For the first time in nearly three years, Vodafone’s (LSE: VOD) dividend yield has dipped below 5%. This follows a 15% surge in its share price after the release of its 2024 full-year results on Tuesday (20 May).

The development could prompt some investors to reconsider the telecom company’s appeal as an income-focused stock. Not that it would come as a huge surprise to many — last year, the company announced a 50% dividend reduction from 9c to 4.5c per share. However, the yield took some time to adjust to the cut as a falling share price counteracted the dip.

Those who bought shares in early November (before the ex-dividend date) would have enjoyed returns of around 10%. But that small window of opportunity is now over. Still, the recent growth and strong financial results will have shareholders celebrating.

So, is Vodafone still a dividend stock worth considering in 2025?

Let’s take a look.

Strategic overhaul

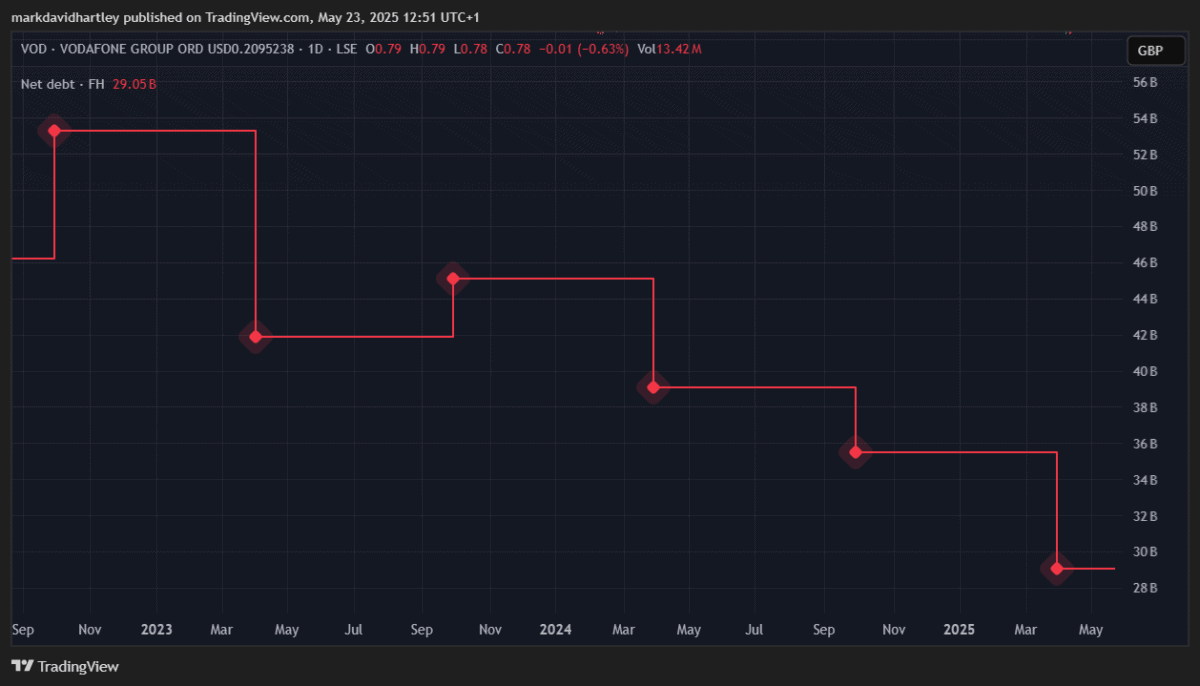

In the past year or so, Vodafone has faced a significant restructuring under CEO Margherita Della Valle, appointed in 2023. Notably, it raised €13bn after divesting several non-core assets, including its Italian and Spanish operations. These funds are being used to reduce debt and invest in key markets, particularly Germany and the UK.

Another development is the merger with Three UK, which should enhance Vodafone’s market position and achieve cost savings of around £7bn.

Risks and challenges

Despite these undeniably positive developments, challenges persist. Vodafone’s German market, which contributes significantly to its profits, continues to lose customers to pricing pressures. It reportedly saw a 6.4% decline in service revenue in Q3. It’s largest rival in the region, Deutsche Telekom, is performing well and is a particular threat to its market share.

