Discovering what hedge funds are shorting can be a great way for investors to avoid potential traps. I’m currently scanning which FTSE 100 and FTSE 250 shares these institutions are betting against as I continue building my portfolio.

However, hedge funds don’t always get it right. Here’s one UK share I think they’re right to be bearish on, and another I’m actively considering buying for my Stocks and Shares ISA.

Ocado Group

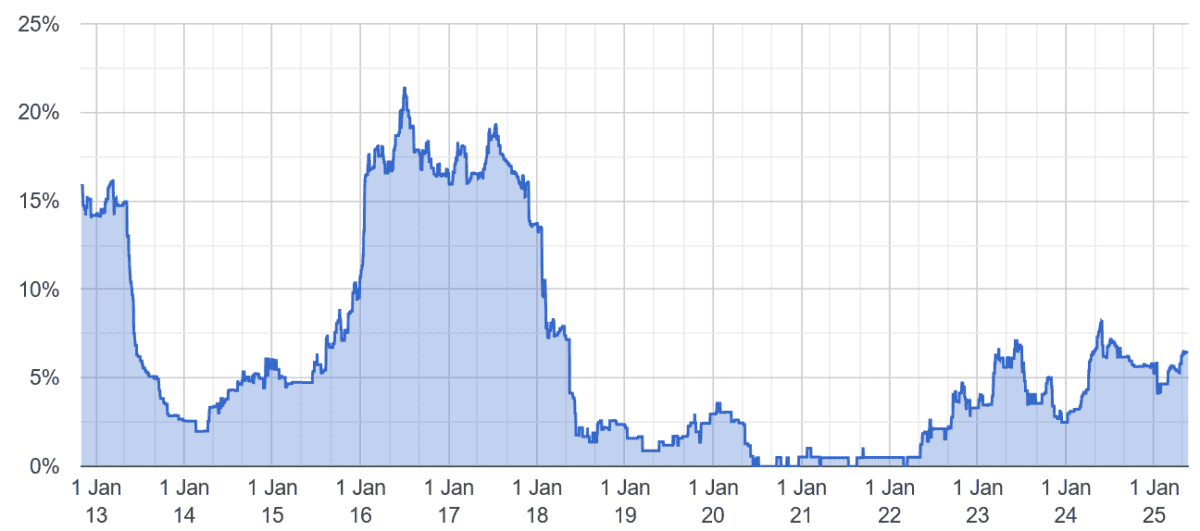

According to shorttracker.co.uk, Ocado Group‘s (LSE:OCDO) the most shorted share on the UK’s second-tier share index today. Some 6.5% of all its shares are held in short positions, with eight separate funds taking a pessimistic view of its prospects.

Short interest in Ocado shares has picked up slightly since the start of the year too. On the London Stock Exchange, only uranium supplier Yellow Cake (6.6%) has a greater proportion of its shares in short positions.

This may, given sustained strength at Ocado’s grocery division, come as a surprise to some investors. Ocado’s been the fastest-growing retailer for 11 straight months, and in the 12 weeks to 20 April sales jumped 11.8%. That’s according to Kantar Worldpanel.

The online grocer may struggle to maintain its impressive momentum as its rivals roll out new price initiatives. However, the biggest danger to Ocado’s shares is the prospect of further underperformance at its technology division.

Demand for its robotics and automation systems continues to disappoint as supermarkets scale back plans for new customer fulfilment centres. In-store shopping has returned with a bang since the end of the pandemic. And so the economics of opening large, automated centres don’t stack up as well as they once appeared.

I think Ocado’s share price could keep on plummeting.

ITV

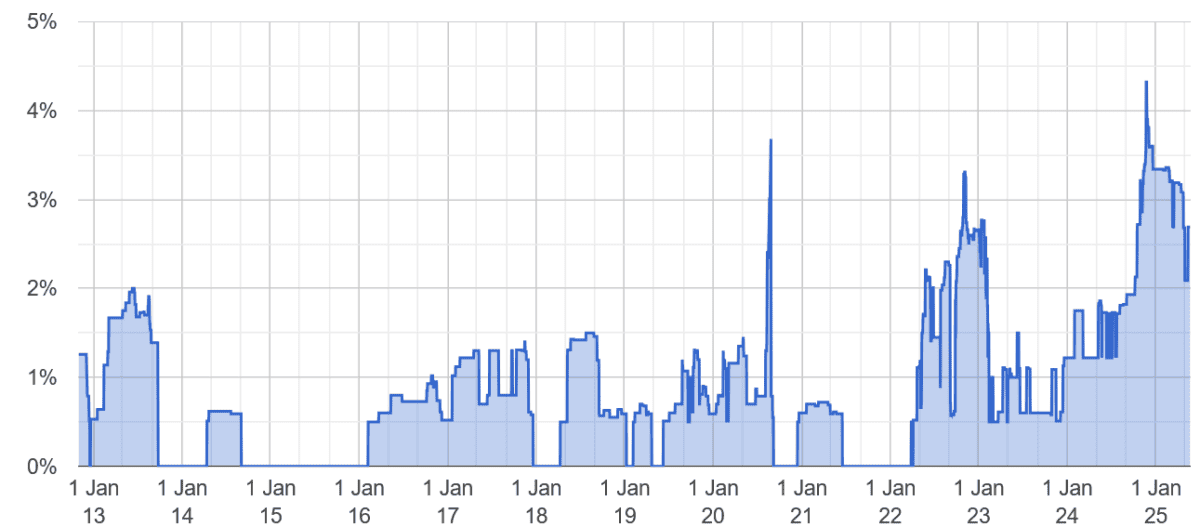

Broadcaster ITV (LSE:ITV) has attracted less short interest than Ocado. But with 2.7% of its shares held in short positions, it’s still one of the FTSE 250’s most shorted, with four funds betting against the company.

This bearishness reflects fears that ITV will struggle as the UK economy flatlines and consumers pare back spending, impacting advertising sales. With a lack of major sporting events in 2025, the broadcaster has predicted sharp falls in ad revenues this year (including a 14% drop in the current quarter).

Despite the threat of a prolonged advertising slowdown, I still think ITV has a bright future. This is thanks in large part to its starring role in the streaming revolution.

First off, the commercial broadcaster is making strong progress of its own here with its ITVX platform. Despite fierce competition from the likes of Netflix, streaming hours continue to climb — these were up 12% between January and March which, in turn, pushed digital ad revenues 15% higher.

Secondly, ITV’s huge production division means it’s benefitting from demand for new content from other streaming companies. External revenues at ITV Studios rocketed 20% during the first quarter as it delivered programming to global rivals.

While some hedge funds might not fancy the company, I’ll consider adding ITV shares to my portfolio when I have spare money to invest.