Lloyds Bank (LSE:LLOY) shares have risen by an impressive 43% in value in the last year. Over the past three they’re now up 80%.

That’s an undeniably impressive rise — the FTSE 100 has risen a far more modest 13% over a 12-month horizon. And it’s all the more remarkable, in my opinion at least, given the Black Horse Bank’s mediocre investment prospects.

Here are four reasons why I’m steering well clear of Lloyds shares today.

1. Weak growth

Banks are highly sensitive to broader economic conditions. During tough times, revenues can fall or stagnate and bad loans spring higher.

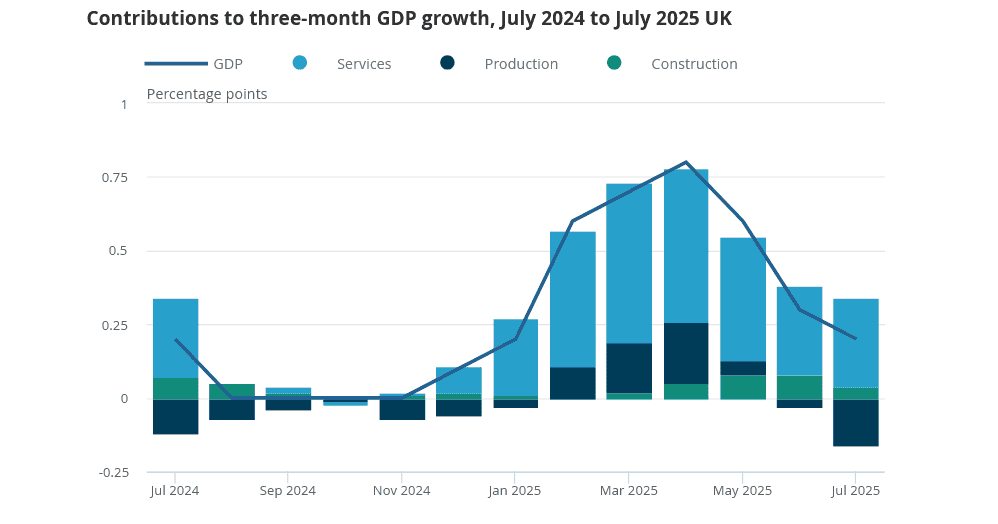

So latest British GDP data on Friday (12 September) bodes badly for high street banks. This showed the economy with zero growth in July, while three-month GDP growth also continued to slow on a three-month basis.

Unlike other Footsie banks like Barclays and HSBC, Lloyds doesn’t have significant overseas exposure to offset increasing strains at home and grow profits.

2. Interest rate uncertainty

In this tough economic climate, the Bank of England (BoE) could step in and cut interest rates to stimulate Britain’s economy. This would be bad news by putting further strain on retail bank’s wafer-thin margins (Lloyds’ was a thin 3.04% according to latest financials).

On the other hand, signs of rising inflation could stay the central bank’s hand. But uncertainty over BoE policy still creates another risk for investors to consider.

3. High taxes

Big banks like Lloyds also faces a potential tax raid in November when the government announced its next Budget. Think tank the Institute for Public Policy Research (IPPR) thinks a windfall tax could sap as much as £8bn a year from banks’ profits.

This would increase already significant tax bills for the industry. According to Barclays CEO CS Venkatakrishnan, UK banks effectively pay a total tax rate of around 46%. That’s significantly higher than the 28% rate on US banks, and 29%-39% for those in the European Union.

4. Mounting competition

The threat from challenger banks to the established operators is severe and growing. These nimbler, digital-led operators are putting revenues and margins under threat as they expand their product ranges. And industry regulations are evolving on issues like capital requirements and reporting to give smaller operators a boost.

Lloyds has significant brand power that’s helping to neuter these competitive dangers. It also has extremely deep pockets it can utilise to fight back and grow earnings (it’s currently closing in on a £120m deal for digital payments specialist Curve). But the outlook remains tough.

A FTSE 100 share to avoid?

I could be wrong but my view is that none of these severe threats are reflected in Lloyds’ current high valuation.

Its recent share price boom means its forward price-to-earnings (P/E) ratio is 11.1 times, above its five-year average and peers such as NatWest (8.8 times), HSBC (10 times), Barclays (9.1 times) and Standard Chartered (9.5 times).

This valuation also fails to reflect the superior growth prospects some of these banks have, whether that’s down to international exposure or presence in investment banking.

I fear that Lloyds’ share price ascent is hard to justify, leaving it open to a potential correction. So I’m happy to avoid the bank’s shares and look for other shares to buy.