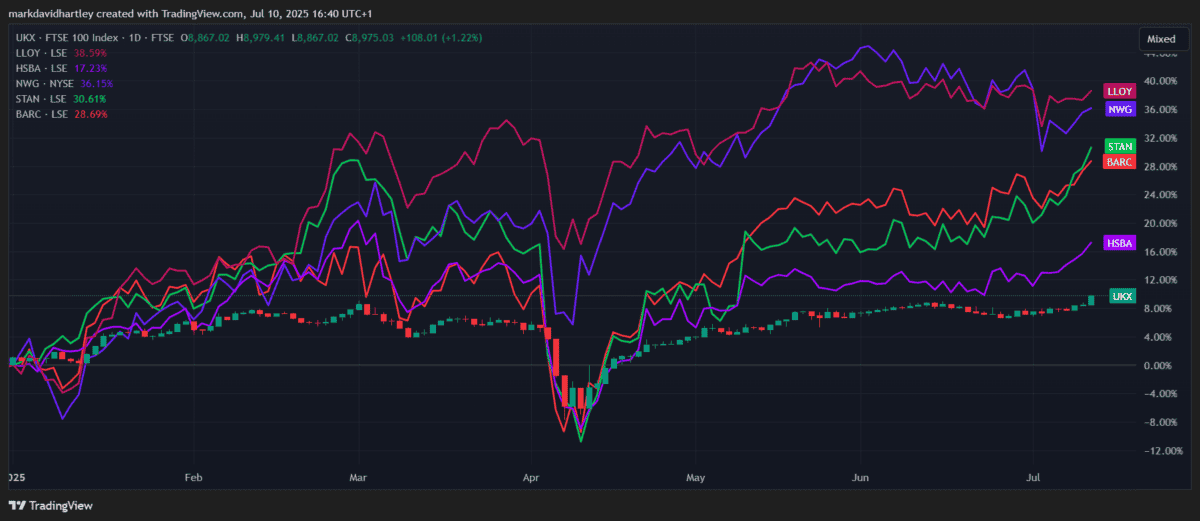

After a strong 2024, the Barclays (LSE: BARC) share price has struggled to keep pace so far in 2025. Among the five major UK banks on the FTSE 100, Barclays is lagging most of its peers.

By contrast, Lloyds (LSE: LLOY) shares have been on a tear, surging almost 40% year-to-date.

Looking at the broader UK economy, various factors continue to affect the banking industry. Inflation remains sticky at around 3.4%, while the Bank of England holds interest rates steady at 4.25%. Geopolitical risks, from the ongoing situation in Eastern Europe to political uncertainty in the US ahead of the presidential election, are adding to investor caution.

Still, higher rates have so far helped banks’ net interest income, though loan defaults are an ever-present worry in a fragile economy.

So as we enter the second half of 2025, which of these banking heavyweights looks the better value buy?

Barclays

Barclays is the second-largest UK bank by market capitalisation, at roughly £48bn, behind only HSBC. It recently made headlines as one of two final bidders for Sabadell’s UK arm, TSB, facing off against Santander.

Financially, Barclays has delivered impressive numbers. Revenue grew by 9.8% year on year, while earnings growth is high at 110%, helped by favourable trading conditions in its investment banking arm. Its operating margin stands at 31.5% and net margin at 20.4% — the highest among the major UK lenders.

Valuation-wise, the Barclays share price looks appealing. It trades at a price-to-earnings (P/E) ratio of just 6 and a price-to-book (P/B) ratio of 0.8. That’s the lowest valuation in the sector. However, its debt load of £176bn is sizeable, almost triple its equity base, and higher than both Lloyds and NatWest. While such gearing isn’t uncommon for large banks, it does magnify risks in a downturn.

The dividend yield is a modest 2.5%, though payouts have risen for four consecutive years, up 5% this year. Risks for Barclays include exposure to global investment banking cycles, regulatory pressures, and the potential costs tied to expanding into new areas like TSB.

Lloyds

Meanwhile, Lloyds’ numbers are more modest, though arguably more stable. Its operating margin is 23.8% and net margin 15%. Return on equity (ROE) is the weakest of the big five banks at 8.7%, but Lloyds carries less debt and has a stronger equity position than Barclays.

The Lloyds share price isn’t exactly expensive, trading on a P/E ratio of 8.8 and a P/B ratio just below break-even at 0.97. The winner here is its dividend yield, which is far more attractive at 4.2%. Plus, the payout’s risen for four straight years, climbing nearly 15% year on year.

That said, Lloyds does face potential headwinds, including the possibility of hefty fines linked to the ongoing vehicle finance mis-selling investigation. Plus, there’s the usual consumer-related risks such as sensitivity to borrowing trends and a potential housing market slowdown.

My verdict

In my view, while the Barclays share price suggests deeper value, Lloyds’ superior dividend yield and stronger capital base make it the more appealing long-term income play.

Despite the looming finance probe, it looks to me the better option to consider as we navigate an uncertain economic landscape in 2025.