Every now and again, a company makes a bold move that puts it firmly on income investors’ radar. One such name is Chesnara (LSE: CSN), the life and pensions consolidator that recently joined the FTSE 250.

Its rise has been remarkable. On 7 April, Chesnara was valued at just £366m. Fast forward four months, and it’s almost doubled in size to a market-cap nearing £700m.

So what lit the fuse?

The spark came in early July when Chesnara announced a £260m cash deal to buy HSBC’s specialist life protection and investment bond provider. The acquisition will add around £4bn in assets under administration and 454,000 new policies, significantly boosting its scale in the UK.

Management expects the deal to generate £140m in cash during the first five years, with the potential to reach £800m over the long run. That’s a sizeable kicker for any business.

To fund it, Chesnara plans to raise £140m through share issuance — a move that may dilute shareholder value and dampen enthusiasm for new investors. Still, the bigger story for many will be its dividend plans. Management expects to raise its final dividend for 2025 and interim dividend for 2026 by an adjusted 6%. For income hunters, that’s tough to ignore.

A dividend machine?

Chesnara already offers a chunky trailing yield of 7.3%, with forecasts pointing towards a bumper 8.5%. That’s comfortably above the FTSE 250 average. But can it last?

One concern is the payout ratio, currently hovering around 950%. For most firms, that would be a huge red flag. Typically, a sustainable ratio sits below 100%. However, insurers play by slightly different rules. Volatile earnings, capital requirements and complex accounting can distort the numbers.

Legal & General, for instance, has often carried a high payout ratio but has managed to keep shareholders sweet for decades. Chesnara too has a stellar track record — it’s increased its dividend every year for over 20 years. That’s not something an investor should dismiss lightly.

Another eyebrow-raiser is valuation. Its trailing price-to-earnings (P/E) ratio stands at an eyewatering 131.5 — more befitting of a Silicon Valley tech stock than a UK insurer. But here’s the twist: analysts expect earnings to grow rapidly, bringing its forward P/E down to just 13.3. Suddenly, things don’t look quite so stretched.

Profitability however, still nags at me. With an operating margin of only 1.1% and a return on equity (ROE) of 1.16%, the business isn’t exactly overflowing with surplus cash.

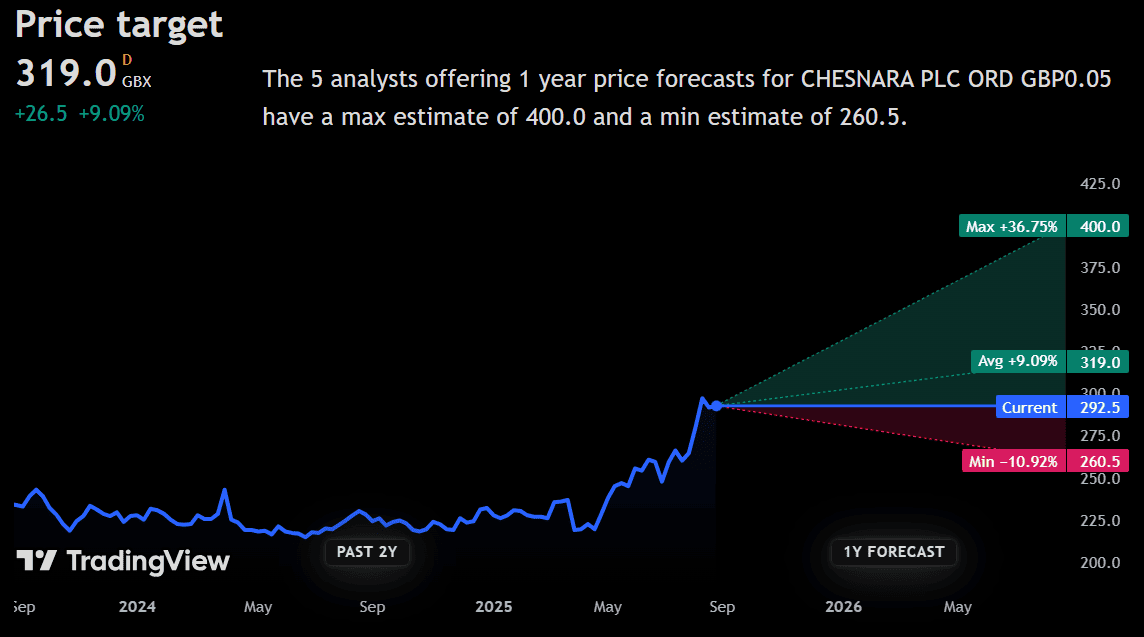

That said, analysts remain bullish. The average 12-month price target sits at 319p — around 9.5% higher than today’s price. Out of five analysts covering the stock, four rate it a Strong Buy, while one prefers to Hold.

My take

The FTSE 250’s full of fascinating mid-caps that often fly under the radar, and Chesnara’s rapid ascent highlights how quickly fortunes can change. The HSBC deal could be a genuine game-changer, but it comes with risks — from share dilution to the challenge of integrating such a large book of business.

If the acquisition pays off and dividends keep climbing, it could prove a rewarding addition to a passive income portfolio. It’s not quite a screaming buy in my book — yet — but at this yield, it’s certainly worth serious consideration.