Warren Buffett’s investment philosophy is famously grounded in simplicity and quality, but he doesn’t invest in UK stocks often. He looks for companies with durable economic advantages — moats — that protect their profits over time.

According to Buffett, the ideal business earns strong returns on equity, operates through cycles with consistent profitability, and is run by trustworthy, capable management.

He insists on reasonable valuation. Stocks should trade below or fairly near intrinsic value, providing a margin of safety. There are several ways to ascertain a company’s fair value, and Buffett will have his own formula. But any investor can seek to build their own model.

Buffett also emphasises sticking to one’s circle of competence. He tells us to invest in what we understand, not fads or opaque industries. Finally, he values patience above all. He buys high-quality businesses at sensible prices and holds them for years, or ideally decades. This is at the heart of long-term compounding.

Does Melrose meet Buffett’s criteria?

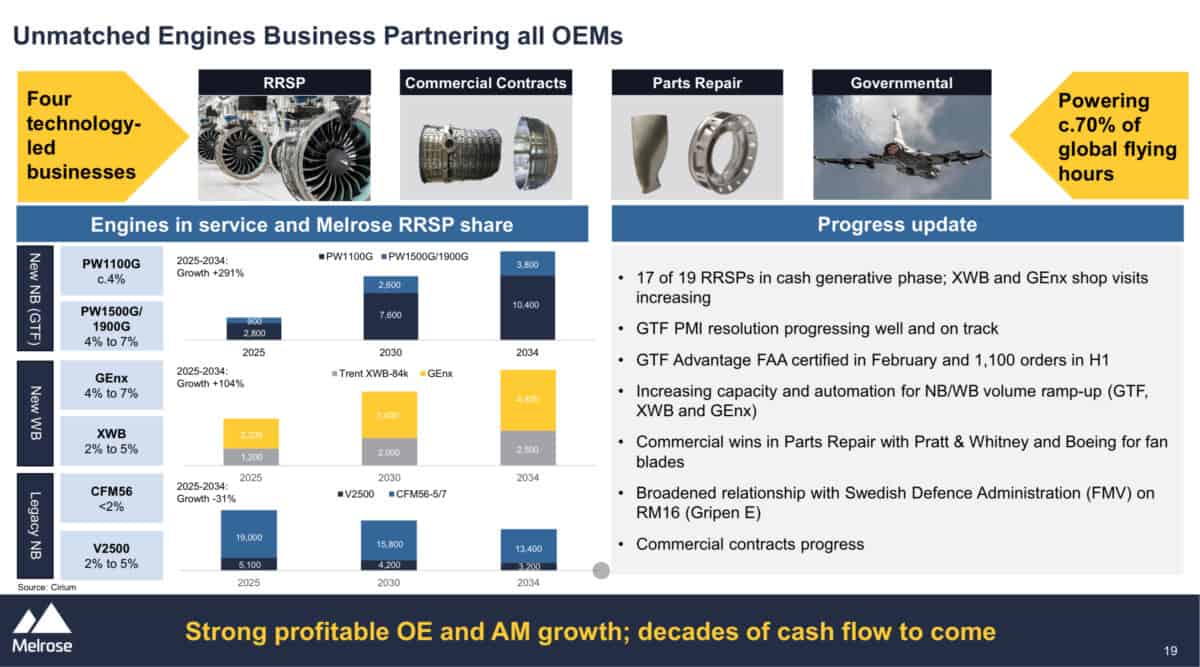

I think Melrose Industries (LSE:MRO) may share some of the criteria that Buffett values highly. Right now, it trades at a forward price-to-earnings (P/E) of 15.1. That’s really not particularly expensive given the company is aiming to grow earnings by more than 20% annually through to 2029. In the first half of 2025, adjusted diluted earnings per share rose 30% to 15.1p, powered by robust demand in aerospace, especially through its GKN Aerospace subsidiary.

This gives us a P/E-to-growth (PEG) ratio around 0.75. That’s incredibly cheap compared to industry peers like Rolls-Royce and GE. Both of these trade with PEG ratios above two and P/E ratios close to 40 times.

The company’s focus on aerospace, a sector with high barriers to entry and long-term contracts, contributes to a structural competitive advantage. Its adjusted operating margin improvements demonstrate operational execution. It also boasts a sole-source supplier position on 70% of its sales. That’s one hell of a moat.

Melrose also engages in active capital allocation. Management has pursued restructuring, share buybacks, and reinvestment into growth areas, echoing Buffett’s preference for disciplined capital deployment.

However, risks remain. Its net debt stood at £1.4bn at the end of H1 2025. This is one of my few concerns about the company. It’s modest in size but enough that it still warrants monitoring as debt could become a drag on performance if interest rates stick or if cash flow falters.

The aerospace sector is also sensitive to supply chain disruptions, regulatory shifts, and cyclical downturns. If demand in defence or commercial aviation slows, earnings targets may come under pressure.

All in all, Melrose combines attractive valuation, genuine growth prospects, and a great economic moat. These are key Buffett-style hallmarks. While not without risks, the company may represent a UK-listed business worthy of consideration for investors seeking long-term, quality compounding. It’s now my top holding.