I reckon most people have heard of the FTSE 100’s Auto Trader Group (LSE:AUTO).

It’s the UK’s largest automotive marketplace, boasting over 80m hits on its website each month. It accounts for over 75% of the time spent on its type of online platforms. In addition, over 14,000 dealers (there are estimated to be around 25,000 in the country) advertise their stock via the site.

If that’s not market dominance, I don’t know what is.

A bad week

However, on Thursday (29 May), after releasing its results for the year ended 31 March 2025 (FY25), the group’s shares tanked 11.3%. This helped make it the week’s worst Footsie performer. But I don’t understand why investors reacted so negatively.

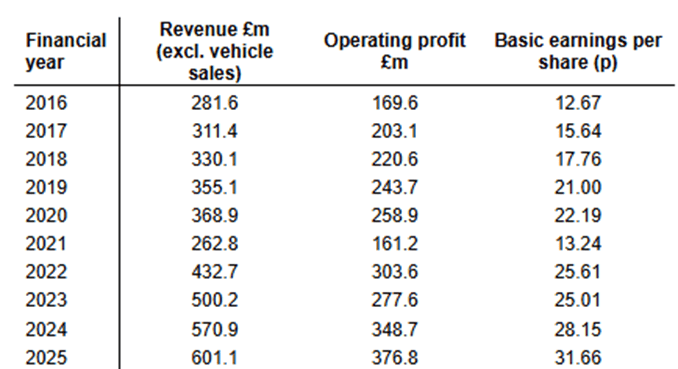

Compared to FY24, revenue was up 5%, operating profit increased by 8%, and underlying earnings per share (EPS) was 8% higher at 31.66p.

Encouragingly, over the course of the year, the group has moved from a net debt to a net cash position.

The FY26 outlook was also positive. The directors reported that “the UK car market is in good health”.

And even though the announcement included those two magic words — ‘artificial intelligence’ (AI) — the share price still went into reverse.

A double-edged sword

However, on reflection, it could be that its success is now its Achilles heel.

Since its IPO in March 2025, the group has increased its revenue every year. And its EPS has grown by an impressive 150%. I wonder if investors – given the group’s market dominance — are questioning where the hoped-for future growth’s going to come from. Even so, the dumping of the stock feels like a bit of an over-reaction to me.

The UK car market’s expected to grow modestly over the next few years, so this will help earnings. And the group’s recently launched its ‘Co-Driver’ suite of AI products that are intended to improve the search experience and make it easier for retailers to advertise.

Another option is to squeeze more from existing customers. This appears to be working. The group’s FY25 operating profit margin was two percentage points higher than in FY24.

But concerns about Auto Trader’s market dominance are not new. Despite this, the group’s grown its annual EPS by an average rate of 9.6% since making its stock market debut.

Indeed, the group’s strategy appears to have satisfied the analysts who are expecting another good year. The consensus forecast is for EPS of 35.33p in FY26. If achieved, this would be a 11.6% improvement on FY25.

Final thoughts

But there are challenges. The Financial Conduct Authority investigation into the alleged mis-selling of car finance is ongoing.

And even after this week’s share price fall, the dividend yield’s a disappointing 1.25%. Therefore, the investment case relies on earnings growth rather than a generous level of income. Any wobble’s likely to have a big impact on the group’s market cap.

However, the pullback in the share price could make it a good entry point.

Although I wouldn’t describe the stock as cheap it’s not out of line with other internet-based businesses that, generally speaking, attract higher multiples. The stock currently trades on 24 times’ historical earnings. For comparison, Rightmove’s multiple is 28.

On balance, after another good year, I think Auto Trader is a stock that long-term growth investors should consider.