Over the last year or so, Palantir (NASDAQ: PLTR) CEO Alex Karp has developed an Elon Musk-like cult following. It’s easy to see why – Karp is very optimistic about his company’s prospects and he’s not afraid to engage in a bit of trash talk. Now, over the long term, Musk’s company, Tesla, has been an amazing long-term investment due to continual share buying activity from his legion of fans. So, should I buy Palantir stock for my portfolio on the back of Karp’s following?

Incredible growth

Looking at Palantir today, there’s a lot to like about the company from an investment perspective, I feel.

For starters, there’s the incredible level of revenue growth that the business is generating due to the demand for its artificial intelligence (AI) solutions. This growth is literally unprecedented for a company of its size.

For the second quarter of 2025, Palantir’s revenues came in at $1.004bn, up 48% year on year (and well ahead of the consensus forecast of $940m). This was driven by a phenomenal performance in the US, where commercial revenue soared 93% to $306m and government revenue increased 53% to $426m.

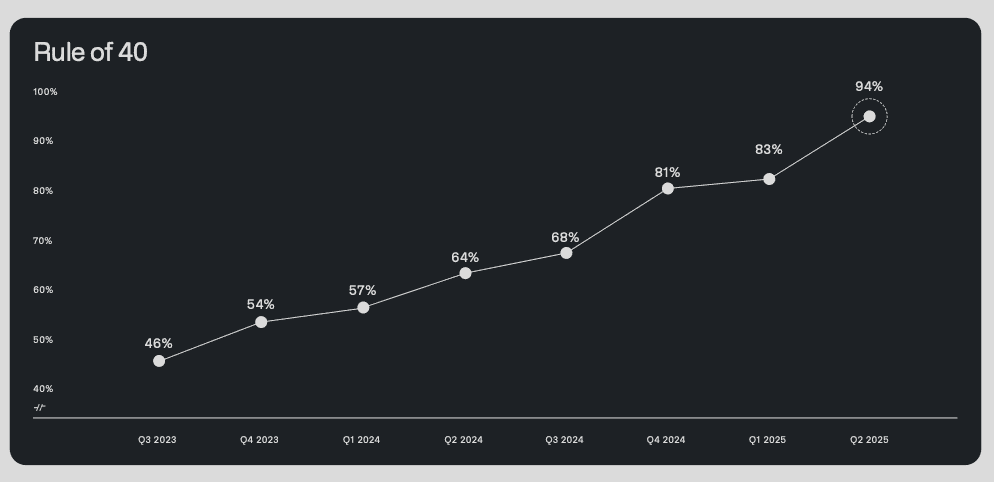

Smashing the rule of 40

Then there’s the level of profitability the company is generating. In the software world, a common benchmark is the ‘rule of 40’ score. This is calculated by adding a company’s revenue growth and profit margin and the idea is that a score of 40 is respectable. Here, Palantir just posted a score of 94 for the latest quarter, which is really impressive.

Confidence

I also like the confidence from Alex Karp. In the firm’s Q2 letter to shareholders, he wrote: “With continued execution, and a focus on what matters and a near complete disinterest in what does not, we believe that Palantir will become the dominant software company of the future. And the market is now waking up to this reality.”

Sure, it’s a little cheesy. But it’s great to see a leader who’s passionate about his company and its prospects.

Price target increases

On his line that the market is waking up this reality, it seems it is. Since the Q2 earnings, a number of brokers have increased their price targets for Palantir. For example, Wedbush has raised its target to $200 from $160. Meanwhile, Bank of America Securities has increased its target to $180 from $150.

“The growth rate of our business has accelerated radically, after years of investment on our part and derision by some. The sceptics are admittedly fewer now, having been defanged and bent into a kind of submission. Yet we see no reason to pause, to relent, here.”

Palantir CEO Alex Karp

A sky-high valuation

While there’s a lot to like, however, the valuation is just a bit of a stretch for me right now. Currently, Palantir trades on a price-to-sales ratio of 90 and a price-to-earnings (P/E) ratio of 247.

To my mind, buying the stock at these multiples would be quite risky. If earnings miss estimates in the upcoming quarters due to less spending on AI, the stock could fall by 20% or more.

I’ll point out that I’m interested in owning this stock in the future. For now though, I’m going to keep it on my watchlist and wait for a better entry point.