Dividends are never, ever guaranteed. But investors can improve their chances of enjoying a large and stable passive income by buying dividend shares in defensive sectors.

With this in mind, here are two top shares I think are worth a close look this July.

Octopus Renewables Infrastructure Trust

Investing for growth has been more challenging for renewable energy stocks in recent times. Two major new UK wind farms — including Hornsea 4, which was to be the world’s largest offshore wind farm — have been cancelled since 2023 due to costs and supply chain issues.

Amid signs that these pressures are easing, and given the bright long-term outlook for green energy categories, I think Octopus Renewables Infrastructure Trust (LSE:ORIT) is a top stock to consider.

UK investors have a swathe of renewable energy shares to choose from today. What I like about this particular one is its diversified approach: its assets span much of Europe and Scandinavia and multiple energy sources. This helps reduce the impact of potential geographic and technological risks at group level (for instance, weak wind currents that impact energy production in Britain).

This provides added strength to a stock that already enjoys strong earnings predictability, and therefore the means to consistently pay a large and growing dividend. Indeed, cash rewards from Octopus have risen each year since it listed on the London stock market in 2020.

City analysts are confident it can keep raising dividends and pay a targeted 6.17p per share dividend in 2025. This would mark the fourth successive year of dividend growth matching the UK Consumer Price Index (CPI) target, and results in a huge 8.2% dividend yield.

Like many energy producers, Octopus Renewables looks in good shape to deliver a stable and market-beating dividend income, then. But it’s not without its risks. Its profits and share price could come fall if interest rates suddenly rise. The trust could also drop if governments’ green energy policies become less favourable.

But, on balance, I think it’s worth seriously considering an investment here.

Assura

Healthcare and real estate stocks can be among the most reliable dividend providers over time. As a major owner and operator of primary healthcare properties in the UK, Assura (LSE:AGR) allows investors to enjoy the best of both worlds.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

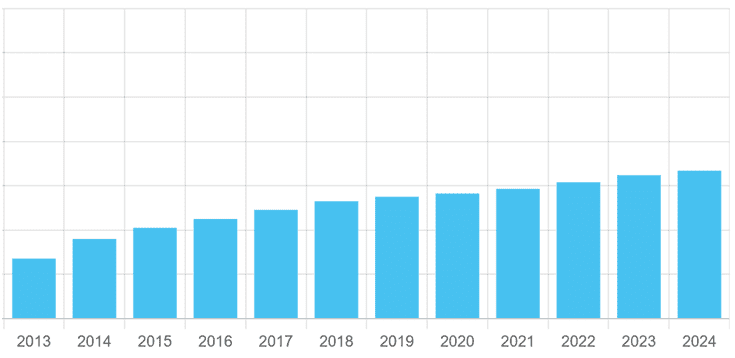

As with Octopus Renewables, this FTSE 250 dividend stock has a solid record of unbroken payout growth. This stretches back more than a decade, as its operations are largely unaffected by broader economic conditions. The government also essentially guarantees a large portfolio of its rental income.

There are risks here, too, such as interest rate dangers and changing government health policy. But things at least look stable on the latter front: in fact, demand for primary healthcare centres is rising as the NHS tries to reduce the strain on the country’s jam-packed hospitals.

Analysts expect Assura to raise its annual dividend again in the financial year to March 2026. A total payout of 3.32p is predicted, yielding 6.6%. I think this real estate investment trust (REIT) will remain a top dividend stock for years to come.