Brokers have a 12-month price target for Rolls-Royce shares of 1,075p. With a current (13 August) price of 1,098p, this suggests there’s no room for further growth.

But given its post-pandemic performance – the group’s now worth around £90bn more than when it announced its life-saving rights issue and debt restructuring in October 2020 – this probably shouldn’t come as much of a surprise.

Having said that, the most optimistic broker reckons the shares are worth around 31% more.

Something else

However, there’s another FTSE 100 company that the ‘experts’ believe offers better value. Unlike Rolls-Royce, which generates around a quarter of its revenue from the defence sector, Babcock International Group (LSE:BAB) earns all of its profit from the sale and maintenance of military equipment. And brokers have set a 12-month share price target of 1,180p – approximately 20% more than today’s price.

But I think it’s fair to say that it’s a relatively unknown stock. From the start of 2025 to the end of July, it’s been the 85th most-traded UK share. By contrast, over the same period, Rolls-Royce ranked seventh.

However, this hasn’t stopped Babcock’s share price from soaring over the past five years. Since August 2020, it’s risen nearly 250%. The group joined the FTSE 100 in March.

A dangerous world

Like many in the sector, it’s benefitted from increased global security concerns. This could be a problem for some ethical investors. However, those who believe that it’s the primary responsibility of a government to protect its citizens are likely to see this as an opportunity.

Pressure from President Trump has forced NATO members to commit to spending 5% of Gross Domestic Product on national security, although some of this is a little creative with expenditure on intelligence and cybersecurity counting towards the total. The UK’s announced an increase to 2.6% with effect from April 2027.

The government sees increased defence spending as a means of boosting economic growth. This means it’s likely to place as many orders as it can with home-grown companies like Babcock. At the moment, the group’s the second-largest supplier to the Ministry of Defence.

Impressive growth

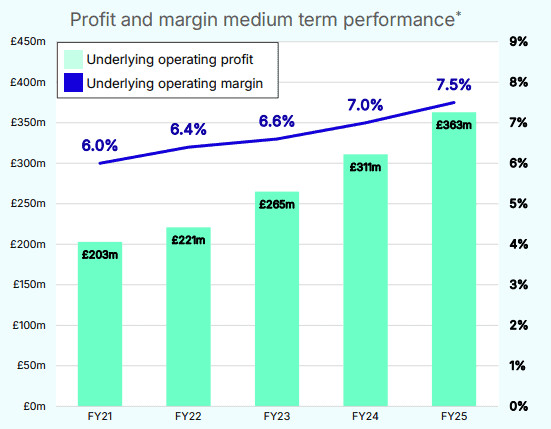

Babcock reported another strong set of results for the year ended 31 March 2025 (FY25). Its underlying operating profit has increased by 79% over the past five financial years. Also, its margin’s improved 1.5 percentage points to 7.5%. It’s targeting a further improvement to 9% over the medium term.

However, these underlying FY25 figures exclude a £90m provision made for cost over-runs on one of its contracts with the Royal Navy. This remains a concern and demonstrates the complexity of some of the group’s projects.

For FY25, it’s announced a 30% increase in its dividend to 6.5p. But with a yield of less than 1%, income investors will probably want to look elsewhere.

Final thoughts

But despite rallying over the past five years, I think the shares still offer good value compared to others with exposure to the sector. Underlying earnings per share in FY25 was 50.3p, implying an historical price-to-earnings ratio of 19.4. The equivalent figures for Rolls-Royce and BAE Systems are 54.2 and 25.6 respectively.

Combined with an order book of £10.4bn and a strong balance sheet, long-term growth investors could consider the stock for their portfolios.