The FTSE 250 can be a great place to go hunting for growth shares. Comprising hundreds of top companies, this index of UK mid-cap shares gives diversified exposure across a range of industries.

Investors must be mindful that growth stocks can be volatile when economic conditions worsen. What’s more, the FTSE 250 is also packed with businesses that are dependent on a strong British economy, creating some geographical risk.

Still, investors can aim to manage this risk by building a broad portfolio than covers different regions, industries, and sub-sectors. With hundreds of shares to choose from, this is well within reach.

A diversified portfolio

But what could a diversified portfolio like this look like? I think a basket of 15-20 shares provides a good way to balance risk and provide exposure to different growth opportunities.

Here’s one potential lineup of top shares:

| FTSE 250 stock | Sector | Main regions |

|---|---|---|

| Softcat (LSE:SCT) | IT services | UK |

| TBC Bank Group | Banking | Georgia, Uzbekistan |

| Bloomsbury Publishing | Publishing | UK, US |

| QinetiQ Group | Defence | UK, US |

| Hochschild Mining | Mining | Brazil, Peru, Argentina |

| Allianz Technology Trust | Investment trusts | US |

| Spectris | Electronic and electrical equipment | US, China, Germany |

| Bakkavor Group | Food manufacturing | UK, US, China |

| Chemring | Defence | UK, US, Mainland Europe |

| Bellway | Housebuilding | UK |

| Gamma Communications | Telecommunications | UK, Mainland Europe |

| Senior | Aerospace | UK, US |

| Baillie Gifford US Growth Trust | Investment trusts | US |

| AJ Bell | Financial services | UK |

| Oxford Nanopore Technologies | Pharmaceuticals and biotechnology | Global |

This collection of 15 stocks covers a wide range of activities, from making sandwiches and producing explosives to digging for gold and developing online security. Though there is a clear UK bias, many of the portfolio’s holdings has substantial operations in other developed regions and fast-growing emerging markets, too.

Thanks to the inclusion of investment trusts, our basket has exposure to 190 companies in total. Tech-heavy trusts Allianz Technology Trust and Baillie Gifford US Growth Trust also include many high-performing US shares like Nvidia, Microsoft, Meta, Amazon, and Cloudflare.

Soft power

This high concentration of technology stocks leaves it vulnerable to cyclical slowdowns. I think it also means the trust enjoys huge long-term growth potential thanks to booming markets like artificial intelligence (AI), cloud computing, robotics, and online shopping.

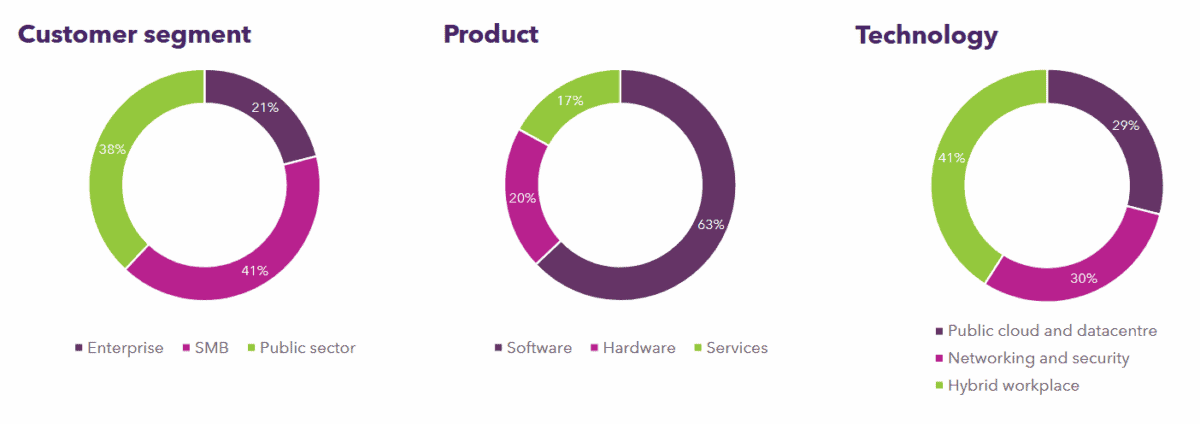

Looking closer to home, Softcat is a FTSE 250 share that’s participating in the booming digital economy. And as the graphic below shows, it does so in a highly diversified way:

This approach has considerable advantages, including enhancing cross-selling opportunities, reducing dependence on one segment or customer type to drive revenues, and boosting customer retention.

It’s a model that’s proved highly successful. Softcat’s operating profits have increased at a compound annual growth rate (CAGR) of 15.8% over the last decade.

Profits can still dip when economic conditions worsen and businesses trim spending. But the company’s recent resilience suggests it has the tools to weather the worst of any downturn. Revenues and operating profit rose 16.8% and 10.4% respectively in the six months to January.

With cash and cash equivalents of £141m, Softcat has considerable scope to invest for growth as well. On balance, I think it could be one of the best UK growth shares to consider.