Chancellor Rachel Reeves is – reportedly – making plans to encourage savers to look at investing, rather than keeping their money in cash. And I think the UK has some outstanding dividend shares to consider.

At first sight, the potential returns might not seem like enough to outweigh the risks. But over time, the difference can be quite dramatic.

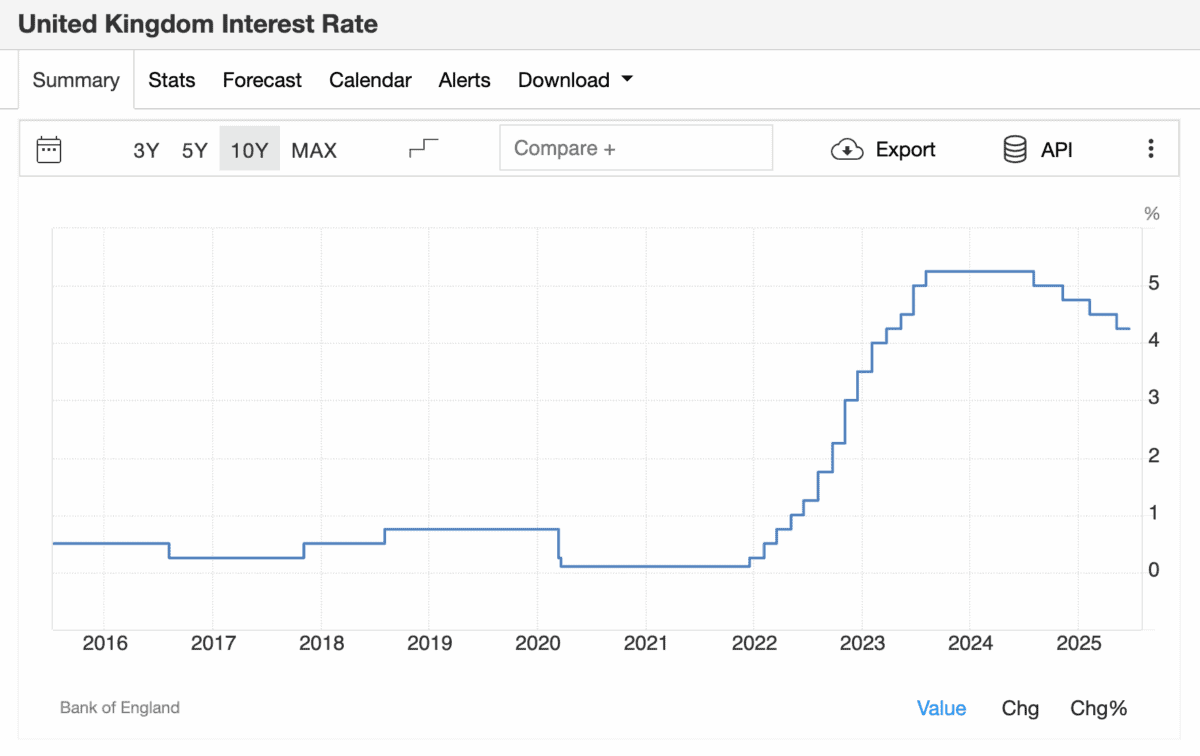

Interest rates

Right now, some savings accounts are offering up to 5% a year. That’s not bad, but interest rates are unusually high and the general expectation is that they’re set to fall.

Source: Trading Economics

Given this, I don’t think expecting to get 5% a year from cash over the long term is realistic. And if rates get back to where they were before the pandemic, 1% might be more realistic.

An optimistic view might be 2.5%, enough to turn £20,000 into £32,957 after 20 years. That’s ok, but the stock market has historically offered much better returns.

Over 25 years, the average annual return from the FTSE 100 has been 6.89% – enough to turn £20,000 into £75,817. Of course, the benefits of cash saving include the fact that the money is safe, which isn’t the case with investing in shares.

The stock market

the stock market’s past performance provided a guarantee of future results, investing would be easier than it actually is. But things aren’t quite so straightforward.

Obviously, share prices go up and down in a way that cash doesn’t. That means it’s mainly suitable for those with a long-term outlook.

This is very important. While it’s no accident that the stock market has consistently generated strong returns in the past, there’s no guarantee of where it will be at any specific time.

But given that many companies distribute part of the cash they generate to shareholders as dividends, this can provide investors with extra income without having to rely on selling.

Passive income

Unilever (LSE:ULVR) is one example of a company that pays dividends. The current share price is £44.83 and the firm returned 147p per share last year, implying a 3.28% yield.

That might not seem like much, but it’s above the 2.5% I think someone might expect from cash. And the firm also has a chance to grow its profits over time and increase its dividend as a result.

Of course, this isn’t guaranteed – Unilever operates in an industry where it’s easy for consumers to switch to alternative products. And this is a risk that it’s impossible to eliminate entirely.

Source: Company Website

Unilever, however, has strong brands and vast scale that both help it negotiate favourable terms with retailers. This is why the firm has been so successful in defending its market share to date.

Investing

At the outset, a £20,000 investment in Unilever shares could generate around £700 a year in dividends. Compared to £1,000 from cash savings, that looks like a bad deal.

Over time though, I expect the FTSE 100 firm’s dividend to grow as interest rates fall. So anyone with a long-term focus might want to consider buying the stock over keeping money in cash.