A SIPP is one of the most efficient ways to build a sizeable nest egg, capable of supporting a comfortable retirement. For a basic rate tax-payer, for every £1 contribution made, the government will top it up by 25p. That’s extremely generous in my book, particularly if one intends to make regular contributions over decades.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Increasing contributions

If an individual contributed £10 a week to their SIPP, with basic rate tax relief that would equate to £650 a year. Assuming a rate of return of 8%, it would take 62 years to reach £1m!

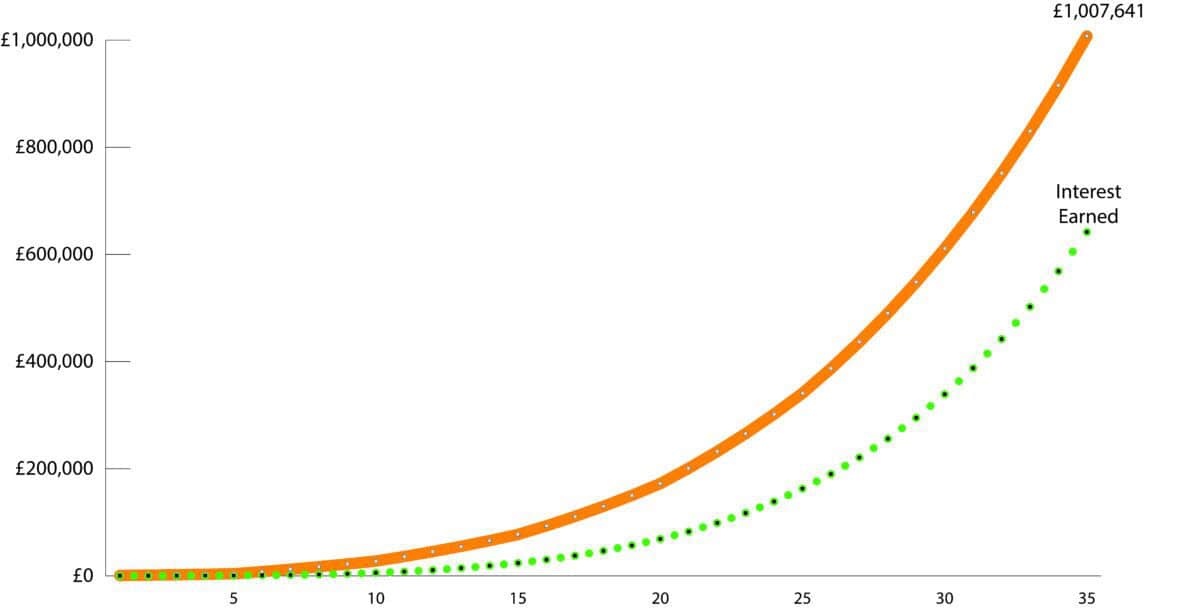

Of course, the reality is that one’s earning potential increases with time. If we assume an employment career lasts 35 years, let us plot out a realistic tiered contribution increase that gets someone to that magical £1m.

| Tiered years | Basic yearly contribution | Contribution with basic tax relief |

| 1-5 | £520 | £650 |

| 6-10 | £3,000 | £3,750 |

| 11-15 | £5,000 | £6,250 |

| 16-20 | £8,000 | £10,000 |

| 21-25 | £12,000 | £15,000 |

| 26-35 | £15,000 | £18,750 |

As the graph highlights below, based on the above payment structure, two-thirds of the total £1m pot will have come from compounding interest along the way.

Chart generated by author

Passive vs active investing

Over such an extended period of time, compounding returns at 8% a year will be tough. Do not assume that because the S&P 500 and the FTSE 100 have recently beat this target, that this will continue for the next 35 years.

Along the way, there will be bear markets and years where returns are meagre. If you invest solely in an index, then your returns are tied to the fate of that index. For example, with the top 10 stocks accounting for 40% of the weighting in the S&P 500, if they falter then your portfolio will decline, regardless of how the other 490 perform.

However, if an investor mixes a passive strategy with active stock picking, then they are no longer solely beholden to the whims of an index.

Life insurer

If I ignore WPP, whose share price has collapsed pushing up its yield, and Taylor Wimpey (soon to be demoted to the FTSE 250), the top three dividend payers in the FTSE 100 today come from financial services. These include Legal & General (at 9.2%), Phoenix Group (LSE: PHNX) (at 8.5%) and M&G (at 8%).

At the moment, I particularly like Phoenix Group. An “accounting mismatch” spooked the market during its H1 results earlier this month. It has since clawed back most of the one-day losses, as investors realised that such a technicality had no impact on the main constituent of dividend sustainability or operating cash generation.

Over the past 10 years, the business has increased its dividend per share by 32%. As the workplace retirement savings market continues to grow over the next decade, its leading brand, Standard Life, is well placed to capitalise on such a trend.

Like many of its competitors, investors’ preference for low-cost passive index-trackers has resulted in fund outflows, lowering fee revenues. Should this issue continue, then this could put pressure on margins and cash flow, threatening future dividend increases.

But with so few people taking financial advice leading up to retirement, and with increasing public awareness of the need to save more during working age, I expect the business to continue to generate healthy profits well into the future.