Building passive income with an ISA can be a powerful way to secure financial freedom in retirement. Rising living and social care costs mean many pensioners are feeling the financial squeeze. But by investing in a Stocks and Shares ISA, many thousands of people have managed to achieve a quality standard of living in later life.

Individuals can choose to save or invest in a Cash ISA, a Stocks and Shares ISA, or a Lifetime ISA. However, the greater annual allowance and stronger long-term returns mean that the investing ISA has proved the most effective choice for building wealth.

Annual returns here have averaged 9.6% over the last decade. With the Cash ISA, this sits way back at 1.2%, according to Moneyfacts.

Using an ISA to buy shares, trusts and funds involves greater risk. But it also provides a formidable chance to build a £1,000 second income in retirement

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Growth AND income

Of the many ways you can aim for a large passive income, investing in dividend shares is one path to consider. It’s the strategy I plan to follow, as it can provide a steady income as well as room for further portfolio growth.

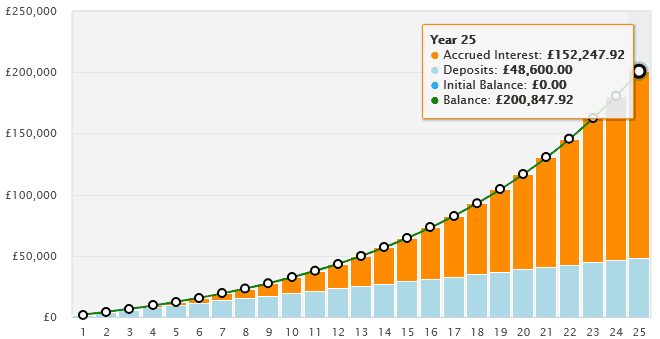

Let’s say I choose to buy 6%-yielding dividend shares once I hit retirement. To make a monthly income of £1,000 a month, my Stocks and Shares ISA will need to be worth £200,000 by then.

That’s not a small sum. But it’s also isn’t one that’s necessarily out of reach for most people, thanks to the long-term performance of the stock market and the tax benefits of the ISA.

If I can hit that 9.6% average annual return I mentioned above, as little as £162 a month (excluding trading fees) over 25 years would let me reach that magic £200,000 portfolio.

Targeting quality shares

Choosing individual shares can be the most effective way to target blockbuster returns through regular investing. This strategy can deliver index-beating returns, helping individuals perhaps double or triple their money, perhaps more.

Take Ashtead Group (LSE:AHT) as one to consider. Rapid expansion during the 21st century has transformed it into a powerhouse in the North American rental equipment sector. It’s benefitted from the strength of the US economy, and the ongoing shift from ownership to rental for construction and industrial hardware.

Revenues have grown from £1.6bn in 2014 to £8.7bn last year (based on average exchange rates). And pre-tax profits have swelled from £357m to £1.7bn. This has translated into an average annual return of 18.8%, taking into account share price gains and dividends.

This is an industry that’s faced challenges due to higher interest rates and trouble in key end markets. But the long-term outlook remains robust, helped by plans for massive infrastructure upgrades in the US. With the marketplace still highly fragmented, Ashtead has scope for further earnings-boosting acquisitions as well.

Not all stocks are equal, and a diversified portfolio could contain winners like this alongside some much poorer performers. But careful analysis to identify quality companies like Ashtead can set ISA investors up for retirement.