Not all investors will have the same view on particular companies. It’s this diversity of opinions that makes a market. When considering which FTSE 100 shares to buy, I always think analysing the short positions of hedge funds is a good idea.

Here’s a couple of UK blue-chips the funds think will fall in value. Yet despite their wealth of collective experience, they don’t always get it right, and I think these instituions are overly bearish on one of these companies. Which would I buy?

Sainsbury’s

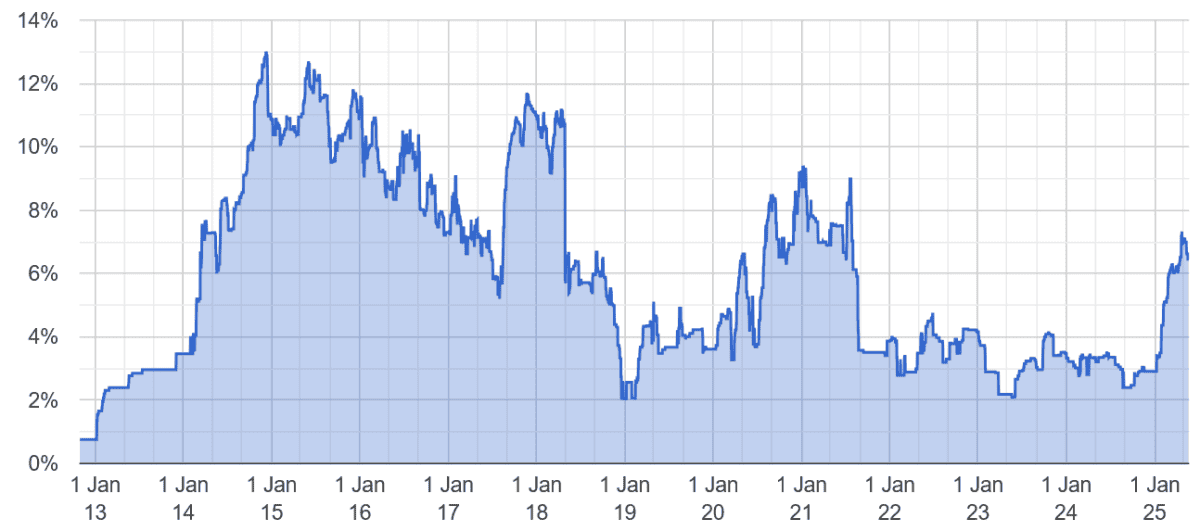

According to shorttracker.co.uk, Sainsbury’s (LSE:SBRY) is currently the most shorted FTSE share right now. Some 6.5% of all its shares are currently shorted, with seven different funds betting against the stock.

In fact, short interest has spiked in recent months. It was sitting around 2.9% at the start of the year.

Margins at Britain’s second-largest supermarket remain under threat as competition grows and costs spiral. Sainsbury’s predicts underlying retail operating profit will stagnate at £1bn this year as it eats an extra £140m costs through national wage hikes and increased National Insurance contributions.

I think it may struggle to reach this target too, with the country’s other Big 4 supermarkets (Tesco, Asda and Morrisons) kicking off a fresh price war in 2025. And of course the ongoing expansion from value specialists Aldi and Lidl poses an ever-present problem.

The Nectar loyalty scheme — which has around 18m members — is a powerful weapon in J Sainsbury’s fight against rising competition. The coupon-and-discount programme helped deliver the grocer’s greatest market share gains in a decade last year.

However, I still think Sainsbury’s shares could fall sharply. I’m with the hedge funds on this one.

The Berkeley Group

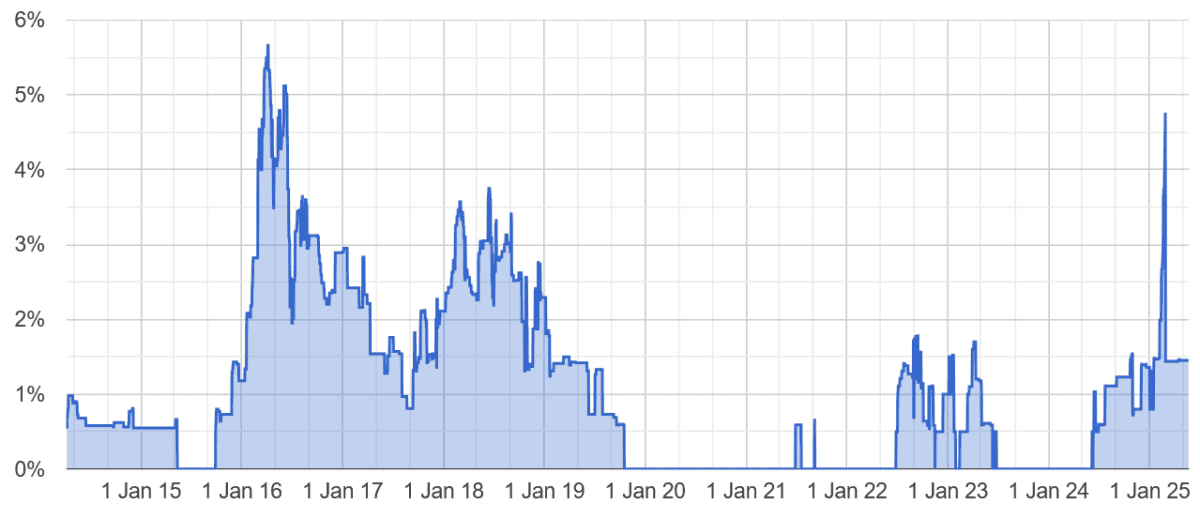

Housebuilder Berkeley (LSE:BKG) is also one of the Footsie’s most shorted stocks today, albeit at a lower level than Sainsbury’s.

Shorttracker.co.uk shows around 1.5% of its shares are shorted, up from 1.3% at the start of 2025. Two hedge funds currently hold short positions in the business.

On the one hand, it’s not hard to see why. Housebuilders are among the most cyclical shares out there, and a gloomy outlook for the domestic economy means Berkeley could struggle to shift stock.

Yet I believe that, on balance, things are starting to look up for FTSE 100 company. Its focus on the more affluent regions of the London and the South East could help it weather wider economic weakness across the broader country too.

Inflation data has been more disappointing of late. But the broader trend for prices in the UK is down, meaning the Bank of England should continue cutting rates and making mortgage products more affordable.

On this front, it’s also worth mentioning the intensifying trade war that’s supporting home sales and prices. Latest official data showed average house values up £16,000 in the 12 months to March, to £271,000.

Given its robust long-term outlook, I’ll consider buying Berkeley shares when I next have spare cash to invest, despite the bearish view of some hedge funds.