Investors may have been surprised to see VT Holland Advisors Equity Fund make Rosebank Industries (LSE:ROSE) its largest single holding, with the growth stock now accounting for a sizeable 9% of the portfolio.

The decision comes at a time when Rosebank’s headline numbers don’t exactly dazzle. The share price has almost halved in a year. And at first glance, its financial metrics look unremarkable.

Not a typical growth stock

Yet Rosebank isn’t a typical growth company and doesn’t fit the standard mould. Established in 2024, its core strategy is to buy quality industrial and manufacturing businesses and drive significant improvement before ultimately selling them. It’s a model that closely resembles that of a private equity firm.

Recent activity has shown this approach in action. Rosebank’s high-profile £1.9bn acquisition of Electrical Components International, a US-based supplier of critical systems, was financed through both debt and a major share placing. This bold move was supported by institutional investors, with the likes of Aviva, BlackRock, and Norges Bank on the shareholder register.

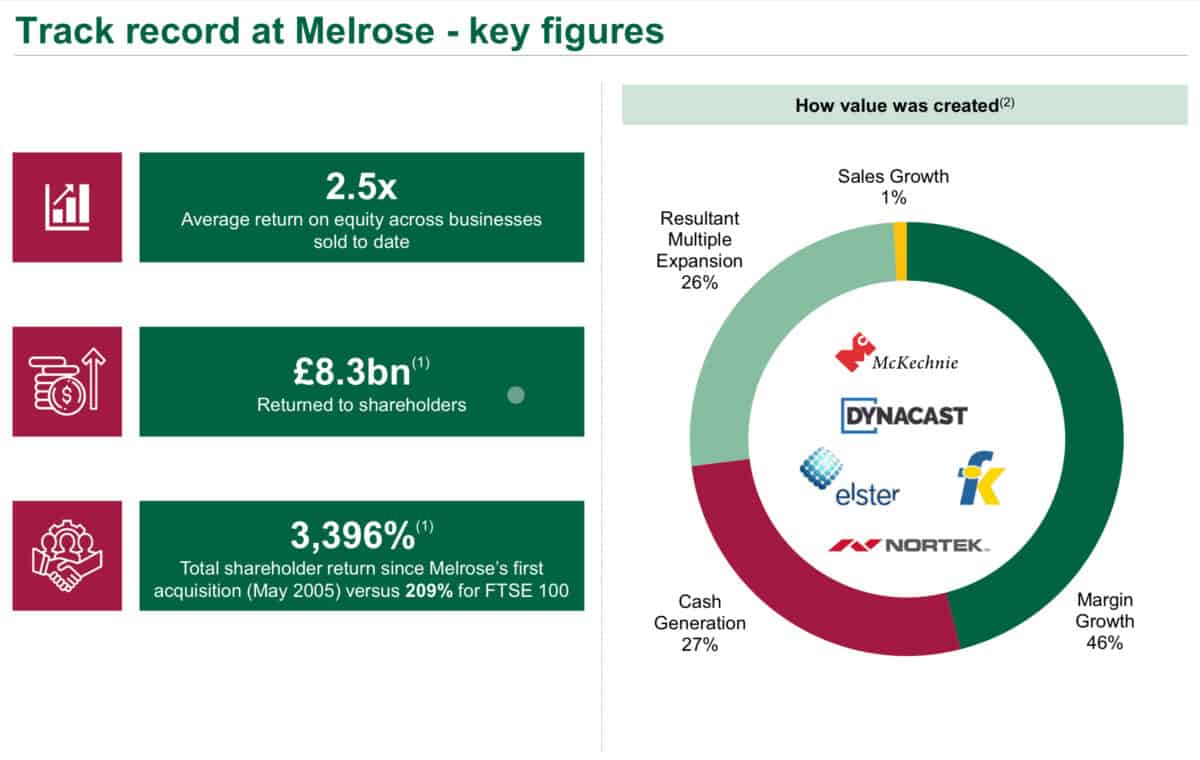

What sets Rosebank apart is its operational focus. Management, led by CEO Simon Peckham, brings deep experience in transforming businesses through hands-on operational improvements and capital allocation discipline. Peckham was the founder of Melrose Industries. That’s one of my favourite stocks right now.

Rosebank targets companies with strong fundamentals but with clear scope for growth under new stewardship. This ‘buy, improve, sell’ method is about driving shareholder value not simply by holding assets, but by unlocking underlying potential and capitalising on market positioning.

The metrics suck

On paper, Rosebank’s growth story is yet to translate into eye-catching metrics. However, that’s not overly surprising as it’s only just completed its first major deal and is yet to fully execute on its strategy.

The approach is heavily dependent on management’s ability to identify and integrate acquisition targets. And then it has to deliver the kind of structural improvements that private equity firms are known for.

For now, sales remain volatile. Performance is resting on future execution rather than current earnings momentum. As such, it’s a stock for investors comfortable with a degree of uncertainty and looking beyond quarterly earnings.

The bottom line

Despite the risks, VT Holland Advisors’ conviction signals confidence in Rosebank’s experienced team. It’s also a vote of confidence in the differentiated, private-equity-like proposition for UK public markets.

The next phase will be crucial as Rosebank sets about proving it can deliver outsized returns through its operational know-how and fresh approach to value creation.

It’s absolutely not the type of investment I’d normally go for however. I like companies that are clearly trading with a margin of safety. This is typically driven by compelling earnings metrics, strong balance sheets, and profitability metrics. That’s not what I can see here.

For now, I’m going to pop this one on my watchlist. It certainly deserves consideration, it just might not be the perfect match for me.