There’s nothing more tempting that a ice-cold coffee in hot weather like this. Even I — an investing nerd who gets their kicks writing about ISAs, shares, and compound returns — would rather be kicking back with an iced caffe latte right now.

But when I consider the cost of a hot and cold coffee over time, and the better ways I could be using that money to build wealth, suddenly my thirst for a tasty caffeine shot cools off.

Let me explain why.

Compound gains

It’s a common misconception that individuals need to invest large lump sums to create retirement wealth. Just the price of an expensive coffee saved over time can achieve this goal.

An iced caffe latte at my local Starbucks today will set a thirsty buyer back £4.78. That’s not going to alter an individual’s retirement plans, but skipping it daily and investing the savings could.

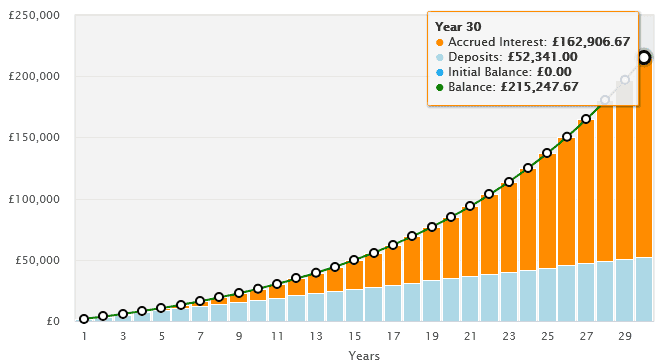

Let’s say an investor skips their Starbucks treat for an entire year. Over 365 days, that £4.78 works out at £1,744.70. If they decided to invested their savings quarterly, they would — after 30 years, and achieving an average annual return of 8% — have built a retirement fund of £215,247.67 (excluding trading fees).

Investing in an ISA can be an especially effective way for small regular savers to generate long-term wealth. This is because taxes on returns can significantly reduce the compounding power of more modest investments. An ISA protects against both capital gains tax and dividend tax, helping savings grow more efficiently over time.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Smart investing

There’s more to investing than just beating tax. Just like skipping the daily iced coffee adds up, so do the costs of buying a range of different shares.

Imagine our investor uses their £436.18 quarterly Starbucks savings to buy five separate FTSE 100 shares. They could easily pay up to £10 per trade, plus a couple of pounds in stamp duty. Those charges would start to feel like paying for a couple of extra coffees each time they invest.

But here’s the good news: just like an ISA helps you dodge taxes, buying a single exchange-traded fund (ETF) that holds dozens of shares means only one transaction fee and zero stamp duty.

A top fund

The iShares Core S&P 500 ETF (LSE:CSPX) is one such fund I think could be an effective way to target a large ISA. As its name implies, this fund invests in hundreds of US blue-chip shares, from tech giants like Nvidia and Apple to retailers such as Walmart, banks such as JP Morgan, and consumer goods producers like Coca-Cola.

This broad exposure creates wealth over time by tapping into the growth of the world’s largest economy and some of its most successful and innovative companies. The proof is in the pudding: since 2015, it’s delivered an average annual return of 12.5%.

It’s true that the fund could still fall in value during broader stock market downturns. Yet, on the whole, diversified ETFs such as this are still a great way to generate long-term wealth. And all for the price of a daily coffee.