This FTSE 100 share has been a painful holding for me in recent times. Its shares have fallen more than a fifth over the last 12 months. And more trouble could be coming as the global economy slows down.

The share in question is Rio Tinto (LSE:RIO). But I have no plans to cut it loose, as I’m confident it will come back strongly over the long term.

Here’s why.

Market opportunity

Owning mining shares can be a bumpy ride at the best of times. Even when commodity prices are strong, a company’s earnings can underwhelm if problems at key mines develop. Strikes, power outages and disappointing ore grades are all constant threats.

Holding metals producers is especially risky today as trade tariffs dent global growth and sap commodities demand. In China — which consumes approximately half the world’s copper — the Caixin manufacturing PMI gauge slumped into contraction in May and to its lowest since 2022.

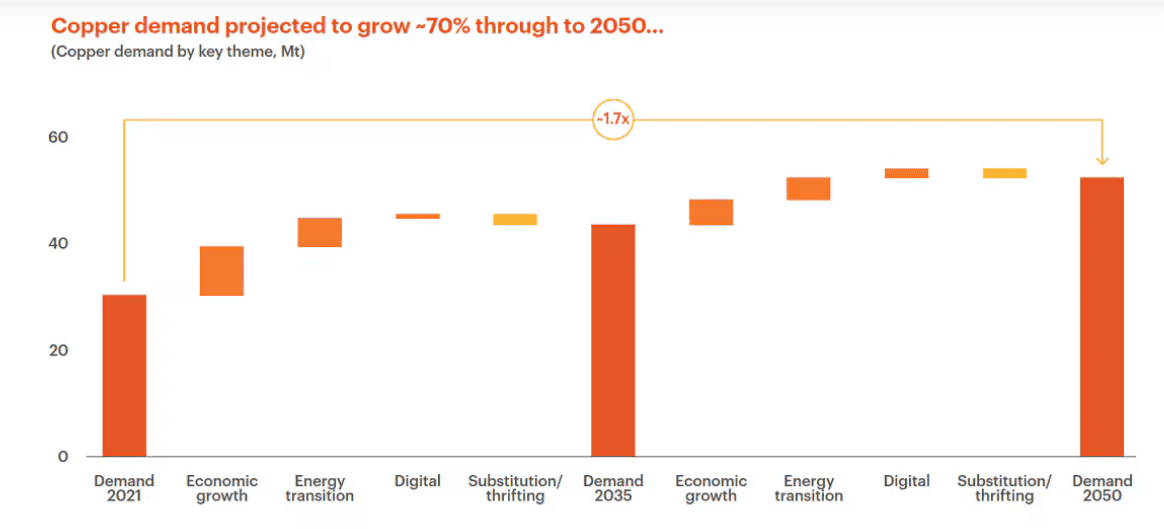

While things could get more painful for Rio Tinto, I have no intention of selling my shares. The long-term outlook for metals demand remains robust, and some key metals (like copper, aluminium and lithium) face potential supply shortages that may drive prices through the roof.

BHP thinks that copper production, for instance, will be 15% below current levels by 2035 as mines get older and ore grades decline. Yet at the same time demand for the red metal is tipped to balloon, driven by factors including:

- Increasing electric vehicle (EV) sales.

- Rising renewable energy capacity.

- Rapid data centre growth.

- Ongoing urbanisation in emerging markets.

Financial strength

Rio Tinto is investing heavily in copper and lithium projects to harness the opportunities from the fast-growing green economy. This includes organic investment — such as expansion of the mammoth Oyu Tolgoi copper project in Mongolia — as well as through acquisitions. Examples include the $6.7bn takeover of Arcadium Lithium in March.

It’s also spending heavily at its core iron ore division, with the Simandou project in Guinea (annual production target: 60m tonnes) set to come on-line later this year. Expenditure here could also turbocharge long-term earnings, though the demand and supply outlook for the iron ore market is more uncertain.

Rio Tinto has considerable financial strength it can employ to continue investing for growth, too. Its net gearing ratio was a modest 9% at the close of 2024.

Long-term winner

Rio Tinto’s shares have fallen 22% over the last year, yet they’re still up by more than two-thirds (67%) over a 10-year horizon.

Combined with dividends paid over the last decade, the mega miner has provided an average annual return of 9.9%. To put that into context, the broader FTSE 100 has delivered an average annual return of 6.3% in that time.

This illustrates the wisdom of holding mining shares over the long haul. Looking ahead, I think returns from Rio Tinto could improve as the energy transition and booming digital economy boost metals consumption.

With an attractive forward price-to-earnings (P/E) ratio of 9.3 times, I think it’s worth serious consideration.