Investing £200 a month can be a powerful way to build wealth and target a substantial second income. This is especially true when we harness the power of compounding.

Compounding means investors earn returns not just on their original investments, but also on the returns those investments have already generated. Over time, this “interest on interest” effect can accelerate growth dramatically.

Slow and steady

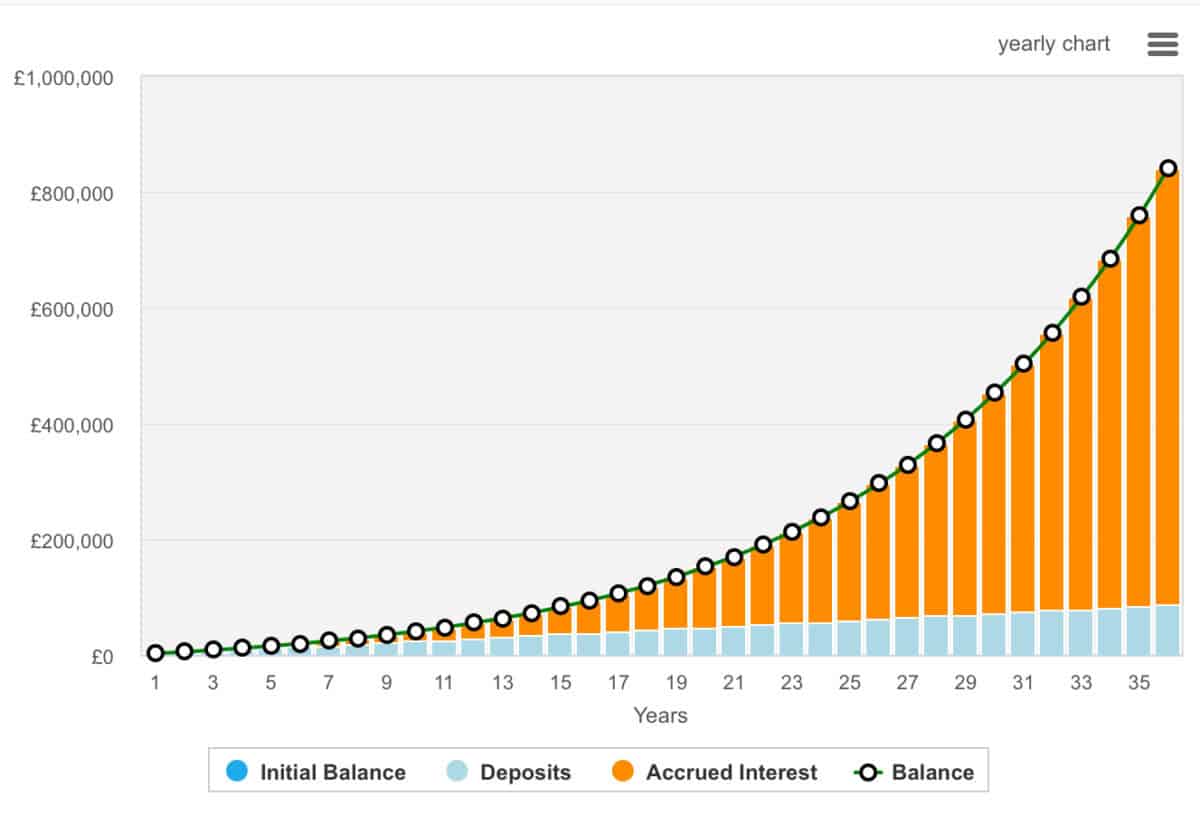

If anyone consistently invests £200 every month and achieves an average annual return of 10% over the long run, the portfolio could grow to over £841,000 in 36 years. Yes, it takes time, but the longer we leave it, the faster it will grow.

The maths behind this is rooted in the compound interest formula, where each year’s gains are added to your principal, so the base for future growth keeps getting larger.

After 36 years, an investor could look to allocate their portfolio towards companies with paying dividends or simply buy debt. With a 5% annualised yield, an investor would receive £42,050 annually. And that’s tax-free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Don’t lose money

The above is great. However, none of this matters if investors make poor decisions and lose money. Protecting capital is just as important as seeking high returns. As Warren Buffett famously says, “Rule number one is never lose money. Rule number two is never forget rule number one”.

This is crucial because a large loss can be devastating. If a portfolio falls by 50%, it needs a 100% gain just to get back to where it started. That’s why it’s wise to focus on quality companies, ideally with strong balance sheets and sustainable dividends, and to diversify investments across sectors to reduce risk.

Investing wisely

One UK stock that I believe has a lot of potential is Melrose Industries (LSE:MRO). The aerospace manufacturer’s valuation massively lags its peers despite the fact that it is the sole source supplier for 70% of its sales. That means it has an incredibly strong economic moat. Its parts also feature on all major aircraft engines.

Looking ahead, Melrose has set out a plan for high single-digit annual revenue growth, targeting around £5bn in revenue and over £1.2bn in adjusted operating profit by 2029. Free cash flow is expected to more than quadruple over the next five years, reaching £600m by 2029.

Management is guiding for more than 20% annual growth in adjusted diluted EPS over this period. All of this from a company valued at 14.1 times forward earnings. This also suggests a price-to-earnings-to-growth (PEG) ratio well under one. Meanwhile several peers are closer to two times or above.

Risks? Well, net debt is a little high at £1.3bn. There’s also the matter of execution risk as it completes its transition. Despite this, it’s a stock I like a lot. It definitely deserves broader consideration.