You’ll often read that Stocks and Shares ISAs are the best way to build cash for retirement. This is thanks to the excellent long-term returns that share investing tends to provide.

With a £500 monthly investment, here’s how an investor could generate a healthy passive income in retirement.

A £50k passive income

As I mentioned, the returns enjoyed by Stocks and Shares ISA investors can be considerable. At 9.64%, the average yearly return for the last 10 years trumps the 1.21% return that the Cash ISAs provided. That’s according to price comparison website Moneyfacts.

Accordingly, prioritising investment in one of these riskier products could be the most effective way to build enough wealth for a comfortable retirement. Of course, Cash ISAs can also play a vital role in wealth creation by reducing risk and providing a stable return across the economic cycle.

Let’s consider how someone with £500 to invest each month could make it work. How much they split between share investing and cash will involve a delicate balance between their long-term goals and their attitude to risk. In this case, let’s say they prefer a 75/25 split that might deliver solid growth while also providing a safety net.

If they can match the averages of the last decade, they would — after 30 years — have:

- £785,269 in their Stocks and Shares ISA

- £54,220 in their Cash ISA

This would give them a combined retirement portfolio of £839,489 they could use for a passive income. With this money, they could purchase dividend shares, which should give them a steady flow of income. It would also give them a chance to continue growing their portfolio.

If they bought shares yielding 6%, they’d have £50,369 to live on each year from their portfolio. Combined with the State Pension, this could give them a bountiful total retirement income.

A top trust

Investment trusts like the JPMorgan Global Growth & Income (LSE:JGGI) product can be great ways to build wealth with a Stocks and Shares ISA.

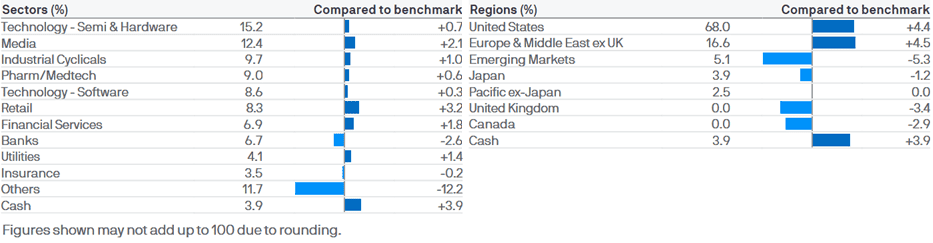

Thise diversified approach provides a way to target capital gains and passive income in a way that effectively spreads risk. The JPMorgan vehicle’s aim is to hold between 50 and 90 companies at any one time, across a spectrum of industries and regions:

Through the use of gearing (borrowed funds) — which today stands at 1.85% of shareholders’ capital — the trust’s managers can also better capitalise on investing opportunities as they arise.

Like other equity-based investment trusts, JPMorgan’s product can still fall during broader stock market downturns despite its diversified approach. Its use of gearing may also present higher risk. But I think its long-term record speaks for itself.

Delivering an average annualised return of 12.8% since 2015, it’s proved a great way for UK investors to build wealth for retirement.