When selecting which FTSE 100 or FTSE 250 shares to buy, I always like to see what other retail and institutional investors are doing.

Discovering what hedge funds are doing can be very informative given the huge resources and mountains of experience these institutions have. I’ve been looking at shares that they’ve been ‘shorting’ in the expectation that they’ll fall in price.

Here are two from the FTSE 250 that have caught my eye. While I feel investors should consider avoiding one of them, I think the other one could prove an excellent candidate for further research.

Wizz Air

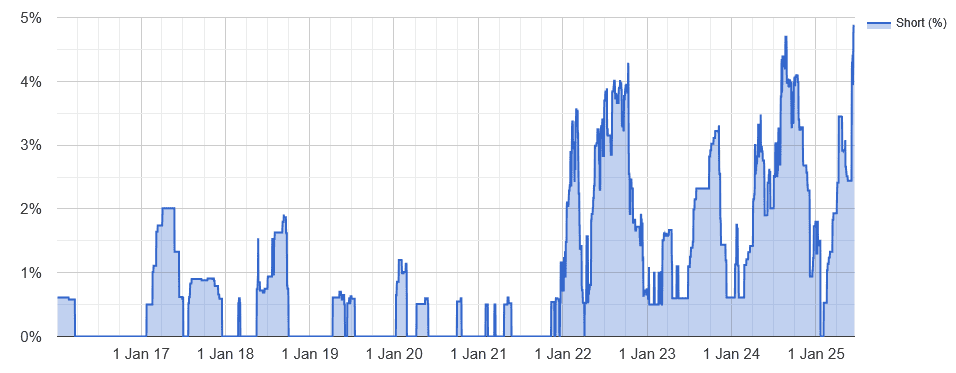

According to shorttracker.co.uk, Wizz Air‘s (LSE:WIZZ) the second-most shorted stock on the index right now, putting it just behind Ocado. Some 4.9% of its shares are shorted, with five hedge funds taking a short position on the budget airline.

As the chart shows, short interest has exploded in recent weeks. This reflects in part a recent spike in oil prices caused by escalating conflict in the Middle East.

Fuel costs form a colossal portion of airlines’ expenses. So this pick-up in shorting activity perhaps isn’t a surprise. However, this is far from the only problem impacting investors’ views of Wizz Air shares.

Indeed, the business — which concentrates on Central and Eastern European routes — has been in freefall, primarily due to engine troubles that have grounded much of its fleet. Wizz’s share price is down 55% over the last year.

The problem is tipped to persist into the latter part of the 2020s. And to rub salt in the wound, the compensation deal agreed with engine supplier Pratt & Whitney is only partially covering the problem.

I feel the company’s focus on emerging European markets could set it up for solid long-term growth. So could its focus on the low-cost segment as value becomes increasingly important with consumers.

But with oil prices rising and its planes grounded — not to mention market competition increasing and economic conditions still extremely uncertain — I think Wizz Air shares are far too risky to consider today.

NCC Group

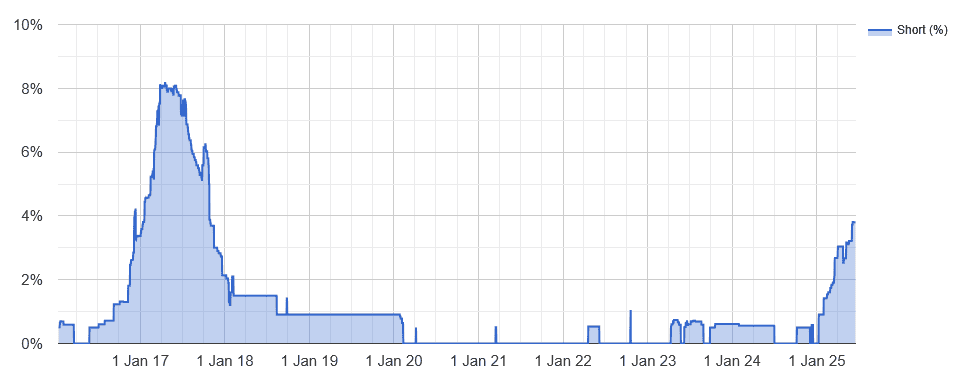

But I feel that cybersecurity specialist NCC Group (LSE:NCC) could be a much better share to look at. That’s even though four hedge funds have shorted its shares, pushing total short interest to 3.8%.

There are some similarities here with Wizz Air, even though the two companies operate in very different sectors. Revenues at the IT company are highly sensitive to broader economic conditions. It also faces substantial competitive threats, and is a small fish compared with many of its US peers (like Palo Alto Networks and CrowdStrike).

However, having online protections in place is a necessity rather than a luxury as the number of cyberattacks rapidly increases. Having them can save businesses a fortune in unnecessary costs and lost revenues, so NCC’s profits may remain more resilient than other IT companies.

What’s more, the rapid rate of market growth still provides exceptional growth opportunities for the company. Analysts at BCC Research think the cybersecurity sector will expand at an annualised rate of 11.3% during the five years to 2029.

NCC’s already proved it has the know-how to capitalise on this market boom, with revenues rising 31.3% at constant currencies in the 16 months to September. I think it’s worth a very close look.