Artificial intelligence (AI) stocks have been the best place to park investment capital in recent years. Since the launch of ChatGPT back in late 2022, many of these stocks have soared. The question is: are there any worthwhile AI shares in the FTSE 100? Let’s take a look.

AI in the Footsie

When I look through the Footsie today, I don’t see any ‘pure plays’ on AI. For example, there’s no company that specialises in AI chips like Nvidia or AI software like Palantir.

That said, there are a few software/internet companies that are heavily integrating AI into their offerings. There are also some tech-focused investment trusts that offer significant exposure to AI.

Software and internet companies

Starting with the software companies, we have:

- RELX – it offers information-based analytics and decision tools so it has the perfect platform to apply AI.

- London Stock Exchange Group – it’s a leading provider of financial data and it’s working with tech giant Microsoft to roll out AI solutions.

- Experian – this credit rating company is actively using AI in various aspects of its business including data analysis and fraud detection.

- Sage – it’s a provider of accounting and payroll solutions and has integrated AI features into its offering recently.

- Rightmove – it operates the UK’s largest property portal and it has been experimenting with AI tools.

- Auto Trader – it operates an automotive marketplace and is using AI on its data.

These are all great companies. And in my view, they’re all worth considering as long-term investments today (I’m personally invested in three of the six stocks).

They all have their risks, of course. For example, they all face the risk of disruption from new competitors and/or technologies.

I’m optimistic overall. I reckon investors in these companies should do well in the long run as the world becomes more digital.

Investment trusts

Moving on to investment trusts, we have:

- Scottish Mortgage Investment Trust – this is a growth-focused trust that tends to invest in disruptive tech companies.

- Polar Capital Technology Trust (LSE: PCT) – this is a more ‘vanilla’ tech fund that offers exposure to the entire technology ecosystem.

Now, both of these trusts offer access to a lot of AI stocks. But if I had to choose the best one for AI exposure, I’d probably go with Polar Capital Technology Trust.

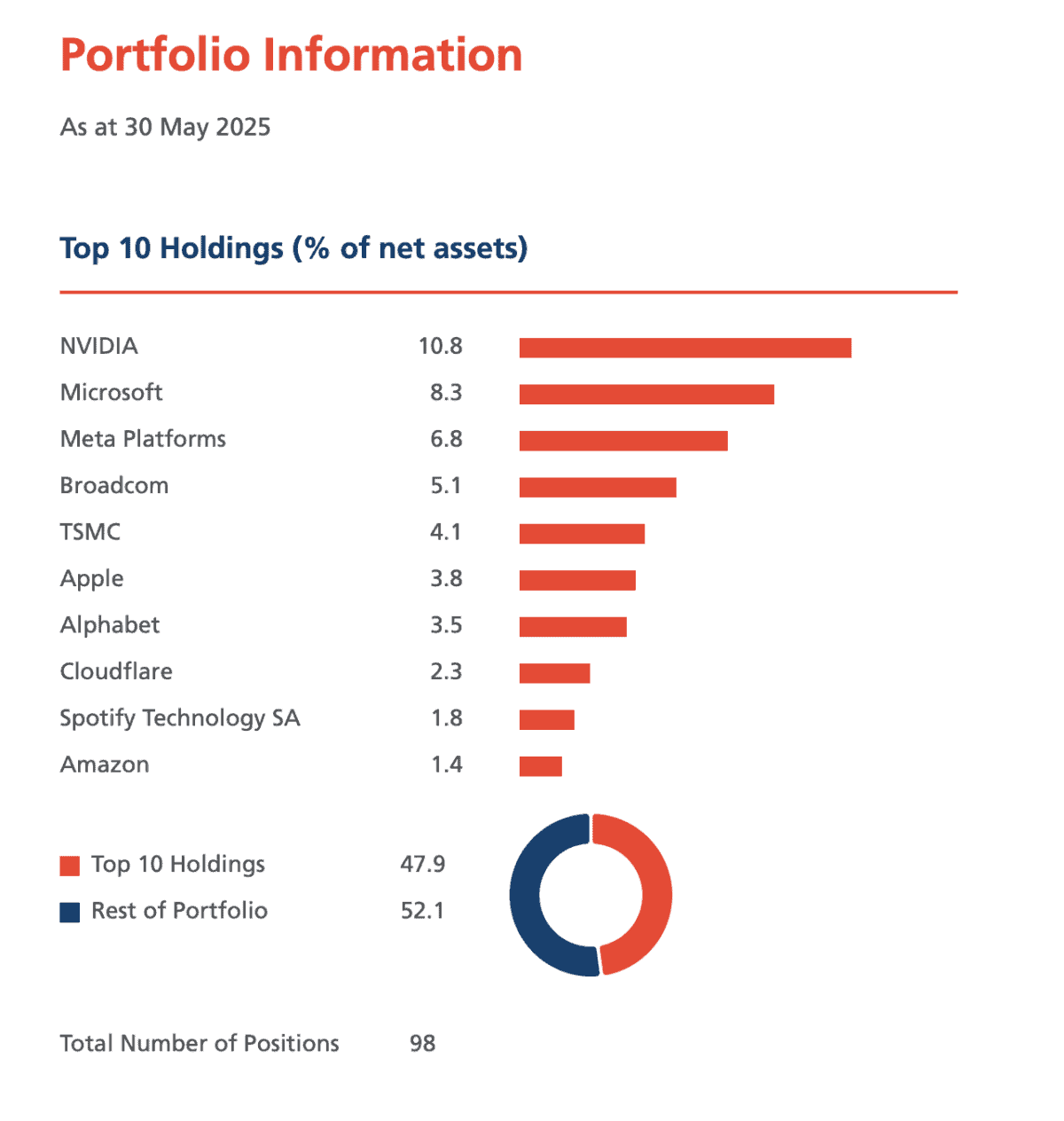

Just look at the top 10 holdings here (as of 30 May 2025). There’s a lot of AI exposure in that list of stocks.

There are AI chip companies such as Nvidia, Broadcom, and TSMC. There are also AI software companies like Microsoft, Meta, Alphabet, and Amazon.

Apple is also in the mix. It hasn’t done much on the AI front yet but looking ahead, it could end up being the main way we all interact with the technology given that so many of us own iPhones.

Over the last five years, this trust has performed well, returning about 75%. That translates to a gain of about 12% per year.

There are no guarantees it will continue to deliver such strong returns, of course. If the technology sector was to tank, returns could be disappointing.

I think this trust should do well as the world becomes more digital in the years ahead though. In my view, it’s well worth considering today.