While hunting for high-yield opportunities on the FTSE All-Share, I recently identified two cheap shares that look undervalued. For income-focused investors, finding companies offering both strong dividends and modest valuations can be a powerful combination.

I tend to look for businesses with low price-to-earnings (P/E) ratios, high dividend yields and solid free cash flow. These are often signs the market has overlooked potential value.

After some digging, two stocks caught my attention: MAN Group (LSE: EMG) and International Personal Finance (LSE: IPF).

MAN Group

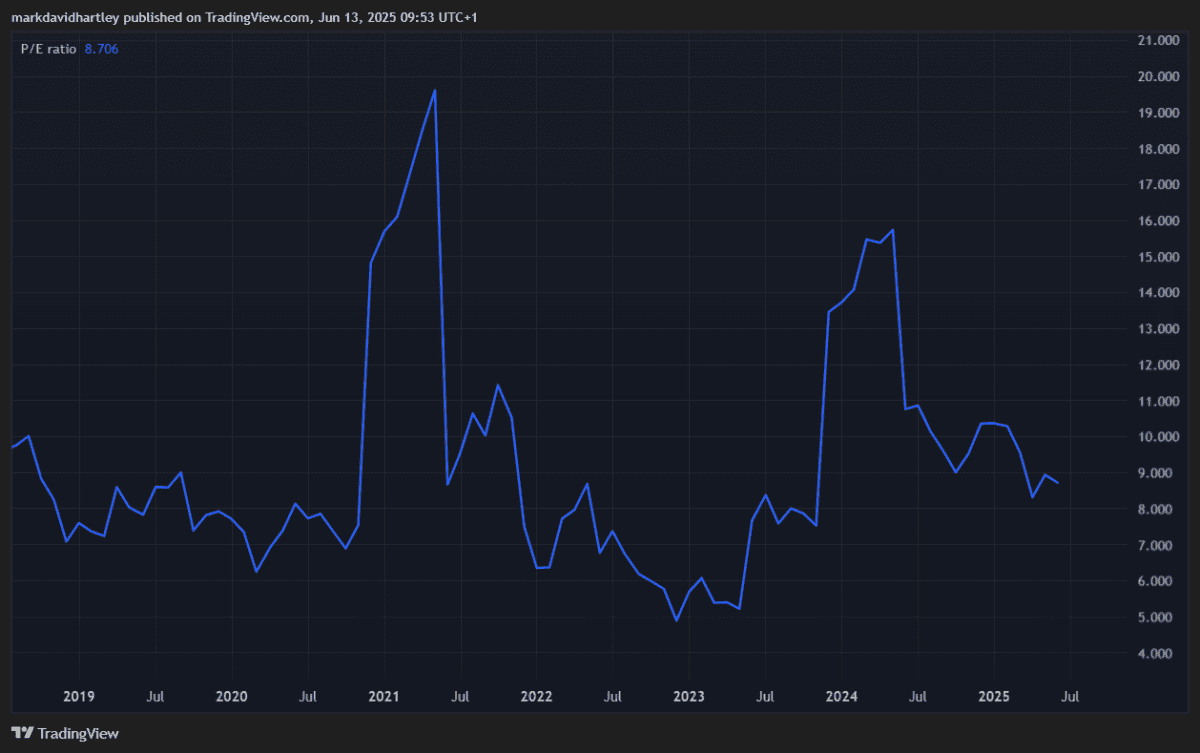

MAN Group’s one of the world’s largest publicly-listed hedge fund firms with a £1.97bn market-cap and a long track record in quantitative and alternative strategies. The shares currently trade for around £1.70 and have a P/E ratio of only 8.7, which is low compared to the financial sector average.

One of the major advantages here is MAN’s capital-light business model. With relatively low fixed costs and scalable operations, the company can maintain strong margins even during volatile market conditions. In fact, market volatility often benefits the firm, as it drives higher performance and management fees.

