NIO (NYSE:NIO) stock‘s jumped 37% in just seven trading days. Now at $6, this means the Chinese electric vehicle (EV) firm’s up 51% over the past year.

Zooming further out however, the share price is still 67% lower than it was five years ago. Not great.

I’ve long thought that NIO was a candidate for a barnstorming comeback, assuming it can turn profitable. Here, I want to take a look at why the stock is up and whether the investment case has improved enough to warrant me taking a position.

Why’s NIO suddenly up?

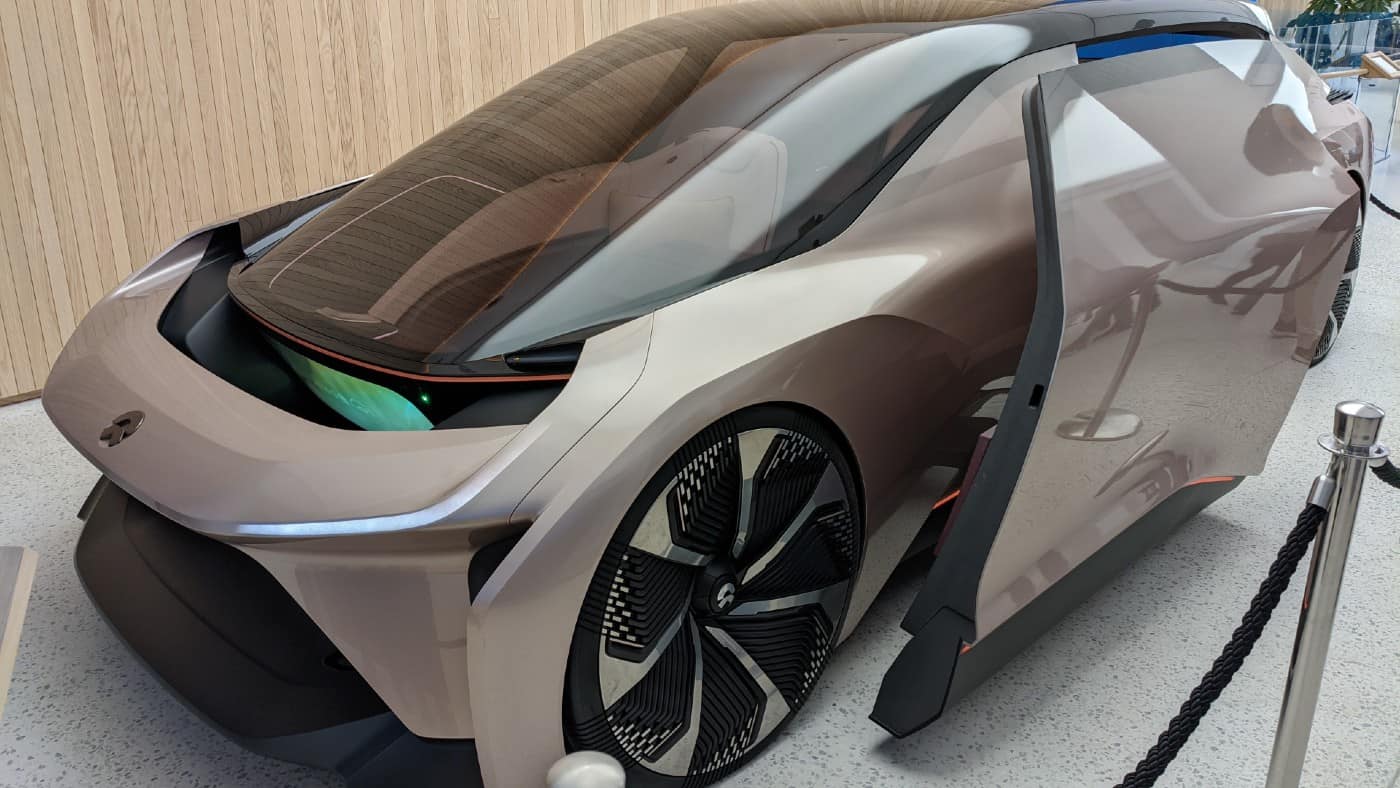

There appear to be two main things that have sent NIO shares flying. First, on 21 August, it unveiled its new ES8 SUV, which it says is the largest battery electric SUV in China. I don’t doubt that, as these beasts are offered with six or seven seats in three rows.

The Executive Premium Edition costs the equivalent of about $58k outright, or $43k with the battery plan. The latter involves a monthly subscription, allowing customers to swap or upgrade depleted vehicle batteries in any of its battery-swap stations.

Based on NIO’s 12 full-stack technological capabilities, the All-New ES8 redefines luxury at a new level.

NIO

On top of this, investors have been piling into Chinese shares, which has boosted NIO’s secondary listing over in Hong Kong. Indeed, the Shanghai Composite Index is now at its highest level in a decade.

The recent surge was sparked by reports that Beijing is thinking about relaxing its stance on digital assets (it banned cryptocurrencies in 2021).

Is this a game-changer?

Neither of these things really change the investment story for me. I’ve always known that NIO makes high-quality EVs. By all accounts, the SUVs are like futuristic spaceships inside.

And while it’s great to see some Chinese stocks flying after a few very difficult years, this could quickly reverse. Parts of the Chinese economy are still fragile, while trade tensions with the US aren’t going to disappear overnight.

Meanwhile, NIO also announced a limited-time offer on the new SUV, with a chunky deduction from the purchase price and various vouchers. That’s going to boost near-term sales figures. But the fact NIO’s offering deductions on a swanky new model highlights how fierce the ongoing EV price war is in China.

For me, this is a serious risk to NIO’s attempts to turn profitable.

Worth a punt?

Looking at the forecasts, NIO isn’t expected to generate positive earnings per share before 2029. If it was able to achieve this sooner, I think the stock could take off like a rocket. And If it was able to do so in the middle of China’s EV price wars, that would be impressive. The investment case would then look more attractive to me.

However, this is far from guaranteed. NIO lost $3bn last year, and has spilled red ink like clockwork every year since listing in 2018.

I like the cars and the recurring revenue element with battery subscriptions. But I fear the firm’s trying to do too much with its NIO Houses (part dealership, part community hub) and new sub-brands (Firefly and ONVO). The lack of cost discipline worries me.

On the whole, I think there are better growth stocks for my portfolio.