Additionally, the capital-intensive nature of telecom operations is a worrying risk, considering the company’s high debt levels.

Financial health

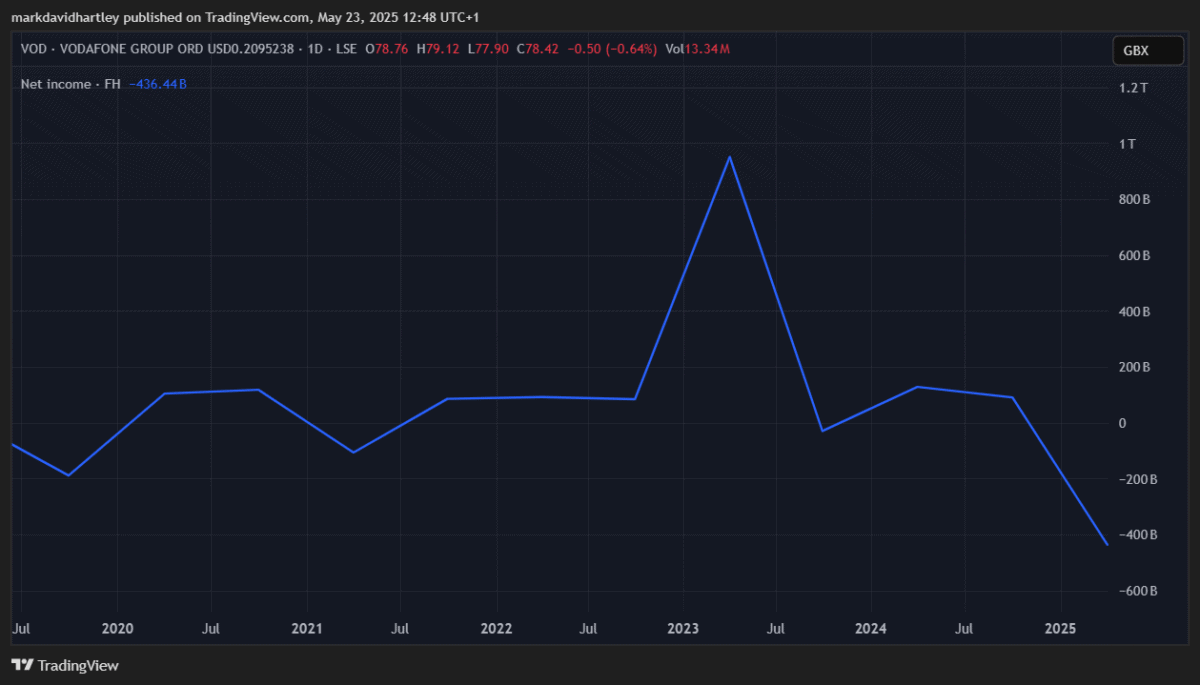

The telecom giant’s financial health is also concerning, with it suffering a loss of £3.51bn in 2024 — despite revenue remaining stable.

However, it is showing some signs of improvement. Net debt has decreased to €31.8bn as of September 2024, aided by the sale of assets. Valuation-wise, it trades at a forward enterprise value to EBITDA multiple of 5.7, slightly above BT’s 4.2 but in line with European telecom peers averaging 5.9.

Looking ahead, dividends are projected to slightly decrease to 4.2c in 2026 before a modest increase to 4.3c in 2027, with dividend cover improving to 2.1 times by 2027, indicating enhanced sustainability.

Analysts forecast a 30% increase in earnings per share (EPS) in FY25 and a 15% rise in FY26, suggesting a potential return to profitable growth.

My verdict?

It’s hard to fault Vodafone’s direction, especially considering the strategic action it’s taken towards creating a more sustainable and focused business model. Yes, the reduced dividend yield isn’t ideal from an income perspective, but the efforts to streamline operations, reduce debt, and invest in growth markets are promising.

If nothing else, it’s now far better positioned for potential long-term growth. Investors seeking a balance between income and growth may find it worth considering — keeping in mind the inherent risks in the telecom sector.

However, for those seeking to boost an income portfolio with dividends, I feel it has lost its appeal.