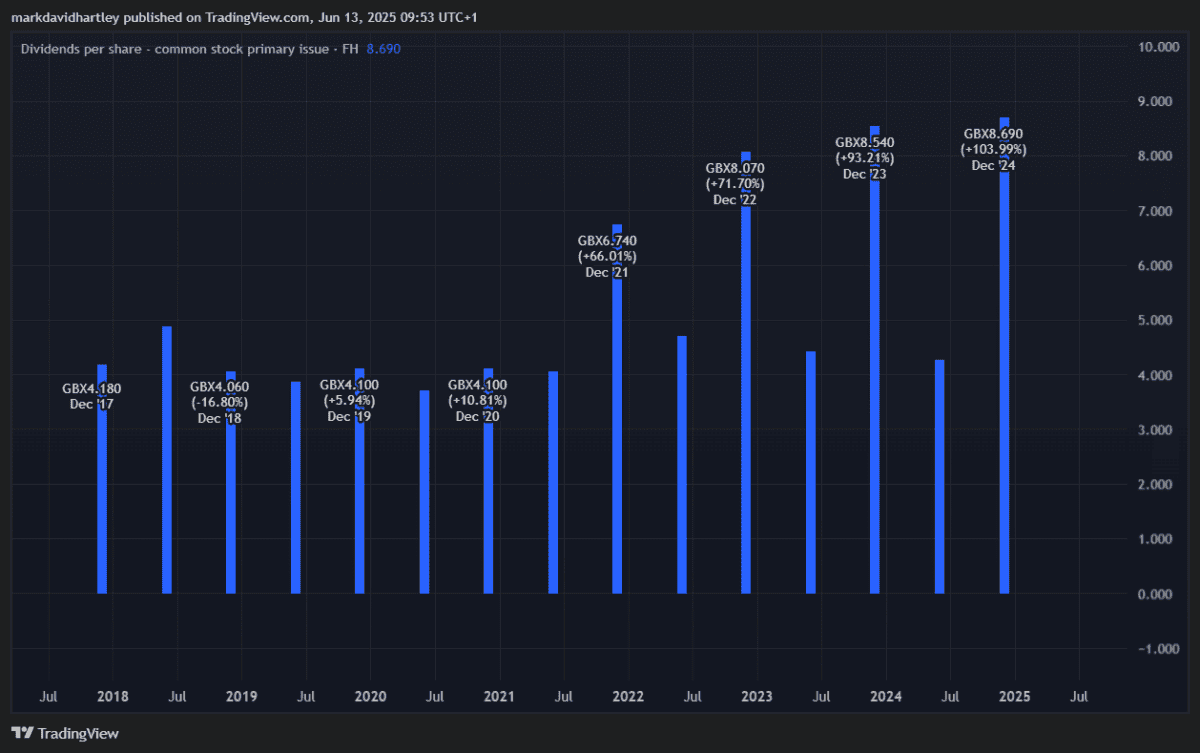

On top of that, the 7.35% dividend yield looks attractive, especially given the company’s history of special dividends and share buybacks.

However, there are risks. The company’s revenue is closely tied to asset performance and investor sentiment. If markets turn sour, performance fees can dry up quickly. There’s also the macroeconomic angle – rising rates and geopolitical shocks could weigh on investor appetite for hedge fund strategies.

Still, for those seeking a cheap stock with income potential, MAN Group seems worth considering, in my opinion.

International Personal Finance

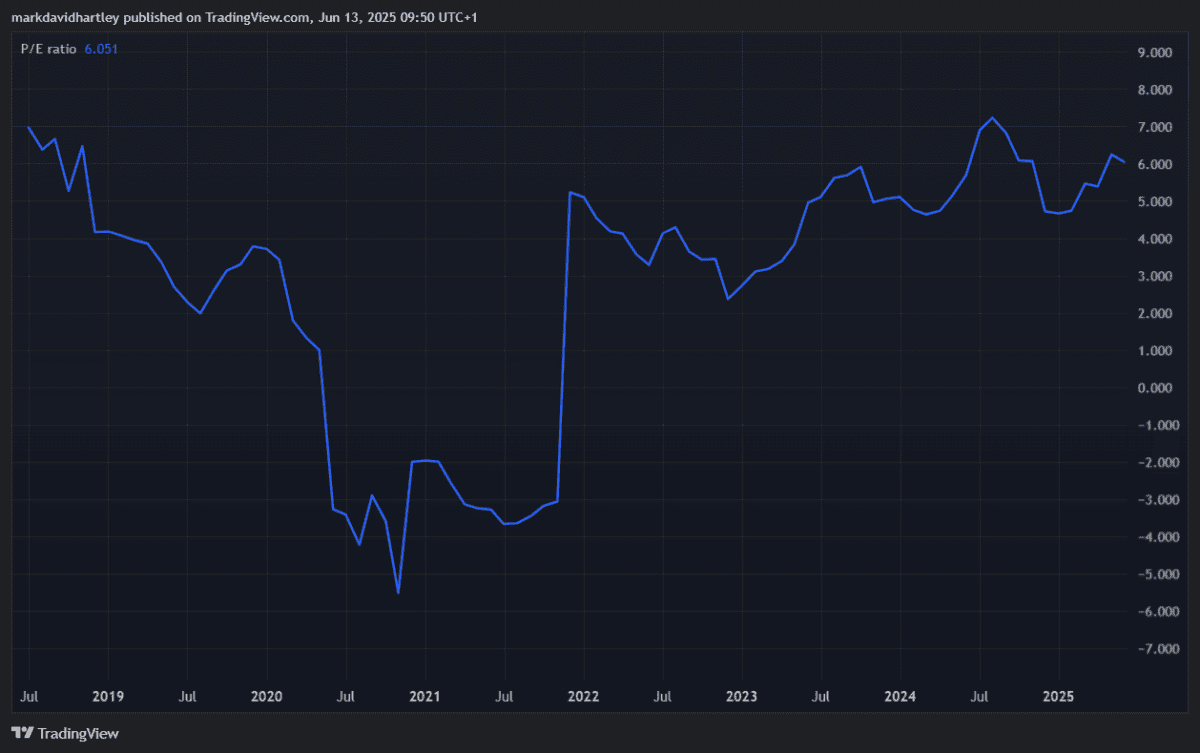

With a P/E ratio of just 6 and a £1.56 price tag, this up-and-coming finance stock looks like one of the cheapest shares on the FTSE All-Share.

The £345m company offers consumer credit services in emerging markets, primarily in Eastern Europe and Latin America. While the sector carries more risk than blue-chip financials, the returns can be compelling. Plus, the company has a long track record of awarding cash to its dedicated shareholders, currently sporting a dividend yield of 7.15%.

A key strength is the firm’s local knowledge. The company operates with in-country teams who understand regional lending conditions and maintain close contact with customers. This face-to-face model helps keep default rates manageable, even in less stable economies.

On the flip side, international operations expose it to currency fluctuations and political instability, which can threaten earnings. Regulatory changes are another challenge, particularly if governments impose interest rate caps or tighten lending criteria. Moreover, funding costs could rise if global interest rates stay elevated.

Still, with both a high yield and room for growth, I think it’s a stock worth further research.

Final thoughts

Both MAN Group and International Personal Finance offer an attractive combination of cheap shares with high dividends. They’re not without risks, but the low valuations suggest much of the bad news may already be priced in.

For investors comfortable with a bit of market volatility, these two stocks could provide meaningful passive income while trading at a discount.