortgage — the UK’s largest trust — is certainly worth considering.