2025’s been a tough time for Berkeley Group‘s (LSE:BKG) share price. Down 7% since 1 January, it’s dropped 30% over the last year as worries over the housing market recovery have grown.

Could this represent an attractive dip-buying opportunity though? I think it’s worth examining, and especially given the cheapness of Berkeley’s shares versus its FTSE 100-listed peer group.

Today, the company trades on a forward price-to-earnings (P/E) ratio of 11.4 times. That’s below corresponding readings of:

- 14 times for Persimmon.

- 14.7 times for Taylor Wimpey.

- 17.3 times for Barratt Redrow.

Here’s my take.

Still on course

The UK housing market remains tough as the domestic economy splutters. Yet the industry’s rebound from 2022’s meltdown remains intact, as lower interest rates and competition in the mortgage market help homebuyers.

Berkeley’s latest trading statement today (5 September) revealed that it continues to make slow but steady progress. It said “trading has been stable… over the first four months of the year, following a similar pattern to last year.”

The firm maintained its pre-tax profit guidance of £450m for the 12 months to April 2026, albeit down from £528.9m in the previous fiscal year. And it said 85% of expected full-year profits have already been secured through exchanged sales contracts.

It added that “we anticipate pre-tax profits to be weighted broadly evenly between the first and second half of the year, subject to the timing of completions.”

Berkeley also confirmed it expects to report similar profits to the current year in financial 2027.

Green shoots

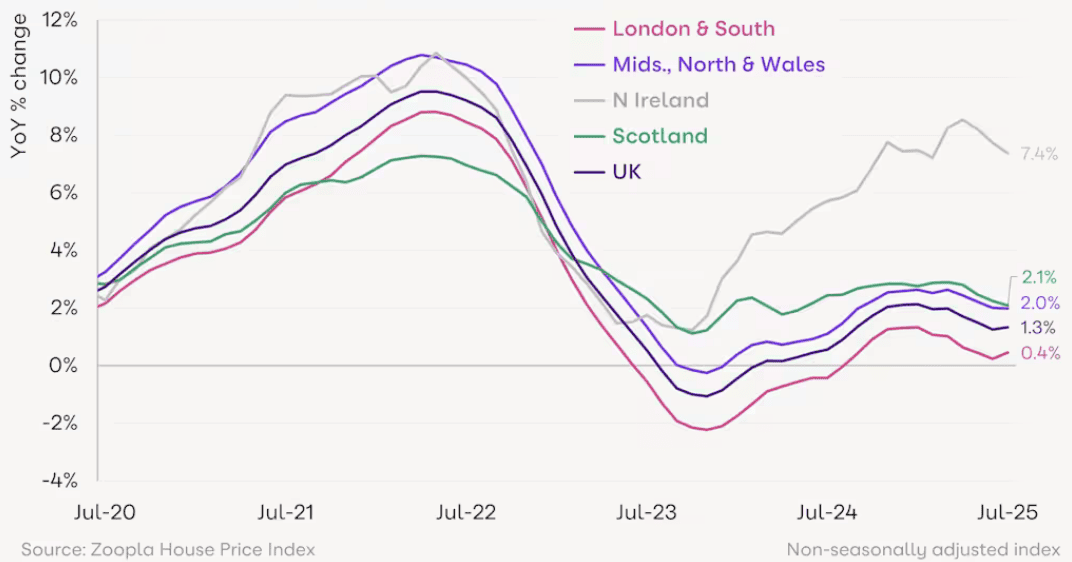

There’s no doubt Berkeley’s focus on London and the South East has muted its recovery. An abundance of new supply means home price growth in the capital and surrounding regions is lagging the rest of the country, as latest data from Zoopla shows.

But signs are growing that conditions in London are improving thanks to a weaker development pipeline and favourable demographic factors (such as the steady return to the office following Covid-19).

Indeed, boffins at Capital Economics think prices in the capital will rise at an average of 6.5% in 2026. That beats the 5% rise predicted for the broader UK.

A continuation of the trend that Capital Economics tips could pull Berkeley’s share price sharply higher.

Growth opportunity

There are of course risks to these forecasts. Signs of stickier inflation cast doubt on the pace of future interest rate cuts. Worrying economic indicators like rising unemployment also present cause for concern.

But on balance, I still think Berkeley could be an attractive option for investors seeking recovery shares to consider. And especially when one considers the cheapness of the builder’s shares.

I certainly remain upbeat about the housebuilder’s long-term prospects as population growth drives demand for new homes. Statista analysts think the number of Londoners will grow by almost 700,000 between now and 2047 to 9.97m. And government plans to ease planning restrictions should help Berkeley better capitalise on this significant opportunity.