I had some spare cash in my Self-Invested Pension (SIPP) last month after receiving some juicy tax relief from the government. Here’s what I decided to invest it in.

HANetf Future of Defence ETF

Defence stocks have risen sharply in recent years as geopolitical threats have increased. Yet buying individual shares like BAE Systems and Rolls-Royce comes with higher risk than a basket of stocks with an exchange-traded fund (ETF).

,This is why I plumped for HANetf Future of Defence ETF (LSE: NATP) this month, which has risen 56.3% in the past year and has further to run, in my opinion. In its own words, the fund — established in 2023 — “provides exposure to the companies generating revenue from NATO and NATO+ ally defence and cyber defence spending“.

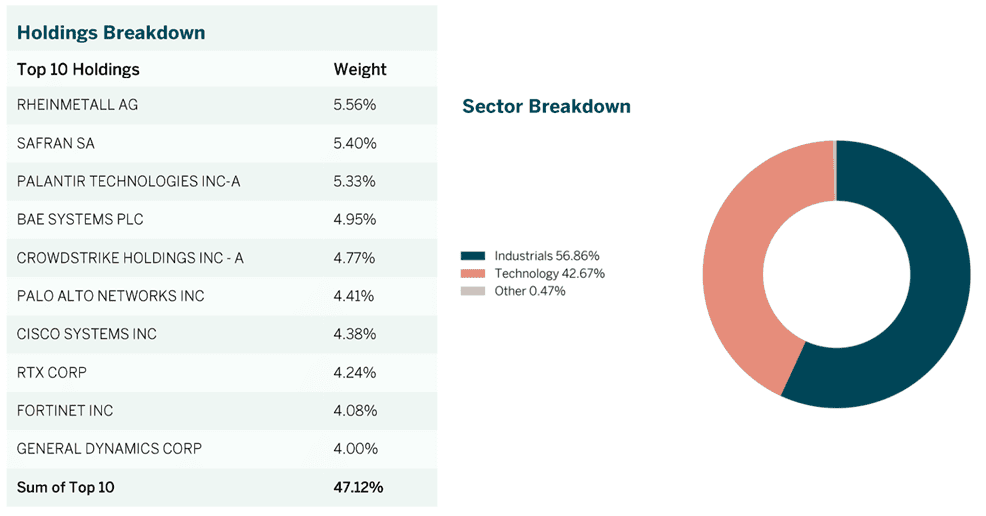

In total, the fund holds shares in 60 different companies. And unlike many defence ETFs, it provides significant exposure to cybersecurity companies (such as Palo Alto and CrowdStrike) alongside pure-play defence firms (such as Rheinmetall and BAE). This provides added diversification and growth potential:

According to Stockholm International Peace Research Institute (SIPRI) data, global defence spending leapt 9.4% in 2024. This was the steepest annual climb since 1988 — driven in large part by heavy rearmament in Europe — and meant total military spending rose 37% over a 10-year horizon.

Spending across broader European NATO members is tipped to continue rising sharply too, in anticipation of reduced US military support. This month, all NATO members (excluding Spain) rolled out plans to spend 5% of their domestic GDPs in defence through to 2035, primarily reflecting concerns over foreign policy threats from Russia and China.

While this HANetf allows me to spread risk, it still leaves me exposed to sector dangers that could depress its performance. Signs that NATO countries are struggling to fulfil their spending commitments could impact returns.

But on balance, I’m expecting it to continue delivering strong returns.

HSBC

HSBC (LSE:HSBA) has also enjoyed healthy share price gains of late, up 27.4% over the last year. Despite economic troubles in its key Chinese market, the bank’s bet on high-growth Asian markets — and on non-interest income segments like wealth management — continue to pay off handsomely.

Yet today, the FTSE 100 bank still offers excellent value for money, prompting me to add it to my SIPP. It trades on a forward price-to-earnings (P/E) ratio of 9.1 times, while its corresponding dividend yield is an enormous 5.9%.

HSBC still commands a low valuation given the risks of US-Chinese trade wars on its earnings. It also reflects the potential impact of falling interest rates on its margins.

However, I think the potential benefits of owning HSBC shares outweigh these risks. The bank has the scale to effectively capitalise on booming population and wealth growth in Asia, and is selling low-growth Western assets to better focus on these emerging markets. It’s also aiming to slash $1.5bn from its cost base by the end of 2026 to boost profitability.

I also like HSBC because of its deep balance sheet. A CET1 capital ratio of 14.7% provides it with substantial financial strength to invest for growth while still returning capital to shareholders through large dividends and share buybacks.