I’m looking for top UK shares that could rise in value over the remainder of the year and beyond. Here’s one top momentum stock I think ISA investors like me should seriously consider.

New gold price spurt?

Gold prices have stepped back from April’s record peaks above $3,500 per ounce. But the bullion market is beginning to bubble again as worries over global growth, rising inflation, and geopolitical challenges grow.

The precious metal was last changing hands near $3,384 per ounce. And City analysts are starting to get excited again about where gold prices will reach in the coming quarters.

Take the boffins at ING. On Thursday (7 August) they raised their forecasts for the next two years, predicting that “potential US Fed rate cuts, along with continued central bank buying and ETF inflows, could send gold to fresh highs“.

They now think gold will average $3,250 per ounce in 2025, up from a prior estimate of $3,128. And their projection of $3,512 for 2026 is up from $3,175 previously.

Top mining stock

I like the idea of buying gold stocks to seize this opportunity. It’s why I’ve purchased the L&G Gold Mining ETF — an exchange-traded fund (ETF) containing a basket of 37 precious metals producers — for my own portfolio.

This way, I stand a chance of making better returns than buying a gold price tracker or physical metal. When gold rises, profitability among mining stocks can boom, as their costs remain relatively fixed while revenues rise.

A fund that holds many shares helps spread the risk that comes with mining companies. But, on the other hand, buying individual shares can generate even greater capital gains if they’re operationally robust.

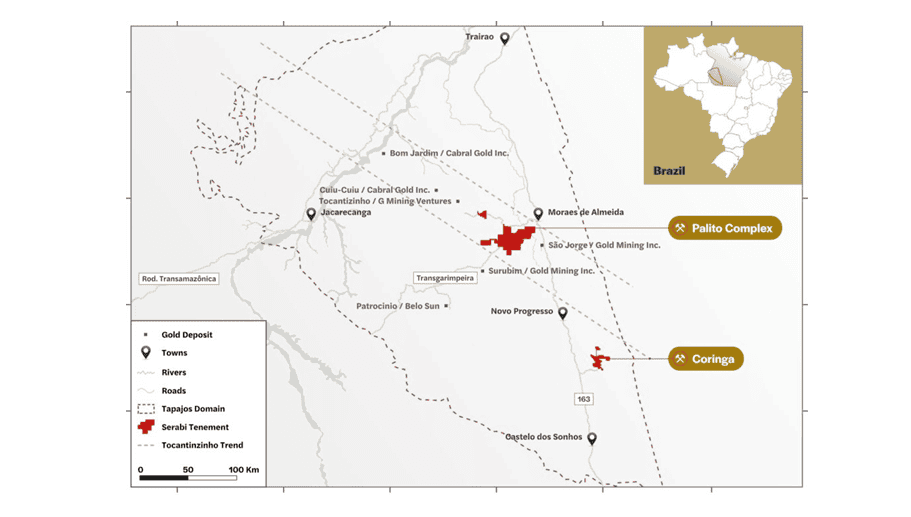

This is the case with Serabi Gold (LSE:SRB) in 2025. The company — which owns exploration assets and working mines in Brazil — has risen 80.3% in value in the year to date.

By comparison, my Legal & General gold miner’s ETF is up 64.3%. The gold price has increased 28.9% over the period, in US dollar terms.

Soaring production

Serabi operates in the highly lucrative Tapajós region in Brazil, described as the world’s third-largest alluvial gold field. The firm has ambitions to leverage this resource-rich area and is making a good fist of it — production is rising sharply thanks to ramp-ups at its Coringa mine, and was up 17% in the second quarter, at 10,532 ounces.

It’s on course to raise output to 44,000 to 47,000 ounces in 2025, and to reach:

- 60,000 ounces next year

- 70,000-75,000 ounces in 2027

- 100,000 ounces in 2028

With a string of promising exploration projects, too, Serabi could deliver solid long-term growth.

A dirt-cheap gold share

Today Serabi Gold trades at 200.7p per share. This means it carries a price-to-earnings (P/E) ratio of 3.9 times, a figure I don’t think reflects its enormous growth potential.

Given the bright outlook for gold prices and its impressive operational progress, ISA investors should give the company significant thought.