Investing in UK dividend shares can be a great way to target a second income. Britain’s blue chips are famed for their ultra-generous payout policies, backed by their leading positions in mature markets and strong balance sheets. Investors have a wide range to choose from to build a diversified portfolio that delivers robust returns over time.

To illustrate this, here’s how you could — with £20,000 in savings and an appetite to invest for the long term — aim for £1,274 every month in passive income.

Building wealth

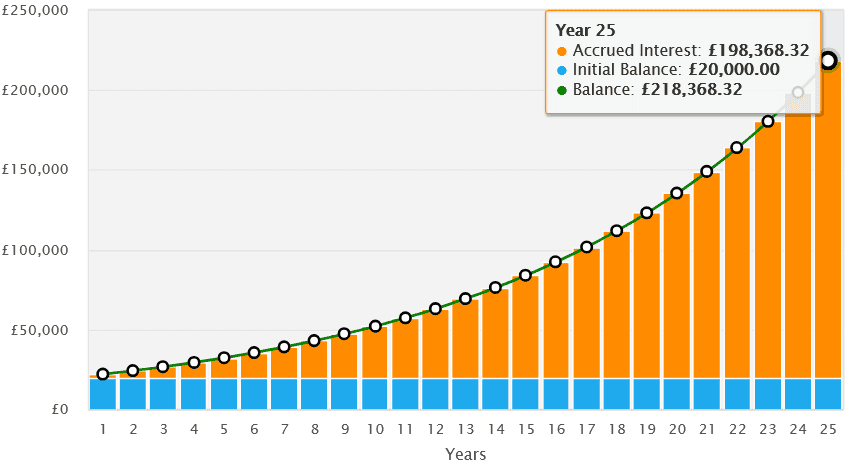

This monthly amount is based on a £20,000 lump sum growing at a compound annual rate of 9.6% over 25 years, and then being invested in dividend shares that yield 7%.

That figure of 9.6% might appear random at first glance. But it’s actually the average annual return that Stocks and Shares ISA investors have achieved over the last decade, through a combination of share price gains and dividends.

An investor who replicates this performances would have £218,368 sitting in their pension pot after 25 years, and enjoy £15,286 a year in dividends from those high-yield shares.

The FTSE 100 has delivered an average yearly return of 7% over the last 10 years. By buying individual growth and dividend shares, investors can enjoy far higher returns, as those Stocks and Shares ISA users have shown us.

A FTSE winner

One top UK share for investors to consider is Legal & General (LSE:LGEN). Founded in 1836, this financial services heavyweight has the scale, the knowhow, and the brand recognition to capitalise on rapid market growth.

It’s one of the FTSE 100’s most consistent dividend stocks, flinging out tonnes of cash for shareholders to reinvest for portfolio growth. Cash dividends have risen in 14 of the last 15 years. And they haven’t been cut since just after the 2008 financial crisis.

On top of this, Legal & General’s forward dividend yield is 8.6%. To put that into context, the average Footsie yield sits way back at 3.3%.

Legal & General is also attractively priced based on predicted profits, leaving scope for impressive share price growth. It’s price-to-earnings (P/E) ratio of 11.2 times for this year falls steadily to a bargain-basement 9.3 times by 2027.

Neither share price gains nor dividends are guaranteed for any stock. In this case, returns could disappoint if competitive pressures worsen, or the global economy endures a prolonged downturn. Yet Legal & General’s operational excellence and focus on growth sectors (like retirement and asset management) puts it in excellent shape.

Targeting income

Finding shares, trusts, and funds that can achieve that 9.6% return requires some initial effort. Fortunately, today’s investors have many tools and resources at their fingertips to build a diversified and high-returning portfolio.

It won’t happen overnight. But with patience and smart choices, a £20,000 investment can flourish into a sizeable nest egg and a healthy second income.